Select a Strategic Approach

Select a Strategic Approach

As a person makes decisions about which asset classes to trade, they should also begin to think about which strategy they may want to employ. This is especially true for the option asset class. Options provide a great deal of opportunity for traders to use them in creative ways. This has resulted in a number of defined trading strategies that can be sorted into categories.

The following strategy matrix may be helpful as you contemplate the strategy you’ll use to engage the markets and implement your trading process.

Market prices are both unpredictable and uncontrollable. While the outcome of individual trades cannot be reliability predicted, if approached in the right way, the outcome of many trades can be. This approach is what we mean by a complete and trusted trading process.

A trading process is trusted because expectations have been verified by actual results. The first step to creating your own trading process is to determine your base winning percentage which is determined by your Natural Trading Style and where you set your exits relative to entries. Additional elements are layered in one after the other until the process is complete and the trader has confidence in both its reliability and its ability to predict results over many trades.

Many new and even seasoned traders don’t have a trusted trading process. This is a danger. Not having statistically relevant expectations or taking the time to create a rules based process of trading that includes a feedback loop for confirmation and improvement is what leads to frustration and loss. This is why traders often break whatever rules they have and assume unnecessary risk.

Everyone wants to have large gains on every trade and many traders spend a great deal of time, energy, and money looking for ways to achieve this desired result. The reality is that this pursuit of perfect entries is unrealistic and unhelpful in the pursuit of profits.

Real financial independence does not come as the result of a few lucky trades. It comes from a reliable and repeatable process that provides consistent results in any market condition. Everything we teach in our curriculum is designed to help you build out a specific, technique oriented trading process that provides constant feedback to help you both monitor its performance and to make continual improvements to its design.

How to Determine the Probability of a Winning Trade

It’s said in real estate that profits are made on the buy. So buyers focus on the purchase price of the house and work diligently to find distressed sellers desperate to unload their home at below market rates. Most people who trade stocks or options mistakenly assume the entry price is just as important. But it’s not. What most people don’t know (or can hardly believe) is that the chosen exit tactic (not the entry price) actually controls your profitability.

Those who wish to improve their performance can if they learn four simple principles:

- Setting a profit target and a stock loss generates a condition that gives the trader a reliable and measurable probability of a profit.

- Where the profit target and stop loss are set (relative to the entry) determines the expected percentage of winning trades.

- The base winning percentage is a statistical reliability and will produce expected results across asset classes, market types, and even when using random entries.

- The choice of what asset classes to trade will, in part, be determined by the selected base winning percentage.

The idea that it’s possible to get statistical predictability and a reliable base winning percentage from the markets may seem unbelievable to some. Yet it’s true. This concept is part of Selecting a Strategic Approach; 1 of the 7 Pillars that individuals control to help them gain predictable and reliable outcomes over many trades.

By internalizing this idea along with the rest of the Pillars, a trader will begin to be able to approach the market much like a professional trader would…with a clearly defined process, a clear understanding of probabilities, and the ability to focus on following your process despite the outcome of individual trades.

Our hope is to help you shift your focus and efforts on your trading process instead of the outcome of individual trades. Focusing too much on outcomes, and not the process, will whipsaw you into and out of trades at exactly the wrong time and for the wrong reasons. This sort of trading might also cause you to give up and go back to what wasn’t working in the past.

This lesson will lead you through four parts:

- What is a base winning percentage?

- How base winning percentages affect your trading

- The five Natural Trading Styles

- The power of alignment

Wall Street has a saying that money flows where it is treated best. If you treat your money well by establishing and then following a well-considered and complete trading process, money will more likely flow into your accounts.

What Is a Base Winning Percentage?

The base winning percentage of your trades could also be thought of as the percentage of trades that must be won for a trader to breakeven. It is determined by the average size of loss compared to the average size of profit.

Every trader who has placed at least 30 trades has a base winning percentage…even if they don’t know what it is. Later in this lesson, we’ll provide a calculator to help you figure out what your current base (or break-even) winning percentage is.

It’s possible to adjust your base winning percentage for higher or lower win rates. Simply adjust the ratio of where the stop losses and profit targets are relative to entry.

For example, to increase your base winning percentage, simply choose profit taking targets closer to the entry, while at the same time increasing the distance of your stop loss orders. The random nature of the market’s daily price range will trigger the profit target more frequently, leading to a higher number of smaller profits and a fewer number of larger losses.

On the other hand, to decrease your base winning percentage, set a profit taking order further away from the entry than the stop loss order, and it will result in a fewer number of trades reaching the profit taking order before they get stopped out. This results in a smaller number of larger gains compared to a more frequent stream of losing trades.

All base winning percentages simply measure the number of winning trades expected over the total number of trades. The relationship between profits and losses means that the base winning percentage will always be statistically break-even unless it is combined with a trading edge, which we’ll discuss in other lessons.

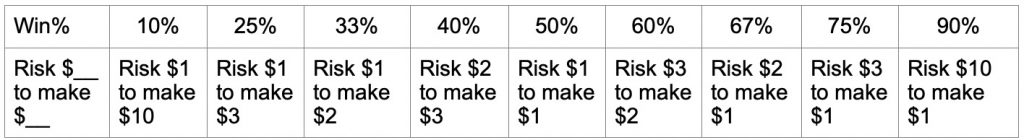

A desired base winning percentage can be selected simply by adjusting the relationship of the stop loss and profit taking orders relative to entries as shown in the graphic below.

The base winning percentage should always be expressed as a dollar amount risked to make a dollar amount of profit. It’s possible that a trader could design their process to win 90% of their trades. The tradeoff is that while losses are infrequent, they would be substantial relative to individual gains.

A good exercise at this point is to look at your past trades. If possible, average the gains and losses over the previous 30 trades. We use 30 trades throughout this course because that is the smallest group of trades that provides a statistically relevant sample size.

Assume that the average loss was the amount risked and the average profit was the amount gained. So if your average losses are $350 and your average gains are $700, your base winning percentage is 33% since you’ve gained twice as much as you risked on each trade (risk 1 to make 2).

Use the following calculator to help you discover the base winning percentage of your current strategic approach.

| Average Trade Profit | |

|---|---|

| Average Trade Loss | |

| The Percentage of Trades needed to Breakeven | % |