Improve Results with Options

Improve results with options

Options are instruments of probability. They are priced using a complex mathematical formula which boils down to the measurement of two variables: (1) Intrinsic value (or how much “in the money” it is), and (2) ‘Time and Probability’ value (most commonly just known as time value). Understanding these two variables is key to trading options profitably.

Far too many traders lose money simply because they don’t understand how market makers adjust option pricing in their own favor. The following simple truths about option pricing will help you recognize where option prices are likely to end up, and the probabilities associated with that final outcome.

- Option prices are set by option market makers.

- Options are priced so they decrease in value more often than they rise.

- The option market maker adjusts the price of the option to make it likely they’ll win 70% of the time.

Because these concepts are true, they lead to three important trading corollaries:

- Option sellers have a higher probability of winning but are guaranteed smaller profits in comparison to the risks they take on each trade.

- Options buyers profit only if the underlying rises fast enough for the intrinsic value part of the option’s price to offset the loss of time value as time passes.

- Option buyers have a lower probability of winning compared to option sellers, but make much larger percentage gains when they do win.

This lesson will explore each of these simple truths and their corollaries to help you understand how you can use the probability profiles and trading edge you learned in previous lessons to maximize profits in your option trading.

Truth #1: Option Prices are Set by the Market Makers

Option market makers use a Nobel prize winning formula and fast computer technology to help them make a market in the derivatives known as options. This formula incorporates many variables which can be boiled down into just two basic components: Intrinsic value and time value.

Intrinsic value is determined by the relationship of the option’s strike price to the underlying’s current price. Intrinsic value moves dollar for dollar as the underlying moves. Meaning if the underlying goes up $1, the call option’s intrinsic value will also go up $1. If the underlying falls in value, the intrinsic value of the call option falls at exactly the same rate. Put options are the opposite. If the underlying drops $1 in value, a put option’s intrinsic value will rise $1 and if the underlying rises in value by $1, the intrinsic value of the put option drops $1. Intrinsic value will always either be positive or zero.

The time value (not the intrinsic value) portion of an option’s price is where the market maker adjusts the price to insure they keep their probable winning percentage at 70%. This means the market maker will inflate or deflate the price of time in response to changes in both the macro environment and conditions of the underlying equity. Time value is also a decaying asset because it loses value as time passes. Therefore, time value both fluctuates and constantly decays as time passes and will eventually be worth zero at expiration.

If expectations are high that the underlying will increase in volatility (like around earnings), market makers raise the price of time to keep their expected winning percentage at 70%. The converse is also true, they’ll reduce what they charge for time during periods of lower volatility. More advanced traders and strategies make use of these factors that affect the price of time and as you gain in experience, you may find a need to learn these advanced features. But for now, the simple approach is to understand time both fluctuates in price and decays in value with each passing day and will eventually be worth nothing on expiration.

Trading stock differs from trading with options because options have more moving parts such as expirations dates, puts versus calls, a wide variety of strategies and the impact on time value from market expectations. The two biggest risks to those who trade option is expiration date (the option eventually expires) and time decay. Not only does a person need to keep track of direction (up vs. down), but they must also keep an eye on all these other factors. Some have compared stock trading to the game of checkers and options trading to chess—and rightly so.

This module will help you better understand the two primary ways to open an options position: Either as a buyer (speculator), or as a seller (cash flow generator). Time decay works against a buyer and for a seller. You can be either (or both) an options buyer or seller depending on the strategy you choose. Understanding how options are priced helps you select the best option strategy to implement based on your probability profile, your forecast, and your system.

Time Value and Intrinsic Value

Intrinsic value

While it is true that you don’t need to understand the Nobel-prize-winning math that drives option pricing, it is also true that traders can gain an edge by understanding a few basic components of that math.

Whether demand is high or low, the option market makers constantly strive to make their price reflect the right value based on potential opportunity and time left before expiration. This value can be sorted into two important components: Intrinsic value and Extrinsic value.

The most important variable you need to understand is the fluctuating nature of the value of time and the continual erosion of its value each passing day. Time loses value faster as an option approaches its expiration. For an option to be profitable on expiration, any loss of time value must be recouped by an increase in the option’s intrinsic value.

Intrinsic value is measured as the difference between the strike price and the actual price of the stock. Call options have intrinsic value if the strike price of the contract is lower than the current stock price. Put options have intrinsic value if the strike price is higher than the current stock price. Strike prices that have intrinsic value are referred to as “in-the-money” options.

