Risk Per Trade Rules

Risk Per Trade Rules

There are a total of 7 Pillars that every trader can use to gain control over their trading outcomes. These pillars do not guarantee the outcome of individual trades. However, when a trader makes conscious choices about each of the 7 Pillars, they gain control of their trading outcome over many trades.

The expectations derived by making choices in each of the 7 Pillars can be formulated into a set of trading rules by which a trader can implement a strategic approach to the markets. The confidence a trader can have in their strategic approach will only grow as actual results (either real money or virtual trading) match the established and clearly defined expectations.

The interplay of matching real world results to previous expectations creates a virtuous cycle leading to more confidence and a willingness to risk more per trade or adopt a more aggressive trading style.

Each of the 7 Pillars are important as standalone ideas. However, they also all interact with each other in the form of tradeoffs and consequences.

So for example, one of the 7 Pillars is Risk Per Trade Rules. The amount risked per trade connects directly to size of expected drawdowns. It also connects directly to the size of potential profits.

Another of the 7 Pillars is Allocation. Allocation is how a trader achieves diversification. If a trader follows Ray Dalio’s suggestion to allocated into 15 – 20 uncorrelated assets, they can significantly increase their potential reward without increasing risk. Mr. Dalio states that the reward can increase 5 times without increasing risk much.

Risk Per Trade and Allocation rules combine to provide a trader a comprehensive risk management strategy.

Gain Control By Managing Risk

The structure imposed by each of the 7 Pillars may seem constricting at first. This is especially true of the risk management strategies. Those who find success on Wall Street do so because they have developed, and religiously follow, careful risk management strategies.

These expert and successful traders know that price movement is both random and uncontrollable. Yet many new traders spend a tremendous amount of time, energy, and money chasing predictable entry signals.

It is true that some edge techniques require specific entry or exit points. However, perfect entries are not a requirement nor a guarantee of success.

Some researchers have suggested that risk management strategies have more influence over results than any other part of a trading process. While this claim may be a little overblown, it is true that a great deal of preparation and hard work can be quickly undone by one catastrophic loss.

From an individual trade basis, a trader should always trade by these four components:

- Entry price

- Stop loss price

- Profit target price

- Number of shares, futures, pairs, coins, or contracts to purchase

The first three components are determined by the timing of the entry signal and the Natural Trading Style. Assume the following:

- Entry signal at $43.50

- ATR at $4.50

- Win Big trading style

Given this information, a trader could quickly know the number for the first three of the four components. In this case the Entry price is $43.50, the Stop loss is set at $39 and the Profit target is set at $52.50. While these components would be known in advance, it is uncertain whether the trader could execute at any of these prices.

However, the fourth component, number of shares, futures, pairs, coins, or contracts to purchase, is always under the traders complete control. Knowing how many shares to purchase is a critical component to success that many traders don’t even consider.

Yet this control matters a great deal which is the purpose of this lesson.

Equalizing Risk On Every Trade

It’s impossible for anyone to reliably predict the magnitude and direction of a move over a specified period of time. The markets are random. Yet it’s possible to get predictable results if a trader follows a complete trading process. Equalizing risk on every trade is part of what provides predictable results. Applying uneven risk on trades re-introduces randomness back into the results. This is why applying equal risk on every trade is such a big deal.

Think about it this way:

Assume a trader places 10 trades. Of these, 9 of them risk just 1% of the portfolio while the 10th one (the sure bet) risks 10%. All of a sudden this one position has more impact to the account than the other 9 trades combined.

Those who ignore the need to keep risk equal on every trade often suffer unacceptable losses which might actually be catastrophic, making it difficult, if not impossible, to keep trading without adding more funds to the account.

A natural human bias tells us that future price movement can be predicted by previous price history. Yet this is not true. If it were, who would ever lose a trade? Equalized risk on each trade the size of which is determined by a trader’s tolerance for account drawdowns is the best way to avoid unacceptable losses.

