Buying Options

Buying options

Option trading is more complicated than trading stocks or other asset class types. Many associate buying stocks to a game of checkers whereas buying options to a game of chess.

When purchasing an asset class like stocks, the trader buys shares and only needs to worry about the price of those shares rising in value over time. The price of the stock is the only measure that matters.

However, options are different because there are three factors that drive price change:

- Changing flow of orders between buyers and sellers

- Decreasing amount of time before expiration

- Movement in the underlying

The interplay between these three elements help option market makers decide what price to charge for the option. These prices change minute by minute when markets are open.

These option market makers both want to keep prices low enough to entice buyers and also high enough so they can profit on the contract. This is not an easy task and is partly why both parties have opportunity.

Using options for speculation

If a trader chooses to buy an option contract, they gain specific contractual rights. These rights are:

- Control 100 shares of stock

- Exercise the option to either buy or sell those shares at the contractual strike price

- Sell the contract to someone else before it expires

The purchase of an option is a bet on a directional price move. Buyers can choose to buy an option that profits when direction is bullish or buy one that profits when direction is bearish.

While traders with smaller accounts have always been able to buy stocks and profit from bullish moves, it was more difficult for them to profit in a bearish market. That is no longer the case. Options make it simple to find profits in either market using either call or put options.

The challenge option buyers face

To be successful as an option buyer, the trader must look for opportunities where a movement in the underlying will overcome the built in loss of value all options have. This built in loss of value are:

- Decaying nature of the value of time

- Bid-ask spread

- Transaction costs

As brokers adjust the price of options to maximize their opportunity, the value of time can fluctuate. For example, during periods of known price volatility such as earnings, options market makers will increase the value of time to help them achieve their goal of winning their trades while keeping the price low enough to attract more buyers.

Because OTM options are comprised solely of time value, any loss of time value is more impactful to their price. The deeper ITM options cost more, but more of their price is comprised of intrinsic value meaning they are less affected by the passage of time and more affected by the change of price in the underlying.

Call options

Call option buyers speculate that the equity will rise in value before their contract expires. Because options are less expensive than the equity, they give the trader leverage and the potential of making a significantly higher percentage return on their risk.

Options provide leverage to buyers based on what strike price is selected. OTM options provide the highest leverage but also the highest risk of loss. ATM options provide the lowest leverage but also have a greater chance of expiring with some value. ATM options are a balance but time value is also most expensive for these options.

The highest percentage gains made by call option buyers comes when they buy an OTM option which becomes deeply ITM during the life of the contract. It’s possible for options to experience a 10X percentage gain compared to the move in the underlying.

Example #1:

When a trader buys a call option contract, they buy the chance to own shares at the strike price on or before the expiration date. Most option traders prefer to avoid buying the stock and benefit from the rise in value of the call option itself. Let’s take a closer look at how that happens.

Suppose a trader buys a call option on XYZ stock with a strike price of $100. Let’s also suppose that at the time of purchase, the option has 30 days left until it expires. The setup might look something like this:

At the moment this chart depicts, the 100 call option contract can be purchased for a price of $2.00 per share. This implies that the trader would spend $200 dollars to buy the contract because the contract includes the chance to buy 100 shares. This might not seem like a very interesting proposal to have the opportunity to buy the stock at a higher price than it is trading right now, but that’s often how option traders operate. They look for a stock they think has an opportunity to move significantly higher within the option contract’s window of time.

They hope to see the stock make a big move in their favor. Imagine if the stock moved more than eight dollars higher in two weeks. If that scenario played out, the option buyer now has the chance to buy XYZ at $100, even though the stock is worth $108. If the option buyer wanted to exercise their right to buy the stock at $100, they could do so.

If they exercised their right, they’d pay $10,000 to acquire the shares which are now worth $10,800. They spent $200 to buy the option which means they have a $600 net gain on the trade.

However, most option traders don’t operate this way. Most option buyers instead choose to sell the option back into the market. They can sell their option anytime until the market closes on the date of expiration.

Let’s assume that over the next few days, XYZ prices rise to look like this:

At this point, the option is priced at $9.10 per share. If the call option buyer sells the call option back into the markets (rather than exercising it) they get $910. That means the net profit from the trade is $710 instead of $600. A favorable outcome such as this is, of course, what every option buyer hopes for.

But anything can happen and the share price might only rise a small percentage, or it might even go lower. Let’s consider how the outcome of this trade might play out in either of these scenarios.

First, let’s suppose that XYZ only rose to a price of $103 per share like this:

In this scenario the option might be priced as high as $3.80. This represents an opportunity for the option trader to generate a net profit of $180 by selling the option.

