Diversification and Allocation

Diversification and Allocation

One of the 7 Pillars part time traders can control as they customize their trading process is Diversification and Allocation rules. Diversification is how much of a portfolio is allocated into non-correlated asset classes. Allocation is how much money a trader decides to put into each trade.

Both Diversification and Allocation impact results over time. This lesson will delve into the concepts and provide some basic rules of thumb. Each trader should customize these ideas as they develop their individualized trading process. This level of personalization is important as it will help the trader trust their process enough to follow it during both winning and losing streaks.

Setting standardized Diversification, Allocation, and Risk Per Trade Rules is one of the elements of a trading process that is completely under the control of the trader. Following these rules helps a trader have more consistent and predictable results using a repeatable process. Uneven allocations or risks per trade introduces randomness back into the process by causing some trades to have more impact on the account than others.

Diversification

Ray Dalio, a billionaire trader and founder of the world’s largest hedge fund, has said, “diversifying well is the most important thing you need to invest well.”

Yet many traders get so focused on the opportunities they don’t take the time to quantify a Diversification and Allocation strategy. This tendency is especially prevalent in those with smaller accounts who also feel a need to catch up and grow their accounts quickly.

Proper Diversification and Allocation strategies may at first seem likely to reduce the speed of potential growth…yet suffering big losses is even worse. A loss of 50% requires a gain of 100% just to get back to breakeven whereas a loss of 10% requires just an 11% gain to get back to breakeven.

Traders who really want to grow their accounts quickly should limit their losses as they hunt for big gains. The easiest way to accomplish this is to establish Diversification, Allocation, and Risk Per Trade Rules as part of a complete trading process.

Diversification is the percentage of a portfolio a trader decides to allocate into various asset classes. Each asset class tends to have unique profit potential characteristics as illustrated in the Select An Asset Class lesson.

The main asset classes are:

- Stocks

- Bonds

- Options

- Commodities

- Futures

- Currencies

- Crypto currencies

The stock asset class is diverse enough that there are 5 additional sub-asset classes within it. These asset classes ranked in order of least volatile to most volatile are:

- Utility stocks

- Dividend paying stocks

- Large Cap growth stocks

- Small Cap growth stocks

- Penny stocks

All traders love more volatile asset classes if it means their holdings appreciate quickly. These sudden increases in value are exciting. The danger is that volatility is a sword that cuts both ways. Wise traders have a plan to protect their accounts from sudden and unexpected losses.

One of the values of a complete trading process is proper diversification into uncorrelated asset classes and careful allocation into specific trades. The rules a trader establishes when incorporating these ideas will protect them from catastrophic loss and help them achieve more consistent profits.

Limiting the loss in a trading account can help a trader in at least two areas. First, it limits the risk of a catastrophic drawdown forcing them out of the market. Second, the protection offered by proper Diversification and Allocation rules helps the trader remain unemotional even during extreme gains or losses resulting from a lengthier streak. For less prepared traders, a high number of losses in a row can create wild emotional swings which makes it difficult to follow trading rules.

Diversification Rules of Thumb

Proper diversification is an individual affair determined in part by account size, available time to trade, and trading goals. Traders with larger amounts, primarily interested in keeping what they have, will choose to spend more time establishing what Ray Dalio calls his “All Weather” portfolio of 15-20 uncorrelated asset classes. At the same time, those with smaller accounts and a greater trade frequency will need to spend less time on diversification as they don’t hold positions for long.

That said, a general rule of thumb would be to diversify across a number of uncorrelated asset classes. Thanks to the advent of ETFs, even traders with smaller accounts can diversify across each of the main asset classes and the stock sub classes within their current trading account.

For those who want to understand this part of the process in more depth, many resources are available online. Simply start by searching for Ray Dalio’s All Weather portfolio first and go from there.

Allocation

Sometimes people might use “allocation” in the same way that we’ve used “diversification.” For purposes of clarity, we use “allocation” as the amount of money a trader puts into individual trades.

All traders should work to limit their trading losses. Protecting against any loss, especially catastrophic loss, is best done through Allocation and Risk Per Trade Rules.

Diversification is the amount a trader choose to put into various asset classes. Allocation Rules set how much of that money is placed into any one trade. Risk Per Trade Rules set how much of this amount is actually risked before the trader simply gets out.

The purpose of these rules is to help individual traders avoid the temptation to cut profits short and let losses run. The most consistent way forward is to limit losses (which also limits profits) in a defined, understandable, and repeatable way.

