Asset Class

Asset Classes

The choice of asset class is one of the 7 Pillars of control a trader can exercise over their trading process and ultimately over their results. Which asset class or classes a trader selects is an important element that affects other aspects of the trading process.

For example, some asset classes are more volatile by nature than others. These more volatile asset classes will cause a higher trading frequency and potentially more pronounced emotional reactions within the trader. Investors who seek the large gains of a higher trading frequency will likely choose more volatile and quick moving asset classes because of the larger price fluctuations they create.

Making a conscious decision about which asset class to trade and knowing how this decision will affect other aspects of a trading process will help the trader prepare for the realities of actually trading it. This helps traders remain committed to their process despite the price swings and losing trades they might see as they trade.

The most commonly traded main asset classes are stocks, options, futures, forex, and cryptocurrencies. That said, within some of these asset classes are sub-classes that have varying levels of volatility. More will be discussed about this topic in later lessons.

As an individual begins to contemplate which asset classes to choose, it may be helpful to understand what makes them, and the equities within them, trade with such varying levels of volatility. The three main elements that drive volatility are:

- Trading dynamics

- Leverage of the asset class

- Investor perception

Use Opportunity and Volatility to Choose Asset Class

Often asset classes are categorized by instrument type. A more useful way for part-time traders to sort them is by how much opportunity and volatility they represent.

Trading Dynamics

This is a measure of how prices might change during the normal flow of buy and sell orders into the market maker. Some asset classes and sub-classes have a very orderly flow of balanced orders which cause prices to remain stable. Others have a more unbalanced flow of buy or sell orders, which creates more rapid price fluctuation as the market maker seeks to re-establish balance.

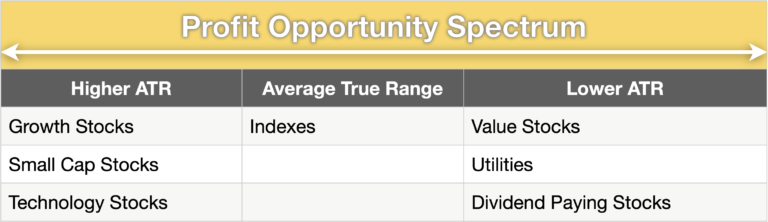

The stock asset class and its sub-classes use “Average True Range” (ATR) to gauge volatility. ATR measures the average daily price movement over some period of time. A higher ATR means that that equity has an imbalance between the number of buy and sell orders which causes more price fluctuation and higher volatility. Imbalance between the number of buy and sell orders is often caused by the wide opinions traders have about what a good price for that equity might be. The disagreement between buyer and sellers creates a more volatile trading dynamic and bigger average moves.

The volatility related to trading dynamics can be grouped along a profit opportunity spectrum. At this point, understand that profits can be made at all points along the spectrum. Traders will naturally sort themselves into the appropriate grouping depending on their individual circumstance and natural trading style.

Those equities on the higher end of the ATR spectrum are those with higher volatility. This means prices will rise quickly…and may also fall just as quickly. Traders who speculate in these equities should be prepared to be nimble and to suffer a number of losing trades.

There is less disagreement between buyers and sellers for those equities on the opposite side of the profit opportunity spectrum. Therefore, these equities have less volatility and a lower ATR. Investors seeking safety often choose these sorts of opportunities.

Leverage

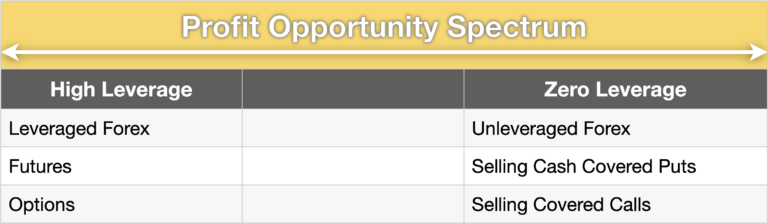

Leverage is the next characteristic that drives opportunity through rapid changes in price. Most of the time leverage is built right into the trading instrument. Asset classes with higher, built-in leverage are futures, forex, and options. That said, each of these asset classes can also be traded without leverage depending on the needs, experience, and temperament of the individual making the trading decisions.