On the other hand, call options with a strike price above the currently traded stock price have zero intrinsic value. Same with put options that have a strike lower than the current price of the stock. These kinds of options are referred to as “out-of-the-money” options.

The premium for in-the-money options have both intrinsic and time value components. By contrast, out-of-the-money options have only a time value component, so they are much more susceptible to time decay.

Extrinsic value

The second important component which determines the price of an option is extrinsic— or time— value. Time value is interesting because it both constantly decays and can also become more or less expensive, depending on demand.

The time value represents a mathematical calculation about how much the underlying could move given the amount of time left before expiration. The time value of an option is established by an option seller’s pricing model which includes traders’ expectations about what will happen with the stock. It also includes the perception of what the stock has done in the past, and what it might do in the near future. The price also includes a measure of how much the stock may move within a given day. Lastly it includes and a valuation of the alternatives to any option trading (such as interest rates on bonds).

This mathematical model includes everything that goes into pricing an option except its intrinsic value. Professional option market makers refer to this combination of factors as implied volatility. We’ve referred to it simply as time value. Whatever you choose to call it, remember that it can fluctuate and become more or less expensive due to market conditions, that it decays in value over time, and that it always works against an option buyer and for an option seller.

In contrast to the complexity of determining the value of time, the intrinsic value is the “in-the-money” value of the option. It is easily calculated as the difference between the stock price and the value of an option’s strike price. For example, if a Call option gave you the right to buy the stock at a strike price of $40, and the equity currently trades at $42.23, then your option would have an intrinsic value of $2.23 ($42.23 current price – $40 right to buy price = $2.23 of intrinsic value). If the option cost $5.43, then time value would be $3.20 ($5.43 price of the option – $2.23 intrinsic value = $3.20 time value). On the other hand, a put option in this example would have zero intrinsic value ($40 right to sell price – $42.23 current price = -$2.23…a negative intrinsic value is automatically set to zero). If the $40 put option cost $3.20, the entire price is time value since the put option is out-of-the-money.

If the equity increases in price to $45 at expiration, the intrinsic value increases exactly as you might expect, penny for penny; while the time portion of the option’s price would continue to fluctuate based on market conditions and also constantly erode until expiration when it reaches zero.

The only way for this (or any) option to be profitable on expiration is for the in-the-money value to move more than the amount of extrinsic (time) value lost to the passage of time — $3.20(in the put option example above.