The alternative would be for the option buyer to exercise their right to buy the shares at $100. They would forgo the profit they might have had from selling the option, and would tie up more capital, but they no longer have to worry about the expiration date of the contract. The trader can now own the stock by purchasing it at a bit of a discount compared to what they would have had to pay if they just bought the stock when it was priced at $99.50.

Trading doesn’t always work out like we hope it will, so now let’s consider how the trade plays out when the move is unfavorable to the trader. In this scenario we’ll imagine that the price of XYZ trended lower after the initial purchase like this:

In this scenario the price of the stock falls to $98 and the price of the call option decreases as well. Notice that taking the opportunity to exercise their contract to buy the stock at the strike price of $100 is not in the trader’s best interest right now, but they have two additional alternatives at this point.

The first alternative is that they might decide to wait and hope that the price will rise over the remaining two weeks before expiration. The second alternative is that they might decide to simply sell their option contract to someone else while it still has value. The value of the option contract is $.90 per share (or in other words $90). That’s because the option still has some time left before it expires. Both the time decay and the price decline have had an influence on the price of the option contract, so the price is significantly lower than it was when first purchased.

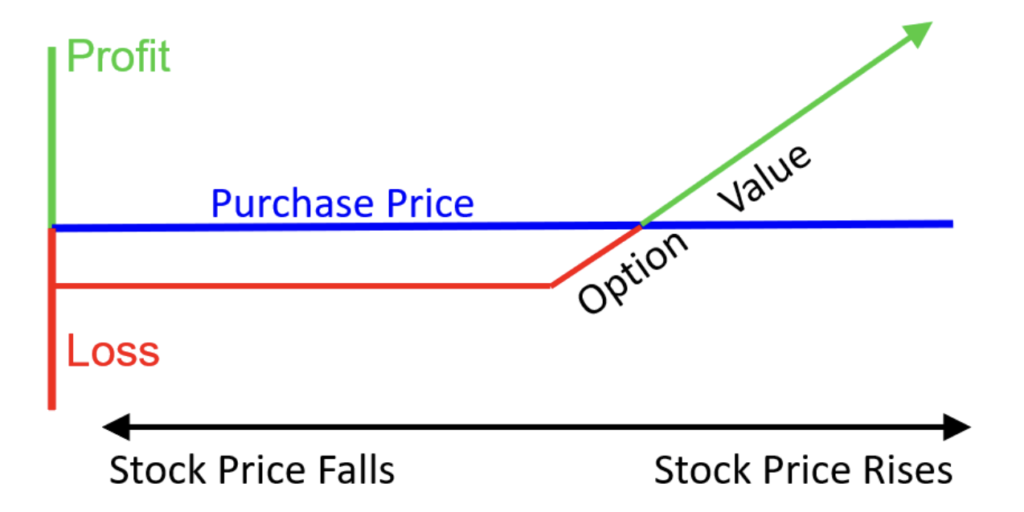

The value of the call option increases when the price of the stock moves higher, and decreases when the stock price moves lower. Call options give the buyer the chance to buy a stock at a set price, but they don’t need to take that chance unless the stock’s move makes it favorable to them to do so. These examples demonstrate how a call option contract can both capture benefit and limit risk depending on the movement of the underlying stock.

Buying call options offers a way to capture the opportunity of a bullish move, while maintaining a limited amount of risk. A common way to depict this relationship is through the use of a risk profile graph like this one:

Example #2:

Look at the following chart of Costco stock (COST). If a trader believed it would continue its upward trajectory, they could choose to buy the stock or buy a call option. If a trader decided to buy the option, they would need to select both the expiration date and the strike price.

The most leverage is found with options that have near term expiration dates and strike prices which are out of the money. These are the least expensive options. The trade off is that these options are more likely to expire worthless. So even though a trader puts less money at risk, it’s more likely that they will lose their investment unless the stock makes the projected move.

Some traders choose to buy options that act more like stock substitutes. What this means is they buy options with more time until expiration and also with strike prices which are deeper in the money. These options have less leverage than OTM options but more leverage than the stock itself.

The following chart is the price action Costco stock experienced over the next 56 days.

Understand the tradeoffs

When making decisions about which expiration date or strike price to select, a trader must also understand the tradeoffs.

Let’s look at various strike prices and expiration dates based on the following:

Date: June 21

COST closing price: $386.86

July 25 expiration:

For the first exercise, let’s assume a trader decided to buy options that expire on June 25 (that Friday).

Between the closing price on Monday and the closing price on Friday, COST rose $7.65 to $394.51 or a gain of 2% on the initial capital invested.

If the trader chose to buy the ATM call option instead, they would have only risked $ 2.40 and had a windfall profit of 177% on the initial amount risked.

