A Quick Intro to Options

A quick intro to options

Options can provide a powerful way for individual traders to achieve their financial goals. The nature of options allow traders to gain leverage, generate steady cash flow, buy insurance, and speculate on downward moves.

Understanding options and becoming familiar with the various ways they can be used will empower the individual trader and give them additional and creative ways to profit.

Options provide a trader with powerful tools to seek out and profit from trading opportunities in any market condition. They can also be easily sorted into the five Natural Trading Styles.

Trading options comes with risk. It’s true that option buyers can use the leverage of options to make windfall profits, but option pricing formulas actually favor options sellers. Option market makers price options so that they (as the option seller) will win about 70% of the time.

There are two reasons why options have risk for buyers. First, all options come with a built-in expiration date on which the contract and all the potential opportunity expires. Second, a main component of option pricing, Implied Volatility, constantly erodes as time passes.

That said, given the right timing, option buyers can experience significant increases in value and recognize much higher percentage gains from their trades. Option buyers can also clearly define exactly how much they choose to risk which is limited to the amount they paid to get into the position.

The challenge is that it’s not easy to predict both the timing or the magnitude of a move. Option buyers must consider both the advantages and the disadvantages of their chosen approach.

The alternative to buying options is to sell them. Option sellers get paid by option buyers to enter into contractual obligations. The passage of time favors option sellers who profit if time passes and the stock doesn’t move that much.

Because of the decaying nature of Implied Volatility, option sellers can profit if the stock moves in their favor, stays the same, or even moves against them a little bit.

All trading decisions and especially those with options have tradeoffs. For example, option buyers give themselves the potential to experience large gains, while option sellers give up that potential in exchange for smaller, more frequent gains.

Another tradeoff is related to risk. Option buyers have a defined risk and an undefined potential for profit. On the other hand, option sellers get a defined profit while entering into a contractual obligation that carries and undefined and potentially large risk.

A good rule of thumb is that option buyers will experience a smaller percentage of winning trades but those winning trades will come with larger profits. Option sellers will have a larger number of winning traders but each win will be smaller and well defined.

An historical review

Options have been around for hundreds of years but not in the easily tradable and widely available form they are today. All market participants now have access to options but only those who understand what options are and how to trade them can really benefit from the opportunity they present.

Option contracts as we know them today were initially developed and made their debut on the Chicago Board of Options Exchange in 1973. Initially options were created for just one equity. As computers, trading algorithms, and networks became more robust and speedy, additional stocks and option types were added until by the late 1990s the modern option market was developed.

The option market has continued to expand and option trading volume has continued to expand. Options can now be traded on a growing number of asset classes such as stocks, futures, currencies, indexes, and Bitcoin among others.

As option market makers have become more sophisticated, they have also added additional expiration dates and option types. Whereas options were initially set to expire each month, market makers have added expiration dates as far away as 2.5 years into the future and as close as every other day.

Options are now less expensive and more easily assessable to the every day trader. This provides a great deal of choice and creates a number of opportunities for individuals to hedge positions, generate cash flow, or find windfall profits in all market conditions.

The contractual realities

Today’s option market allows all participants to trade their money or protect their assets in new and exciting ways.

Options are contracts which spell out specific contractual terms applicable to both parties in the contract. These parties are the option buyer and the option seller. The contractual terms are standard for all option contracts and include:

- Rights or obligations

- Strike price (contractual price)

- Expiration date

Each option gives buyers rights and obligates sellers to contractual obligations. A buyer may choose to exercise their right or not. However if a buyer chooses to exercise their right, the seller is obligated to perform under the terms of the contract. Buyers will only exercise their right if the contract’s terms are favorable compared to market prices.

An option’s strike price is the contractual price both parties agree to. All optionable securities have a number of strike prices which range from below the current price of the equity to above the current price. This range of strike prices is sorted into “in-the-money (ITM),” “out-of-the-money (OTM),” and “at-the-money (ATM)” strike prices.

All option contracts come with a built in expiration date. This is the date after which the buyer’s rights and the seller’s obligations disappear. This is the date on which all profits or losses for that option are realized.

Both option buyers and sellers may choose to exit the contract prior to expiration if they want. To exit a position, buyers enter a “sell to close” order and sellers enter a “buy to close” order.