Changes in time and intrinsic value

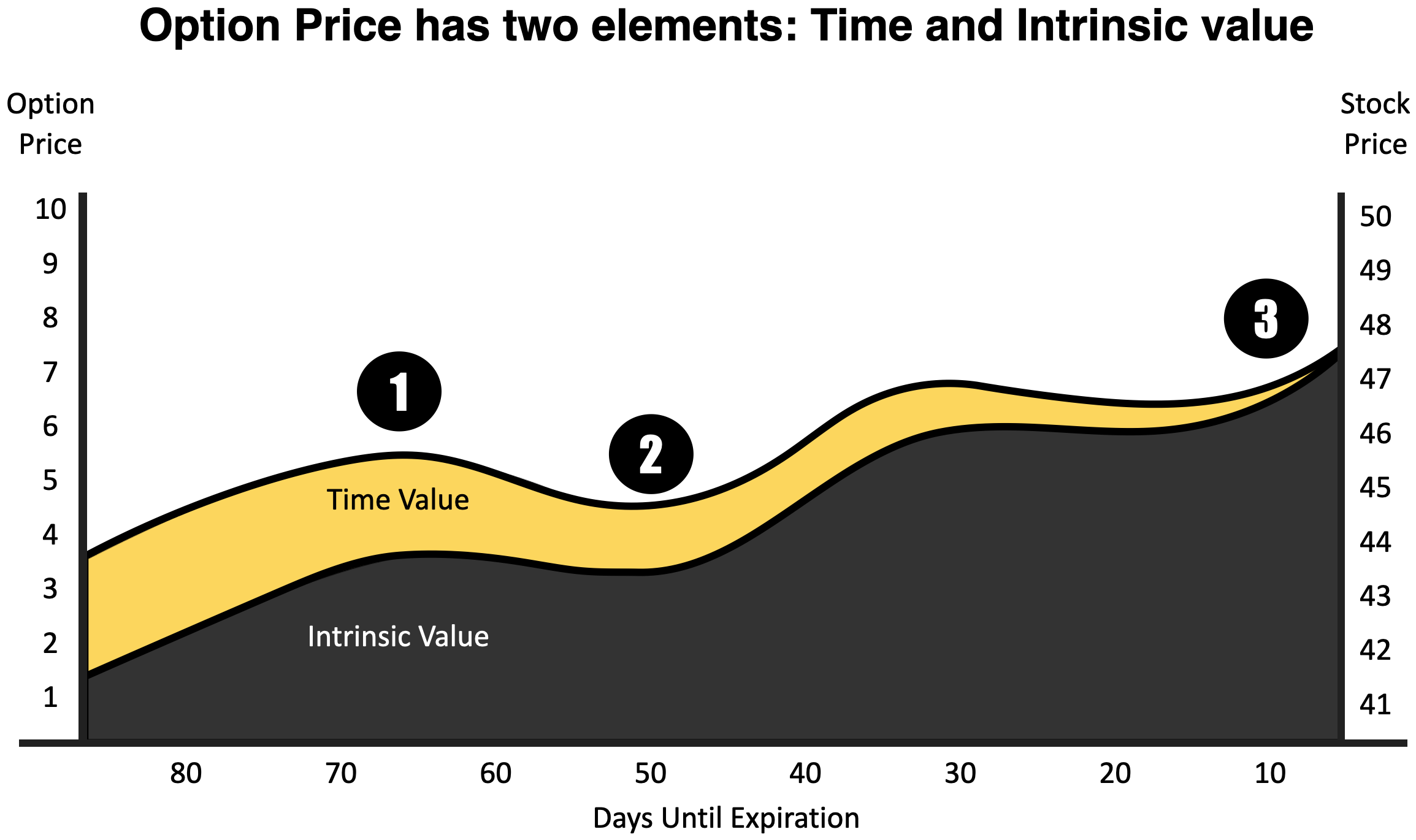

Understanding changes in time value is a different matter from changes to intrinsic value. If the stock value goes up $1.00, the intrinsic value increases by one dollar, but the time value will most likely decrease, both with the passage of time and also with the rise of the stock. This means your option will not always rise in a dollar-for-dollar pace. At times it may go up with a rise in the stock, but at a disappointingly slow rate. The following figure demonstrates how it the price of the option changes over time in comparison to the stock price. The intrinsic value is depicted in black, while the time value is depicted in yellow.

In this figure hypothetical stock and option prices are depicted over the course of 90 days. The price of the stock begins at $42.75 and fluctuates upward until expiration day when it happens to close at $47.75.

The option depicted here is a call option with a $40 strike price and an expiration date 90 days from the start of the graph. This chart attempts to demonstrate how the stock and option prices vary in a related fashion over time. Notice four important concepts shown in this figure:

- Over the course of 90 days, the time value—depicted in yellow—diminishes.

- At times the stock price may hold steady, but the option price will fall relative to the stock (as depicted between point ① and ②.

- Towards the end of expiration, as depicted near point ③, the option price moves in close tandem to the stock price. This assumes that the option price has some intrinsic value.

- Option pricing works efficiently when the price of the stock and the price of the option do not vary greatly, as depicted between points ② and ③.

When you can perceive this change to the extrinsic value over time, you can see more clearly why the three truths about options are consistently apparent in the options market.

Options can be bought and sold at any time, it is not necessary to wait until expiration before selling a profitable option. In fact, it is often better not to wait until expiration before liquidating your option positions. Using this losing trade as an example, it is very possible that the equity moved around enough before all of the time value decayed for this option to have been profitable at some point during its lifespan.

Truth #2: Options Are Priced so That They Decrease in Value More Often Than They Rise

Truth #3: Option Market Makers Price the Option to Win 70% of the Time

These two truths are closely related so we’ve combined them into one discussion. The truth is options are not like stock. A stock buyer can hold the stock forever. Options traders don’t have that luxury. Stock buyers can set stop losses and profit targets to give them a mathematically proven statistical base winning percentage. Options traders don’t have that luxury. The initial price of an option is set by (and in favor of) the market maker and the reality that time value decays and the option will eventually expire present real danger to option traders.

But, options also present such an exciting and potentially lucrative range of possibilities for profit that every investor and trader should make implementing them a priority. Any percentage move in the stock creates a much bigger percentage move in the option. Option buyers put less money into the trade (risk less) and have the potential to make a large multiple on any move in the underlying makes in the desired direction.