Now to be clear, if the trader had determined to buy 100 shares of COST, they would have spent $38,686 and would have experienced a gain of $765.

On the other hand, the call option buyer would have controlled 100 shares by spending $240 for 1 contract. By selling this contract at expiration, the trader would have received $424.80.

January 21 expiration (sell on December 15)

In this case, Costco stock rose from $386.86 to $565.48 by December 15th. This represents a whopping $178.62 or 46% gain.

One of the tradeoffs of buying more time is that a trader may also opt for strike prices which are OTM or ITM. If they choose OTM, they hope the extra time gives the the stock more room to make its expected move.

Those who choose ITM options get less leverage that those who buy OTM options, but are more likely to have a position that is profitable on expiration.

Had a trader decided for leverage and bought the $410 strike price, they would have paid $13.10 or $1310 to control 100 shares. This contract gained 940% on a 46% move in the stock.

Traders who opted to buy ITM options at the $365 strike price, would have paid $36.05 or $3605 per contract to control 100 shares. This contract gained 402% during the same move.

Call option summary

Those who choose to speculate on directional moves may do so using options to gain additional leverage and to put less money at risk. In all of the examples shown, the amount used to buy the option and control 100 shares of stock is just a fraction of the amount required to actually buy the stock.

If the call option buyer chooses to do so, they may either sell back their option to capture profits (or salvage value) or they may choose to exercise their contract to buy shares. Either choice is valid though most traders simply choose to sell back their option to avoid the additional expense and effort of exercising their option.

Our next segment will discuss put options. Put options can be purchased to profit from an expected downward move.

Put options

Put option buyers speculate that the equity will drop in value before their contract expires. Put options are a simple way for traders with smaller accounts to play the downside.

Traders may choose to buy puts as a hedge on equities they own like a type of insurance protection against loss…or they may choose to buy puts on equities they don’t own as a way to profit from speculation.

Buying a put options gives the trader the right (but not the obligation) to sell the equity at the contracted strike price. This right to sell becomes more valuable if the equity drops in price.

Example #1

Suppose a trader has a bearish outlook on XYZ stock when to trades at $99.50 and decides to buy a put option on XYZ stock with a strike price of $98. Let’s also suppose that at the time of purchase, the option has 30 days left until it expires. The setup might look something like this:

At the moment this chart depicts, the $98 put option contract can be purchased for a price of $1 per share. This means the trader would spend $100 dollars to buy the contract. Put traders may choose to buy an option with a strike price below the current price of the stock because they know that there is a chance the price might go lower. If they buy the put option contract now, they can benefit from this move. They look for a stock they believe could move significantly lower within the option contract’s window of time.

A put option trader hopes for a drop in stock value. Now assume XYZ stock does drop to $98 as expected within two weeks like so:

Since the original cost of the option was only $1, the trader would have only had to spend $100 to purchase the option. Now as the stock price has drifted lower to $98, the value of that put option has increased by more than double.

The put option buyer now has two alternatives. The first alternative is the chance to exercise their right to sell the stock short at $98 per share. But in doing so, they give up the value of the option. This creates a net loss of $100 at that moment, but they wouldn’t have to worry about the expiration date of the option contract. This would allow them to hold onto the short position as long as they like.

The second alternative is to simply sell the put option back into the market, and benefit from the increased value of the contract. That would create a net profit of $110 before commissions.

There are times when a move is unexpectedly large. If this happened on XYZ stock it would look like the following:

Notice in the chart above, the put option price is depicted as being $4.70 per share after the share price moves down to $94.25. The move of the stock is the biggest influence on the price because a stronger move lower means the option value increases more dramatically. If the put option buyer simply sells the option now (rather than exercising it) they give someone else the chance to sell XYZ short at $98 and they receive $470 for doing so. That means the net profit from the trade is $370. This outcome, or something even better, is what every put option buyer hopes for.

But option traders must be aware of the risks they take and the stock can move in any direction including unfavorable ones. In this example let’s consider what would happen to the put option if the share price rose instead of falling like shown here:

If XYZ traded as high as $103 per share two weeks later, it could create a scenario where the price of the put option falls dramatically. In that scenario the put option might be priced as low as $.40, losing more than half its value.

The trader can still take the chance of selling short the stock at $98, but doing so would put them in a position of losing $5.00 per share at the outset. Even though the put option has lost value at this point in the trade, it is worthwhile to consider the alternative. The value of the option has lost only $.60 per share by comparison. This is an example of what makes option contracts attractive to some traders. In this scenario, even though they lose a larger percentage of the money they spent on the trade, their loss is a smaller net amount than they might have lost from making a short sale trade.