Market makers create options for multiple expiration dates. All option contracts are sorted into tables known as option chains by date of expiration and strike price. All investors may choose to buy or sell any of the expiration dates or strike prices listed in the options chain. That said, some expiration dates and strike prices are more popular and are therefore more liquid and less expensive than others.

Buyers acquire their contractual rights by paying an amount known as a premium. Sellers enter into their contractual obligations by getting paid the premium.

Options pricing

Premiums are set by the market maker who uses a Nobel prize winning formula to determine fair prices. Premiums are higher for ITM options and lower for OTM options. This is because fundamentally option premium is made up of two things:

- Intrinsic value

- Extrinsic or time value

ITM options are more expensive because their prices include both intrinsic and time value. OTM options are less expensive because they only have time value…intrinsic value is zero.

Intrinsic value will either be a positive number or zero. Also known as “moneyless” it measure how far ITM an option might be. Intrinsic value moves in direct proportion to the price movements in the underlying equity.

On the other hand, extrinsic (or time) value is affected by both the passage of time and how much market makers think that time is worth. So extrinsic value both constantly decays as time passes and also fluctuates up or down based on the value of that time.

Among other things, the value of time is affected by volatility. Market makers increase the price of time during periods of high volatility or when they expect such high volatility to occur.

Option prices are derived from the movement of the underlying equity they are based on albeit priced significantly lower. This provides significant leverage to those who buy options, speculating on market direction.

Options make it simple to profit from any market direction. They provide speculators more leverage, act as a hedge against risk, and provide a way for sellers to generate regular cash flow.

How option prices change

When the stock market is open, the value of an option contract can change continuously. The way the value changes is important to understand, because option prices move differently from stock prices.

Generally stock prices rise or fall based on the flow of orders between buyers and sellers. Prices will rise if there are more buyers than sellers.

One the other hand, option contacts can rise of fall based on three different factors. Let’s look at each one:

The normal flow of orders between buyers and sellers

The first factor is the normal market action generated by buyers and sellers.

Similar to stocks, options also rise or fall in value depending on the flow of orders between buyers and sellers. If buy orders come in faster than sell orders, the price moves higher. If sell orders outnumber buy orders, the price moves lower.

Market action tends to be the biggest factor moving stock prices higher or lower at any given moment. However, except during earnings announcements or other big events, market action is often the least influential of the three factors that move option prices.

The decreasing amount of time before expiration

The second factor is the decreasing amount of time left before expiration.

Since all option contracts have a time limit, the value of the option decreases bit by bit as the expiration date draws near. That decrease is known as time decay. Those new to option trading often overlook the influence of time decay, but they shouldn’t. Option values decrease at an increasing rate, so the value of the option decreases faster as the expiration date draws closer. Some option buyers ignore the influence of time decay, but that’s because the third factor is more influential most of the time.

The movement of the underlying

The third factor is the movement of the stock.

The value of an option is connected to its underlying equity through the option’s strike price. The movement of the stock can push the value of that option higher or lower depending on the type of the option contract, and what the option’s contractual strike price is.

A call option will increase in value if its underlying stock moves higher. That’s because call option contracts mimic the action of owning the stock starting at the strike price. A put option will move higher if the stock moves lower. That’s because a put option contract mimics the action of short-selling the stock, starting at the strike price.

How to read option prices

Reading option prices takes a bit of getting used to, but even beginners find that it doesn’t take long to catch on to what they are seeing. Without being able to read option prices accurately, option traders might not clearly understand what they are getting into, or how much money they might put at risk.