Additionally, options give people strategies to take advantage of every kind of market. There are cash flow strategies, market neutral strategies, protection strategies and speculation strategies. Each of these strategies key in on the corollaries mentioned above:

- Option sellers have a higher probability of winning but are guaranteed smaller profits in comparison to the risks they take on each trade.

- Options buyers profit only if the underlying rises fast enough that the gain in the intrinsic value part of the option offsets the losses of time fluctuation and time decay.

- Option buyers have a lower probability of winning compared to option sellers, but make much larger percentage gains when they do win.

These corollaries align well with the probability profiles discussed in the lesson titled, “Select a strategic approach.” The Win Frequent probability profile often employs option selling strategies. The Win Big probability profile often employs option buying strategies. The Just Win probability profile is flexible enough to enter trades either as a buyer or a seller. Future lessons will explore the risks and rewards option buyers and sellers both face as they implement the various strategies you’ll learn through your curriculum.

Risks and rewards for the option buyer

Option buyers are speculators and they like volatile markets. The underlying has to move enough in the right direction for their positions to make money. All option buyers face the risk that the time value of their purchased option will decay faster than the intrinsic value will rise before the option expires. For option buyers to make money, they need the underlying to move far enough in the desired direction that intrinsic value increases faster and further than the loss of time value. It’s possible to buy an option, have the underlying move in the right direction and still lose money because time lost value faster than intrinsic value appreciated.

Market makers always create a series of options with strike prices above and below the current price of the underlying for each expiration date. This gives the option buyer several choices to select from as they seek to implement their strategy. There are trade offs to buying options above or below the the current price of the stock which individual strategies will teach.

Remember there are two basic components of an option’s price: Time value and intrinsic value. Options with more intrinsic value cost more but time value makes up a smaller portion of the overall price and are therefore more likely to expire with some value. Options with no intrinsic value are comprised only of time value and these options have a greater chance of expiring worthless though they can be much more profitable on a percentage basis if the stock does as expected.

The Win Big (risk 1 to make 2) and the Win Big Extreme (risk 1 to make 3+) trading styles look for conditions where the underlying is likely to move farther and faster than the odds would predict. They expect to only win 30-40 percent of their trades and are therefore prepared to make trades that can deliver realistic gains of double or triple the amount they risk.

Our curriculum gives you a way of looking at the market and finding your edge in forecasting both the direction and the magnitude of a trade. Whatever you use to determine the trade setup, understand that active option buyers must be prepared to endure losing streaks of 8 or 9 losses in a row over the course of 6 months to a year. Option buying can still be a highly profitable trading strategy with proper trade management (taking small losses) and portfolio balancing. Once properly understood, losing streaks can simply be a psychological hurdle rather than a financial one.

One exception to this rule is that put buyers may be both speculators and insurance buyers. If you own an equity you can’t (or don’t want to) sell and believe it may about to lose value, buy a put option as insurance. The equity will drop in value as the put option rises in value, protecting your assets. Some people purchase insurance on their entire portfolio using index put options.

Winning as an Option Buyer: Establishing Success Criteria for Entry

Option buyers must find excellent opportunities that provide a defined loss when they are wrong, but are capable of generating proportionally larger winners if they are right. The buyer further refines their strategy by timing the purchase to correspond with some additional components like technical analysis, unusual trading volume, unexpected news, earnings, etc, that could rapidly change the price of the underlying and thereby the price of the option. Option buyers love volatility. Anything that adds to movement in the underlying gives them a bigger chance for higher percentage gains in their options.

Most option buyers don’t use fundamental analysis or other long-term trading tools, focusing instead on short-term technical analysis. Listen carefully in class to identify possible screening criteria and then create a checklist to identify potential trades.

Below is a sample list of potential criteria:

- The underlying’s price is near a support or resistance line.

- Technical indicators on the underlying show a potential breakout.

- The underlying’s price, previously downtrending, crossed up through a shorter term moving average on more than average volume.

- The related major-market index or ETF shows a definite trending pattern

- There is a known news event coming two weeks or more away (earnings, Fed announcement, etc).

- Unusual trading activity by larger players.

We asked you to identify 10 random stocks to paper trade using just the risk/reward characteristics of your natural trading style (risk 1 to make 2, etc). As an exercise, go back to those 10 random stocks (or select new ones) and do the same thing (set stops and profit targets according to your probability profile) only this time only enter a trade using one of the potential criteria listed above. Continue following these stocks over time even as you paper trade the setups you see in class.