Leverage is an interesting dynamic in that the price may be relatively stable in absolute terms. Volatility isn’t a result of price action as much as it is in the speed at which the position will change value. For example, forex traders can leverage their investment dollars 50 times or more. This leverage will not affect price action though it will have a tremendous affect on the volatility and opportunity they see in their own trading account.

Many traders are attracted to these asset classes because of the potential to gain such high leverage. It’s tempting for traders to begin by looking at the potential for gain as they make decisions and begin building their trading process. However, a more helpful point of view is to consider the level of discipline needed to control losses or to experience a high number of losing trades because of the choices made. There are always tradeoffs accompanying any trading rule added to the trading process.

The asset classes that can be highly leveraged are classified into the table below.

Investor Perception

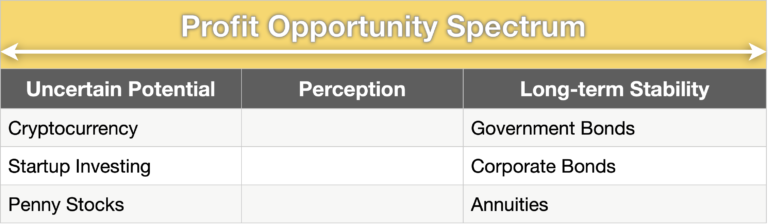

Investor perception is not something most part-time traders consider, but it is a powerful factor affecting both daily price movement and long-term directional trends. This is especially true for those asset classes or subclasses for which little reliable information is available. The equities within these asset classes are highly sensitive to changes in investor perception and may experience dramatic price swings on rumor alone.

Another way investor perception impacts pricing ties into the perceived potential of an asset class, sub-class, or individual equity. If these investing vehicles appear to have strong potential in the near future, then investors consider it to be more valuable and will bid up the prices quickly.

The danger is that investor perception may change rapidly creating significant and unexpected price movement and much higher volatility.

Summary

The opportunity to profit from the markets has a wide variability often tied to the perception of future growth or leverage. Some see opportunity in the unknown potential and higher volatility of certain asset classes, while others prefer to invest in more stable asset class which won’t experience such wide price swings or create a higher annual trading frequency.

One thing to understand is that if some people can be persuaded to pay a surprisingly high price for something, others will consider doing so as well.

Apply the Appropriate Strategic Approach

Investors and traders continually make tradeoffs as they make decisions. The choice of asset class, sub-class, or equity each carries tradeoffs regarding trade frequency, opportunity, and trade strategy. Developing a deeper understanding of these tradeoffs to help guide your decision making is the purpose of our curriculum.

The selection of asset class will often affect or be affected by a trader’s desired Annual Trade Frequency, Natural Trading Style, and desired strategic approach. For example, traders who want to generate a higher number of winning trades may not be comfortable trading more volatile or leveraged assets or may need to choose a particular asset simply because of the availability of a desired strategic approach.

As you customize your trading process start with just one asset class. Other asset classes may be added later as you gain confidence in your trading process and begin to experience consistency in your results.

By adding in additional non-correlating asset classes as part of a larger method of managing their risk, traders will be able to significantly increase their potential without assuming more risk. Proper diversification costs nothing, though it can seriously reduce the negative impact losses can have on an account.

It might also be appropriate to begin analyzing your current positions through this new lens. Where on the three profit opportunity spectrums do your current positions fit? Is the portfolio balanced? Does it fit your Natural Trading Style? Will it give you the opportunity to apply a desired strategic approach? Is it diversified enough or too much?

It’s unnecessary to make wholesale changes at this time, though it is wise to begin thinking more specifically about what you have right now and where you want to go as you move forward.