Knowing the Potential Drawdowns of Equal Risk

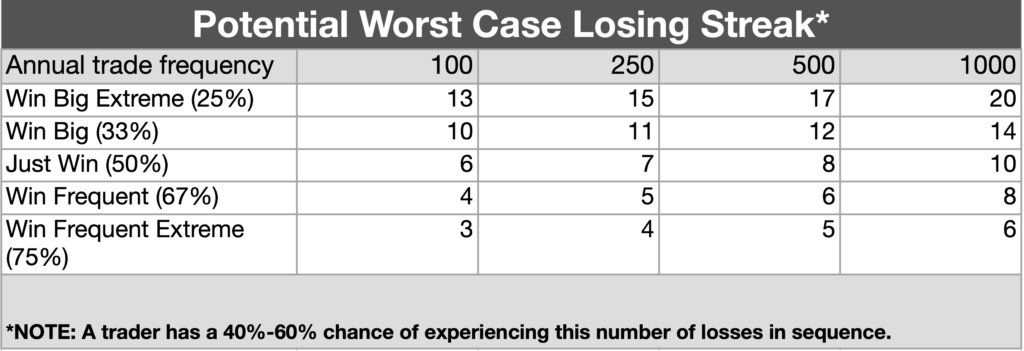

Most traders understand the concept of not putting their entire account at risk on any given trade. However, they may not have considered how much of their account is at risk during a likely losing streak of series of losses in close proximity.

While losing streaks are not controllable, the size of the account drawdown is. It is controlled by selecting an amount to be risked per trade.

The following table shows the likely size of a longest losing streak scenario for each of the five Natural Trading Styles. Note that these numbers, while based in statistics, are not absolutes. It is also statistically possible for smaller losing streaks to come in close proximity further complicating the calculation of a worst case max drawdown.

As you begin establishing your trading process and the amount you want to risk per trade, use the numbers below as guidelines.

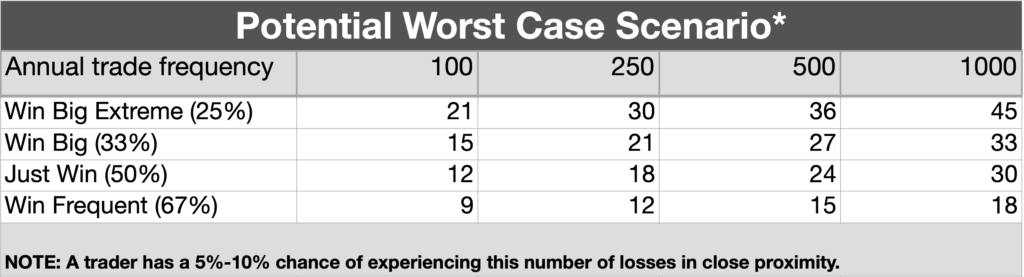

The following chart shows a lower likelihood of losing trades coming in close proximity. In an ultimate worst case scenario, losing streaks will come in close proximity with some number of winning trades between them.

The chart below shows a possible worst case scenario if a trader experienced a number of smaller losing streaks grouped in close proximity. Note, while there is only a 5-10% chance of such a worst case scenario actually happening, a trader is well served by using this number to help them calculate the desired amount to risk per trade as a way to avoid a catastrophic drawdown that forces them out of the market.

A student was once asked how much they risked per trade. The response was surprising…in essence they generally risked 10% of their account on trades they really felt were going to run and 5% on the rest of the trades. Think about this response for a minute.

There are two problems with this approach to risk management.

First, the trader put varying amount of risk in to each trade depending on how they felt about the potential. If this was the case, why even take the other trades? Why not just focus on the “sure fire” trades that they felt good about?

Second, the trader hadn’t fully considered the negative portfolio impact putting 5% – 10% at risk on each trade would have.

Use the table above to calculate the size of a maximum potential drawdown given a 5% individual risk per trade rule. In the case of a Win Big trader risking 5% per trade and placing 100 trades a year, a maximum drawdown could be 50% even when the system worked as designed. Catastrophic!

That said, the amount risked per trade is an individual decision. Some traders can handle loss better than others. Some traders will be able to keep following their trading process during a losing streak and a large account drawdown better than others.

Take some time visualizing a worst case scenario. Think about your reactions to a loss and a few losses in a row. Think about how you would respond to different levels of account drawdown. Then begin making decisions about how much you should risk per trade as part of your trading process.

The Limitations of Risk Per Trade Rules

Traders who start trading with an urgency to make up some financial shortfall are the ones most in need of standardized and limited risks per trade. Yet these are also the traders who are most tempted to increase the amount they put at risk.

This temptation usually comes when a trader has experienced a gain or even a few winning trades in a row. The size of their gains will mostly be determined by how much money they put into the trade. Risk Per Trade Rules limit the size of the investment, which also limits the size of potential gains.

If a trader thinks too deeply about a missed opportunity, they will being to second guess their trading process through a series of “If only…” statements. Avoid this temptation. Avoid the temptation to believe it’s possible to accurately predict directional movement. Employ standardized Risk Per Trade Rules.