Trading Options Systematically (as a Buyer)

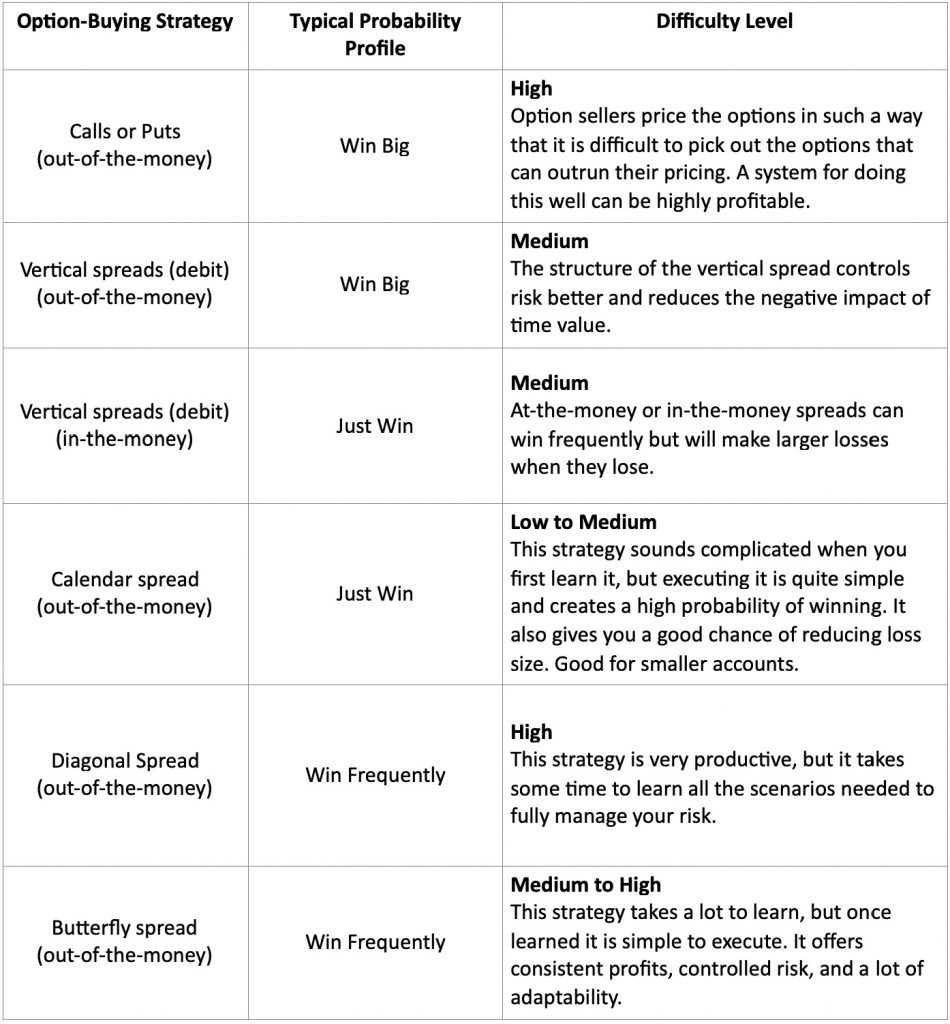

The following is a list of option strategies that buyers might employ and the probability profile associated with each. Though there are many options strategies that can be profitably traded, these are the most reliable for traders new to option strategies. You should discuss this list with your instructor so that you can select those strategies you would like to learn more about.

Risk guidelines for buying options

Successful traders are not emotionally-driven gamblers going all-in when they get a wild hunch. They have a specific trading methodology which they trust and follow on every trade, regardless of the outcome of the most recent trade.

Even following the best system in the world still makes you a gambler if you don’t practice proper risk management. All the effort to find great setups and execute trades flawlessly is wasted if you allow fear or greed to influence or change the amount of your portfolio risked on each trade.

Because markets are random, the results of individual trades cannot be predicted with any sort of accuracy. But the results of many trades can be predicted with great accuracy,unless each trade carries varied risk from other trades.

For example, if one trade represents a portfolio risk 5 times higher than other trades, the outcome of that single trade creates an unpredictable impact on your portfolio, which turns you into a gambler.