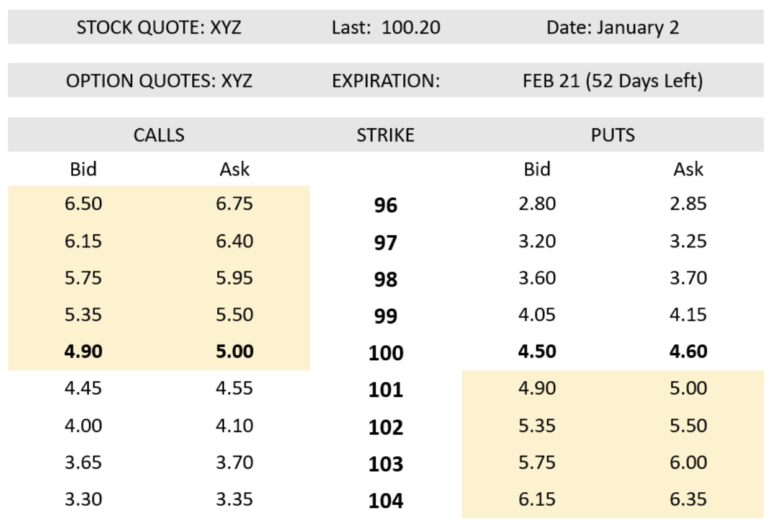

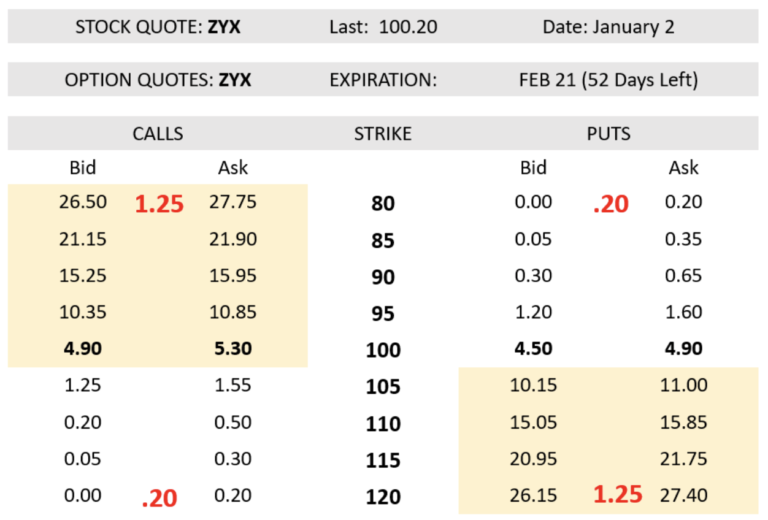

This part of the lesson will teach you how to read option prices from a broker’s quote screen. Keep in mind that the illustrated examples are hypothetical prices only. Option prices are usually displayed in a format containing the same information as in this illustration:

This is what is known as an option chain. It is a table of prices that organizes options by strike price and expiration date so buyers can locate the exact option they need. It is important to understand that the data in the option chain is interrelated. The following illustration will identify each of the six most important elements an option buyer would need to know. Let’s walk through these elements one by one.

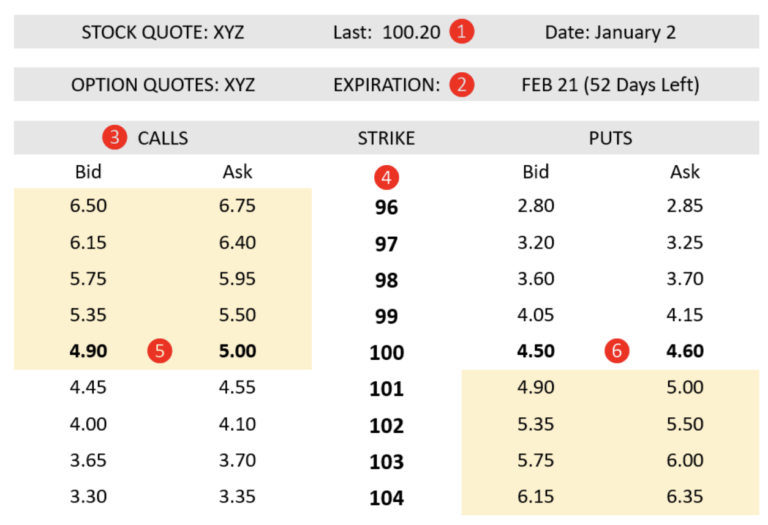

- The current stock price

This price fluctuates as the stock price rises and falls. On broker’s platforms, the option prices will change in real time as they adjust to any changes in the stock price. It is important to understand that the option prices you are looking at in the option chain are always based on the last published price of the stock. - The expiration date

Brokers platforms will show a separate table of option prices for each available expiration date that options are offered. New groups of options with a new expiration date are created as previous groups expire. - The option type

Calls give the right to buy, puts the right to sell. Calls are always listed on the left side of the table and puts are always listed on the right. - The strike price

This is the price where an option buyer has the chance to own shares (calls) or sell them short (puts). The more heavily traded a stock is, the greater the number of different strike prices that are likely to be available for option traders. - The bid and ask price