A good rule of thumb for allocation is to place available capital into 5 different positions and to further reduce risk by limiting the risk per trade to just 1% of the amount put into each asset class.

So, if a trader chooses to put $20,000 into the stock asset class, they would limit individual position allocation to just $4,000. The trader would then set a stop loss such that only $200 (1% of $20,000) was risked in each of these 5 positions.

The amount of money allocated to an individual trade will not be the same as the amount risked on that trade if a stop loss is set. That said, option traders may choose to risk 100% of their position, but limit their allocation to just $400 of the available $4,000 to maintain the 1% Risk Per Trade Rule.

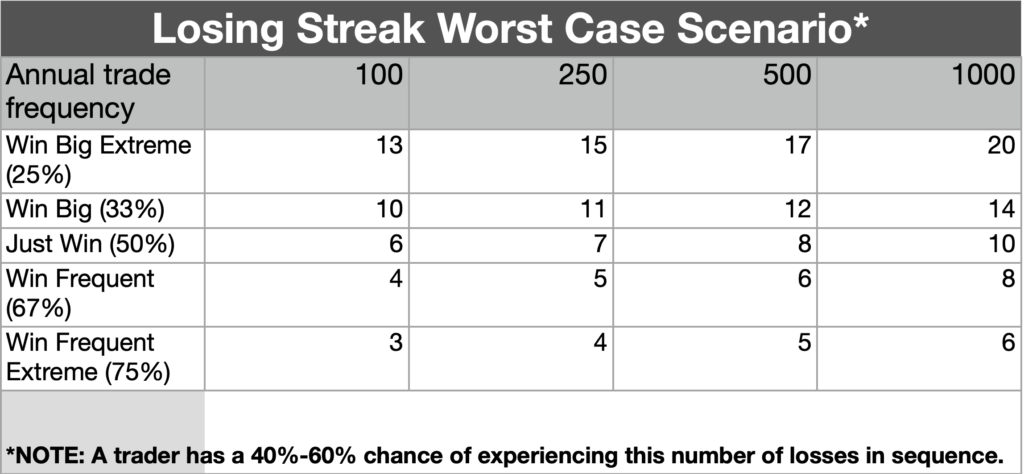

When contemplating a trading strategy, a trader should always consider both trading frequency and the expected base win rate. These two numbers can be used to determine an expected max losing streak. This max losing streak can then be multiplied by the amount risked per trade to determine an expected max drawdown.

In this way, a trader may be able to adjust their Risk Per Trade Rules higher or lower to better balance potential gains against the potential for a catastrophic loss.

Below is a chart showing the potential longest losing streak for each of the five Natural Trading Styles over a range of trading frequencies:

The amount risked on each trade directly impacts the expected max drawdown if a trader were to suffer a worst case scenario.

Traders with smaller accounts, those who are new to trading, or those who prefer a higher win rate may all want to limit their risk per trade to just 1% of their entire portfolio.

Allocating the same amount of money to each trade reduces risks and increases the likelihood of long-term profitability. Each loss has a similar (and small) negative affect on the overall portfolio.

The statistical approach contained within this curriculum will help a trader achieve predictable results using a repeatable process. Equal allocation and risk per trade is key to this predictability.

The markets are random. If a trader chooses to place uneven amounts of risk over the course of 10 trades, some of those trades will have more impact on the overall portfolio than others. Since the outcome of individual trades cannot be predicted nor controlled, this uneven allocation or risk per trade actually introduces randomness back into the results and destroys predictability.

All trading strategies experience losses. Even when their system works as designed, traders can expect to experience losing streaks. Wise traders establish rules to reduce the impact of losing streaks. This helps them both reduce the likelihood of catastrophic loss while also giving them confidence to keep following their rules.

Conclusion

Having an accurate expectation about the size of potential losing streaks helps a trader custom tailor their risk management plan to tolerable losses. Following a plan that reduces and standardizes risk helps a trader avoid mistakes caused by emotionally-driven trading.

This emphasis on risk management is fine as a mental exercise. And traders are always grateful to these rules when experiencing a losing trade.

However, during winning streaks, traders may become tempted to change the amount they risk per trade because of the lost opportunity that comes from limiting the amount allocated into a trade and forget the importance of risk management.

Avoid this temptation. The trader should establish their risk management rules based on the size of a max drawdown they could experience and still follow their trading process’s rules exactly.

All traders must manage risk if they want to enjoy long-term, consistent success. The most important way for part time traders to manage risk is to set limits on how much money is allocated into each trade and how much of this allocation is placed at risk.