Option pricing can experience wild swings over short periods of time. As they are also leveraged, these price swings can have a significant impact on a portfolio’s overall value. Without proper care, an investor may begin to overweight the risk between trades and trade strategies.

A good rule of thumb is to limit the risk of each trade to just 1% – 3% of the overall portfolio. When buying stock, losses are limited through the use of stop orders. When buying options, the trader limits the risk by only spending 1% – 3% of total portfolio value on each trade.

So if a person had $10,000 to trade, the total amount of premium paid would be limited to $100 – $300, and the number of contracts purchased would be limited by the amount risked. Investors who commit to this plan limit impulsive decisions, avoid the unpredictable portfolio impact of varied amounts at risk, and create a system of long-term financial success in options trading.

In general, option buyers should consider risking an amount closer to 1% of their account, while option sellers might consider containing risk to as much as 3% of their account, but no more if possible, in the event of a worst-case scenario loss.

Risks and rewards for the option seller

The single biggest risk a call option seller has is the exact same risk of those who buy stocks, ETFs and other underlying equities: They can drop in value. The second biggest risk is lost opportunity. When sold to open a position, call options obligate the seller to sell their underlying equity at the strike price of the option. This obligation to provide the underlying at the strike price limits (or caps) the profit of the underlying at the strike price. Option sellers limit the potential upside of their positions in exchange for capturing a desired and defined premium (paycheck). They hope to make many small paychecks on a high percentage of their trades without having the underlying drop enough to wipe out all their cash flow gains.

Remember, time decay works against an option buyer….but it works FOR an option seller. Also remember that “time” is what we’ve been calling the portion of an option’s price which is not intrinsic value and that “time” is where the market maker manipulates the option’s price to give them a 70% chance of winning.

Remember one of the truths about option pricing: Options are priced so that they decrease in value more often than they rise.

Option sellers understand this truth and have positioned themselves to profit from it. The advantages of approaching options as a seller are real. Option sellers can be profitable if the underlying moves in their favor, stays the same, or even moves against them a little bit.

Those who sell options may choose from any and all the available options for that underlying. There are advantages to selling more or less time and advantages to selling more or less in the money. Future curriculum will explore a number of option strategies and help you match strategies to your natural trading style.

Winning as an Option Seller: Criteria for Success

Option sellers obligate themselves to buy (in the case of puts) or sell (in the case of calls) the underlying at the strike price of the option sold. They receive a premium (paycheck) in exchange for this promise to either buy (puts) or sell (calls) the underlying at the strike price. The safest way to employ this strategy with calls is to own the underlying or another call option. This is known as a “covered call.” Selling calls against stock or options you own has been deemed safe enough to do inside an IRA or other self-directed retirement plan. Selling a call option carries the same risks of equity ownership: The underlying could lose significant value. Beginners should only employ this strategy on stocks or ETFs which are bullish or neutral, not bearish.

Put option sellers obligate themselves to buy the equity at the strike price by expiration. The safest way to employ this strategy is to only do it on equities you like and wouldn’t mind owning and to only obligate yourself to buy the shares that you have cash on hand to pay for (no leverage).

The times that tend to create excellent opportunities for sellers are when there is excitement and high expectations in the market. Market makers tend to price options higher during these times even though the underlying is also likely to go up or at least stay the same. These trades generate small but consistent paychecks with a lower chance of the underlying losing value. If you carefully invest in equities you like anyway, and manage the risk of equity ownership, you can be very successful as an option seller focused on generating cash flow from the markets.

If you have a source of option trading ideas, such as our research tool, a subscription service you trust, or a well-chosen set of screening criteria from other sources, then you can use the following checklist to help you identify your option candidates from among the trading ideas you accumulate:

For each potential candidate, review the chart and answer the questions below:

- The equity has been heavily discussed over the past two or three weeks in emails or news coverage.

- Good earnings were published within the previous few days

- The stock has bounced up off support

- You already own the equity and simply want to generate cash without selling your position

- The related major-market index or ETF is showing a bullish to neutral pattern

- A known news event has recently passed within the last two weeks

- Smart players seem to be accumulating

As an exercise, work through a random company to see how many characteristics your candidate has from this list. A simple rule of thumb is that three or more of these mean it is likely a strong candidate for a successful implementation of the covered call strategy. Once you feel more comfortable with these characteristics, you may add one or more of these (and others that you learn about) to your Trade Plan.