The value of a put option increases when the price of the stock drops and decreases when the stock price rises. Put options give the buyer the chance to sell a stock short at a set price, but the buyer doesn’t need to take that chance unless the stock’s move makes it favorable for them to do so. These examples demonstrate how a put option contract can both capture benefit and limit risk depending on the movement of the underlying stock.

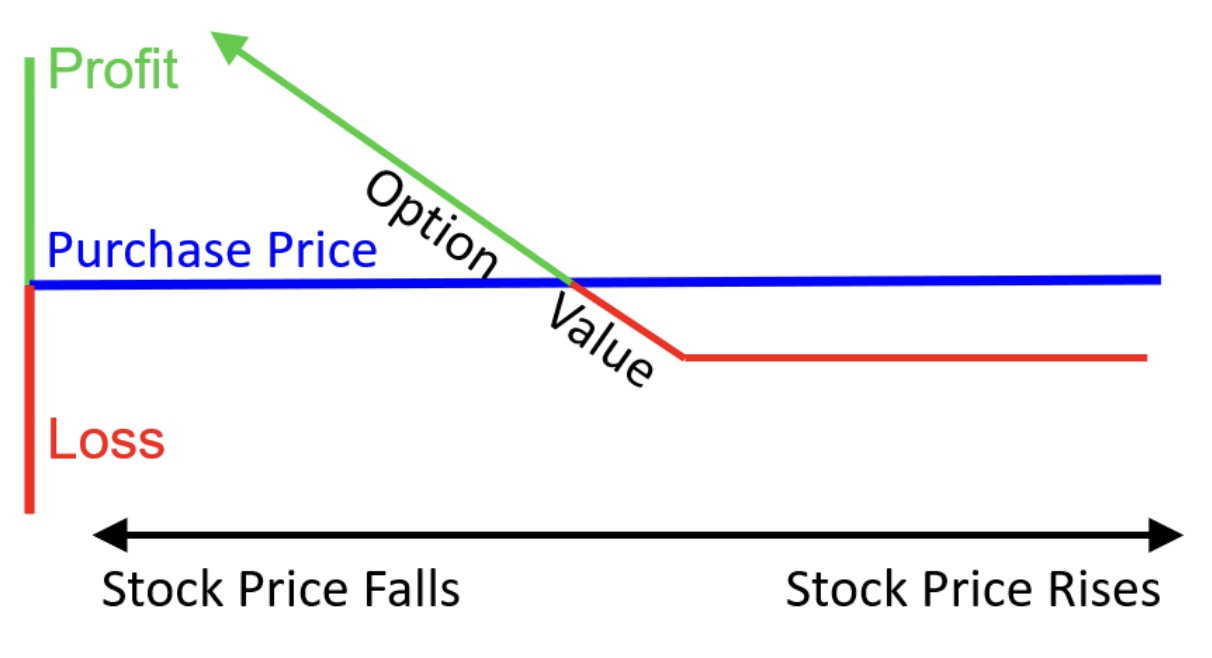

Buying put options offers a way to capture the opportunity of a downward move in a stock price, while maintaining a limited amount of risk. A common way to depict this relationship is through the use of a risk profile graph like this one:

This depiction shows how the option price changes based on the movement of the stock price. Once a put option is purchased, the value of the option will tend to increase as the stock price falls. Theoretically, this increase is only limited by stock price reaching a zero dollar value. If the stock price rises, the value of the put option can only go to zero, so the amount of loss is limited to the purchase price of the option.

In summary, buying a put option allows the trader a chance of shorting a stock if they choose to do so. The cost for having that chance is the price of the option. If the stock moves favorably, they can benefit by exercising the option or by selling the option to someone else. If the stock moves unfavorably, they will lose some or all of the money they used to purchase the option, but their risk is limited to that amount of loss.

Example #2:

Let’s take a look at an example where speculation in puts makes sense. Suppose you saw that the chart of Costco’s stock which looked like this…

And you decided there was a good chance it would do this within the next 90 days…

One way to profit from a bearish forecast is to sell stocks short. However, this is both more expensive and more risky than simply buying puts.

In this case, the $380 put option costs $17.25 per share or $1,725 per contract.

The put option buyer would spend $1,725 per contract for the right to sell the stock short for $380.

If the stock did as expected and dropped to $320 three months later, the contract would have risen in value to $6,000 or a net gain of $4,725 or 274%.

However, if COST remained at $380 or even rose in price by expiration, the trader would lose 100% of their initial investment of $1,725.

Put option summary

Those who choose to speculate on bearish directional moves may do so using put options to gain additional leverage and avoid the expense of selling short.

If they choose to do so, the put option buyer may either sell back their option to capture profits (or salvage value) or they may choose to exercise their option to sell stock short. Either chose is valid though most traders simply choose to sell their contract back to capture their profits.