When a trader wants to buy an option, they look at these prices. The example here is the 100 strike price, and if a trader wanted to buy that option, they would usually have to pay the ask price. In this example the price is 5.00 per share. Since option contracts usually include 100 shares of the stock, the price for this option is $500. If the buyer wanted to sell the option immediately after buying it, they would need to accept the bid price. In this example that price is $4.90, so buying the option at $5.00 and selling it at $4.90 represents a ten-cent transaction cost. When that ten cents is multiplied by one hundred shares, it amounts to a difference of ten dollars. This transaction cost is in addition to any commissions the broker might charge. - The at-the-money (ATM) strike price

In this example, the $100 strike price is the closest to the last traded stock price. This particular option is referred to as being “at the money.” Option traders look for the at-the-money option when they want the most efficient balance between cost and leverage.

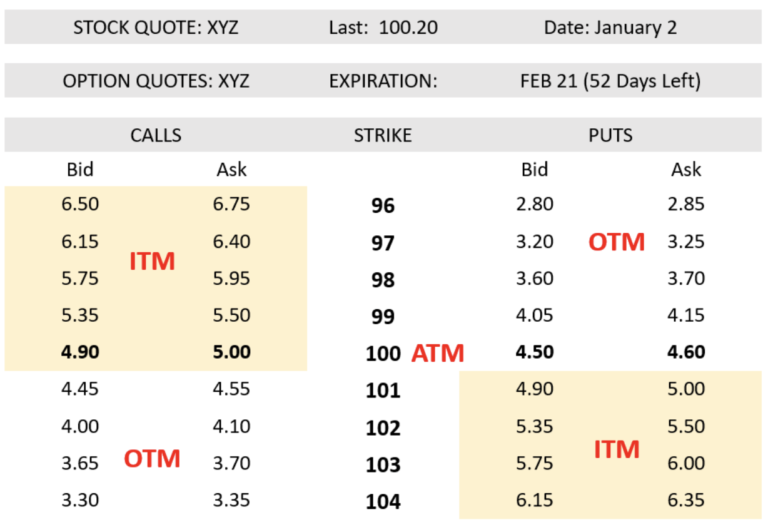

In addition to at the money (ATM), options can also be “in the money” (ITM) or “out of the money” (OTM). Calls are in the money when they have a strike price below the current price of the stock and puts are in the money when they have strike prices above the current price of the stock as the following graphic depicts.

The state of being in the money comes from the value a trader gets if they choose to exercise their contractual rights. Call option buyers have a contractual right to buy the stock, so a strike price below the current price means they can get the stock for below market rates. On the other hand, put option buyers have the right to sell stock. So if a put option trader can initiate a short sale on the stock with a strike price that is higher than current market price of the stock, then that put option is in the money. The illustration previously shown labels the options in each of the following states.

ITM:

The options in the shaded area are in-the-money because they have value if exercised at the current stock price. As the stock price rises enough to cross through strike prices, these strikes become ITM. Put options become ITM when stock prices fall below the strike price. All option data providers will highlight these options.

OTM:

The options not shaded are out-of-the-money because these options have no value if they are exercised at the current stock price. Call options become OTM if the stock price falls below the strike price. Put options become OTM if the stock price rises above the strike price.

ATM:

This is the strike price closest to the current price of the stock. Note that this option may also either be ITM or OTM. In this case, the 100 strike price is ITM for calls and OTM for puts. This option more sensitive to stock price moves than any OTM options, but less expensive than any of the ITM options.

Option contracts are created and sold by market makers in response to demand. When these options are created, the market maker sets the price. Changes in an option’s price are driven by the normal market action of buyers and sellers, but also by movement of the stock price and the perception of investors.

Market makers are constantly publishing new bid and ask prices for all of the option contracts they offer. They compete with other market makers and this competition is good for option buyers because it creates more efficient pricing on the option chains.