Use Risk Management to Sleep at Night

Risk management strategies prevent catastrophic loss and reduces the stress of trading. It’s important to balance a desire for gain with the proper Risk Per Trade Rules. The proper amount to risk per trade is determined by the size of an expected max drawdown. Use the size of a max drawdown and the frequency of losing trades as you contemplate your answer. How frequently could you experience trading losses and how much could you lose and still be able to follow your process exactly?

Use the answer to this question to determine your own, personal Risk Per Trade Rules.

It is tempting to think only of how much potential can be made when trading. But successful traders also know how much they can lose and they work to both limit the impact of losing trades on their accounts and on their ability to follow a trading process.

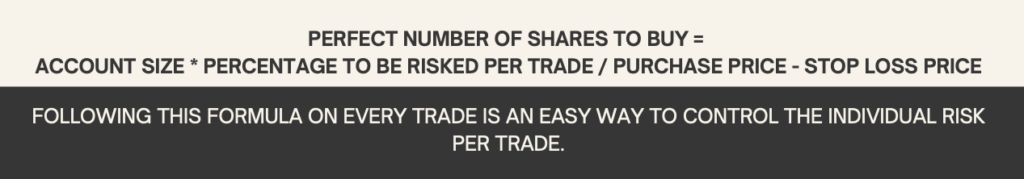

Finding the Perfect Number of Shares

The simplest way to equalize risk is to buy the right number of shares. The number of shares purchased will be influenced by three factors:

- Dollar amount risked per trade

- Account size

- Percentage to be risked per trade

Continuous Improvement to Your Trading Process

Approaching the market in a standardized way using a carefully designed and complete trading process incorporating the 7 Pillars is a powerful tool. It’s only possible to get consistent results from the market when using a consistent approach to trade the market.

That said, if a trader follows their trading process exactly, it will become more valuable because it will help them continually improve their approach. Trading can only be improved if the results can be measured against a detailed and specific set of expectations.

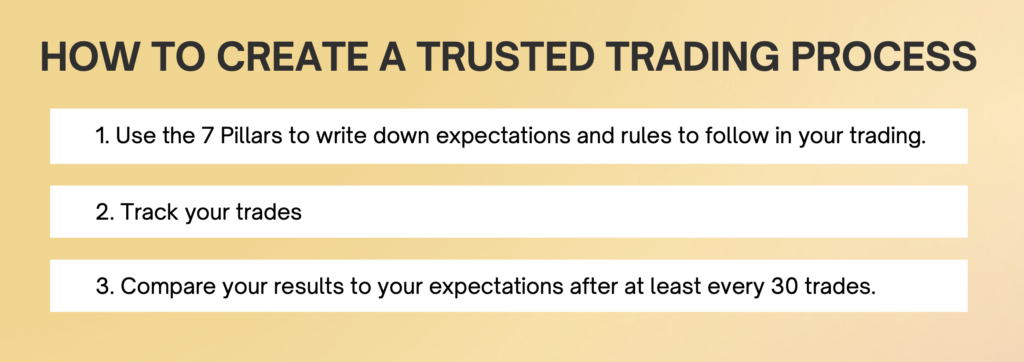

Creating a trading process that is trusted requires three elements. First, a trader must use the 7 Pillars to write down expectations and rules to follow in their trading. Next, they need to then track their trades. And finally, they need to compare their results to their expectations after at least every 30 trades.

If results are as expected, the trader should continue their trading and evaluate again after another 30 trades. If results continue to be as expected, confidence in the trading process and in the trader’s ability to follow it to get predictable results will grow.

If results are worse than expected, the trader can carefully evaluate why. This evaluation should both look outward at market conditions and inward at trade execution. Did the trader follow all their rules? Did they make mistakes when entering their order?

If the results are better than expected, the trader can do a similar evaluation to figure out why. Perhaps they did something that could be incorporated into their trading process and future improvement.

Any changes a trader may decide to make should be done cautiously and only in a simulated environment at first. This will protect the trader from unexpected negative consequences as they practice a new technique.

Having a complete trading process and trusting it enough to carefully follow it on every trade means the trader will approach the markets in a consistent way. Consistency is one of the hallmarks of true greatness. Trading is a learned skill that anyone can master if they follow the process outlined in our curriculum and make the behavioral shifts necessary to fully implement it. This is the importance of your live, interactive classes.