Trading Options Systematically (as a Seller)

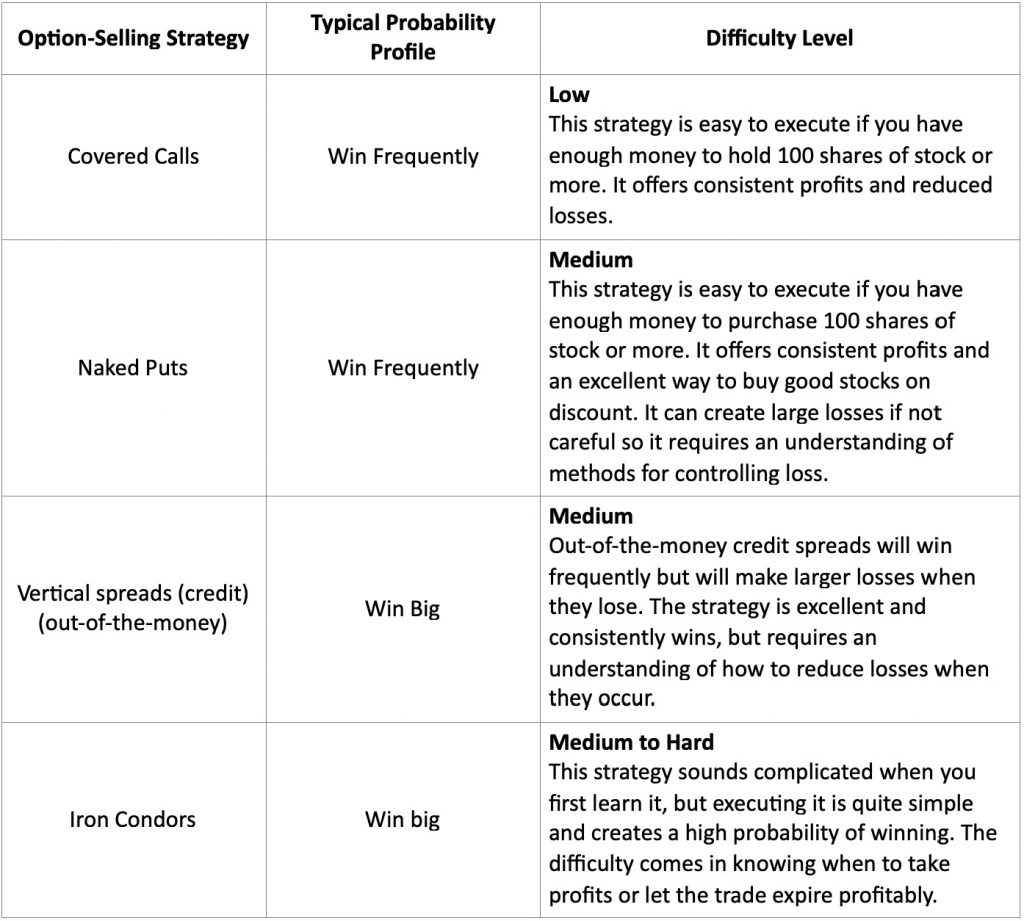

The following is a list of option strategies that traders might employ when acting as the option seller. The probability profile associated with each strategy in this list is a default, though each of these strategies can be adapted for different probability profiles. Though there are many options strategies that can be profitably traded, these are the most reliable for traders who are new to options.

Some of these strategies may be new to you and some of them may require additional permission from your broker to trade. As you look over these strategies and the rest of the information presented in this lesson, think about which approaches seem most appealing to you. Once you have singled out a strategy, add it to your Trade Plan and begin paper trading it for experience and to build your confidence and anticipation to trade it with real money.

Conclusion

Your success as a trader is not determined by your account size, nor by the amount of time you can devote to trading every day.

What measures your success is how well you follow the rules of your system on every trade and whether or not you keep trading through inevitable losing streaks.

It’s true that you will lose a percentage of your trades. t’s also true that you lose 100% of the trades you don’t take.

Try to think of your efforts as a trader more like a marathon, not a sprint. While many people who decide to trade for themselves feel a great urgency to make up for lost time, try not to put yourself under that kind of pressure.

Your success will ultimately not be measured by a few lucky trades or by how much you have to trade. The real measure of your success is your annual rate of return. A high enough annual rate of return will make up for any lost time or small account size.

Done right, options are a fantastic way to reduce risk, increase profitability, and significantly improve annual ROI.