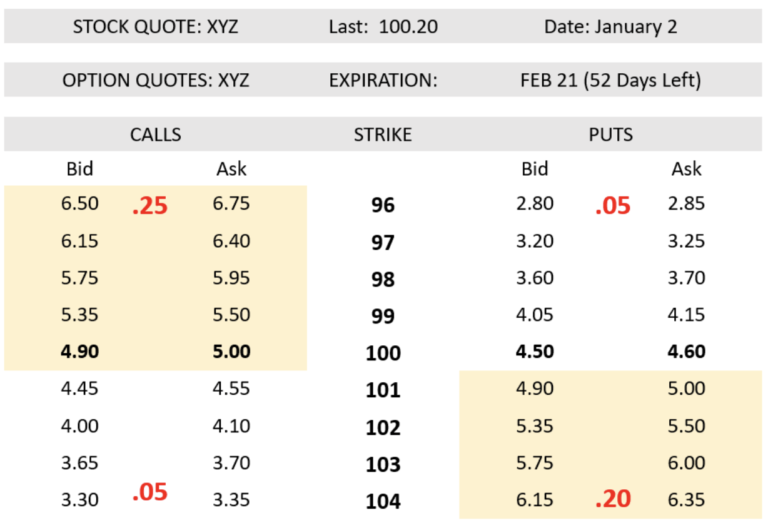

The difference between what buyers pay to secure their contractual rights and what sellers get when entering into the contract is known as the bid/ask spread. The size of the gap between the bid and ask prices is not the same for every option. Generally this size of this gap is affected by two things:

- ITM or OTM. The bid/ask spread is tighter for OTM strike prices than OTM ones.

- The liquidity of the option. More popular and heavily traded options have tighter spreads, while less popular and less liquid options have wider spreads. Compare the example of the hypothetical prices for XYZ options (previously shown) and ZYX options (following illustration).

In this hypothetical example of an option chain for ZYX stock, the prices are depicted as what might be typical for a stock which is less popular and therefore less liquid than XYZ stock. The option chain looks very similar except for two things:

- The bid/ask spread for each contract is much wider. This wider bid/ask spread is an indicator that fewer option traders have chosen to speculate on price moves in ZYX stock.

- The gap between the strike prices is also further apart indicating a lack of trader interest.

Compare the following two charts between XYZ stock and ZYX stock. Notice the difference in size between the Bid and Ask prices (the bid-ask spread).

XYZ Stock

ZYX Stock

Watching the gap between the bid and ask prices and the strike prices is a useful detail for a trader to notice. As either of these widens, the transaction costs for these options increases adding additional risk to the trade.

There is a lot more to learn about what can be read from option prices, and brokers include additional information beyond that captured in these examples. While it’s not completely necessary to be a successful options trader, some traders believe an edge can be found by tracking open interest, volume, and the changing values of the greeks associated with option pricing formulas.

Being able to accurately review option price information helps a trader more effectively approach the market as either a buyer or a seller of options.

Closing an option trade

The great news is that both option buyers and option sellers can close their positions anytime they want—they don’t have to wait until expiration. The procedure for closing a trade is simple. “Buy to close” orders are used by option sellers to get out of their positions. “Sell to close” orders on the other hand are used by option buyers to come their open trades.

While it’s true that option buyers have rights that allow them to buy or sell stock, most choose to avoid the expense and complexity of exercising their rights by simply selling their contracts back into the market before they expire using a sell to close order.

Option sellers obligated themselves to the terms of the contract they sold. Yet, these obligations need not last until expiration. The option seller may choose to buy back their option from the market at any time to remove the obligation and close out the position.

Those who exit option positions may use either market or limit orders to do so. Market order give an instant fill at a potentially unfavorable price (especially for illiquid options) whereas limit orders are not instant fill and may not ever trigger. Limit orders protect from volatility and allow a trader to work the spread. However, they may not get the trader out in a quick moving market.

Using a “buy to open” order for either a put or a call option creates a “long” position. In contrast, a “short” position is created with a sell-to-open order.

As shown in other parts of your curriculum, the base win rate is determined by the placement of the stop and profit taking orders relative to the entry. With stocks, if a stop and profit taking order is set equidistant from the entry price, the investor has a 50/50 chance of winning that trade and can expect a base win rate of 50%.

While the principle applies to the options market it is not the same, due to the depreciating nature of time decay. Option buyers are negatively affected by time decay, which increases the distance a stock must move in the desired direction to become profitable. On the other hand, option sellers are helped by time decay since they get paid for time.

Option buyers who place stop and profit taking orders equidistant from the entry will win less than 50% of the time while option sellers will win more than 50% of the time.

Each trade you make should be done with specific exit rules. In addition to profit taking rules, these rules should also serve to save some of the eroding value of an option that isn’t profitable.