Journaling

Importance of Journaling

Many part-time traders don’t realize just how important it is to journal trades. For many, journaling imposes a structure that is difficult to persist in doing. It is seen as boring and unnecessary compared to the excitement of finding profits. Yet, journaling is the capstone of a trading process that is both defined and predictable.

An axiom in business states that “if it can’t be measured, it can’t be improved.” It’s the same in trading.

If a trader commits to the structure of journaling trades and periodically reviews their results, they can improve their trading methodology in at least three ways:

- Identify biases, calm irrational fears, and learn from mistakes

- Identify trading edge and continually find ways to improve it

- An early warning system to help you see when your approach or the markets have changed.

Stress and complexity creates pressure to which individuals respond to in pre-programmed ways. These response patterns may cause us to break our trading rules in a consistent way. Journaling helps us identify these patterns and plug the holes we introduce into our trading simply by the inner dialogue or emotional responses we have to pressure.

Techniques used to capture trading edge wax and wane over time. Journaling allows us to monitor our edge over time and helps us either find new tactics or improve upon current ones. Continuously monitoring trading edge is also a way to improve our ability to find and seize opportunities in the market in new ways.

Journaling trade results is also the only way to identify expectancy. Expectancy can be used as a quick way to determine trading effectiveness. Expectancy can be measured per trade and can be averaged over at least 30 trades. Expectancy tells the trader how much money they can expect to make for every dollar they put at risk. For example, if expectancy is 1, then the trader can be confident that they will make $1 for every $1 they put at risk.

Multiplying expectancy with trade frequency also provides a quick way to gauge expected Annual Rates of Return.

Markets change. What has worked today may not keep working tomorrow. Careful trade tracking and periodic review will help you see the bigger picture and help you adapt to changes in the macro environment which affect markets.

Expectancy can be used as an early warning indicator about the markets.

For example, if a trader is used to seeing an expectancy of .3 and after a few trades it has changed to .1 even though they have been following trusted rules, then something significant has likely changed in the markets.This gives the trader a chance to pause their trading activity, carefully review recent trades, and shift to new strategies or tactics if necessary.

What Data to Capture

Journaling trade results and periodically monitoring results is a critical element of a trading process. But what information should be captured? There are many types of data that can be captured about each trade. When choosing which data to select, think about the information that might be valuable to you when you look back to review your results.

Trading requires a certain amount of discipline. Such things as the amount of sleep, diet, exercise, outside stressors, and emotional state all contribute to decision making and may affect trading results in unexpected ways. Capturing this information may prove to be quite informative.

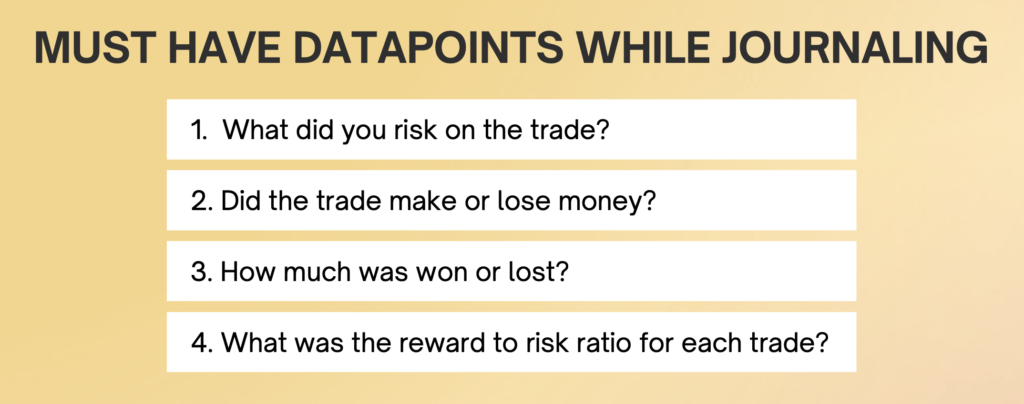

That said, the following four pieces of data should be captured on every trade. This data, periodically evaluated, will help you spot your blind spots and recognize when markets have changed.

The four trade specific pieces of data we recommend capturing are:

- What did you risk on the trade?

- Did the trade make or lose money?

- How much was won or lost?

- What was the reward to risk ratio for each trade?

The reward to risk ratio for each individual trade may not provide valuable information. However, an average reward to risk ratio from all your trades is the best early warning detection system you can have.

A significant fluctuation in this ratio indicates something has changed. This might be something market facing, or it could be something you’ve introduced into your process. If you experience a sudden negative downturn in your reward to risk ratio, stop trading and work to determine the root cause.

Finding the Reward to Risk Ratio

The reward to risk ratio is found by dividing the amount won or lost by the amount risked on the same trade.

For example, suppose you risked $500 on a trade and gained $1,400. The reward-to-risk ratio for this trade is $1,400 / $500 = 2.8.

Further suppose that on the next trade you risked $500 again, but that this time you had a loss of $300. The reward-to-risk ratio for this trade is -$300 / $500 = -0.6.

Track the reward to risk ratio on every individual trade and keep a running average over all your trades. Use this as the measurement by which you track your progress or detect changes in the market.

Journaling doesn’t have to be complicated. We suggest creating a chart with four columns in it to keep track of this information. Each time that you close out a trade, fill in the necessary data. This simple process ensures you measure your trades correctly and have the right information to improve your results.

Evaluate and Continually Improve

You will benefit greatly from periodic evaluation of your trade results. This periodic evaluation is best accomplished in two phases.

For the first phase, we recommend averaging the results of your first 30 trades and then asking yourself the following four questions:

- What is your winning percentage?

- Are you keeping risk equal on every trade?

- What was your longest losing streak?

- What is your average reward to risk ratio?

We recommend reviewing your trading results only after 30 trades because this provides a large enough sample size to get statistically relevant data.

As additional trades are made, journal them individually and evaluate the average results every 30 trades just like previously.

Phase two of the evaluation process is to compare the new block of 30 trades to the previous block of 30 trades or the running total of trades for the year. Look for similarities and differences especially in the reward to risk ratio. If the reward to risk ratio has changed significantly, take time to figure out why.

Risk to reward ratio is incredibly important. It ultimately tells you if you are going to make sufficient gains over time. If your ratio results in a number that is above .2 you most likely will be satisfied with the results. If it’s below .2, then evaluate why. Because your trading may be frustratingly mediocre. If this number ends up being negative, you should switch to paper trading as you figure out what’s going wrong.

Once this initial comparison between the two blocks of 30 trades is complete, add the results together to keep a running average of all your trades which can be used for future comparison.

At the end of every year, write down the yearly average. Use this average to compare the first block of 30 trades of the next year. Each year, continue this process, comparing the annual trade results to each other and making adjustments in your trading as necessary.

Each year evaluate your trades to find the longest losing streak and worst case scenario. Determine how much drawdown you experienced in your account during this period. Use this number to adjust the average risk per trade so that you can maximize gains while continuing to follow your process.

Careful journaling and periodically reviewing your results is the best way to remain a profitable trader over time. It provides insights into all areas of your trading and helps you remain more consistent in how you manage your risk, remain focused on the process, and continually enjoy a trading edge.

A well-kept journal provides a foundation for self-evaluation and continuous improvement as a trader. Doing a deeper review of the results at least every 30 trades is key to utilizing the journal effectively.

We recommend trading a virtual account as you practice and work to develop confidence in your ability to follow a complete trading process tailored to your individual circumstances and needs. Having confidence in and following the process is key to long-term success when committing live funds to additional trades