Supply and Demand

Supply and Demand

Companies report earnings only quarterly though their stock prices fluctuate (sometimes wildly) each trading day. Today’s increasingly volatile market means individual stocks can vary in price by as much as 20% in a month or less.

This kind of volatility is helpful to those who know how to trade it, but it also makes it harder for people to remain calm and focused on following their trading process. Volatility cuts both ways. People love volatility when accounts quickly rise in value. However, sudden and unexpected moves against them can create emotional swings that are difficult to control.

Understand that the market is not out to get you even though it might feel like it sometimes. Once, in a roomful of students, the class was asked how they could tell when the stock was about to experience a negative move. Someone called out an answer than many people leave unvoiced: “When I buy it!”

The stock market is a continuous, high-speed auction where stocks are traded between buyers and sellers in a largely automated process. The thing being auctioned off is the supply of shares. Those who own stock and choose to sell it ask a given price and see how buyers may respond. The price of shares responds to the number of sellers offering supply and the demand of buyers interested acquiring.

The market maker is responsible for maintaining balance between the buyers and sellers and for insuring an orderly market. They monitor every order from every individual actively trading a stock. If there are more buyers clamoring for shares than sellers at that price, the market maker will raise prices to lure more sellers into the market. The opposite happens when more sellers enter the market.

While earnings are reported each quarter, the market itself if forward looking. This means prices are highly sensitive to investor perception and expectations about a company’s future performance. This perception may change for many reasons including company released news stories, macro economic performance, or the performance of companies with similar products or services.

Each individual investor or trader have their own perception of the future potential of a company which influences their trading decisions and emotional reactions to price movement caused by the decisions of other investors. If the individual investor’s perception changes, they may decide to take action to either buy or sell the stock. It is this interplay between millions of investors that creates price movement and not the performance of the business on a daily basis.

Daily changes in market price are not dictated by some sort of machine where everything functions in an orderly and predictable manner. Additionally, daily changes in a stock’s price are not set by a centralized computer and don’t happen according to predefined rules. All market price action is driven by the availability of and demand for shares.

Technical analysis, or the art of applying some sort of predictor to this continuous price action, is what many traders use to identify sentiment and make trading decisions. There are hundreds of different methods by which traders have tried to gain a trading edge. Other lessons will go into more detail about different techniques traders have used to gain a trading edge and how they can be applied in your trading.

If the normal flow of orders into the market fluctuates dramatically, prices will change rapidly in response as market makers frantically work to equalize the balance between buyers and sellers. This effort increases volatility in the short term and creates a ripple affect as speculators jump in while longer-term investors re-evaluate their positions.

Having a better understanding that investor perception is what actually moves a market is helpful when trading price fluctuations in the short term or holding through these fluctuations for the long term. But there is another reason why stock prices move and understanding the mechanics of this sort of price movement will help you avoid common pitfalls caused by sudden movements in price.

The Bid and the Ask

As discussed previously, listed prices between buyers and sellers are not calculated on somebody’s spreadsheet or even calculated by a computerized algorithm. Prices are determine by transactions between individual buyers and sellers who each make decisions based on things that matter to them and their perception of the future potential of that equity. In today’s computerized marketplace, orders can be processed within milliseconds and prices can shift rapidly in real time.

That said, one thing many part-time traders or investors don’t fully understand is that market makers always list two prices for each stock at the same time. These prices are known as the bid and the ask. The bid price is the highest price any buyer is willing to pay for the shares. The ask price is the lowest listed price a seller will accept for their shares. The difference between these two prices is known as the bid/ask spread or simply, the spread.

All market orders to buy shares are executed at the bid price. If buyers want more shares than are available at that price, the market makers raise the ask price to attract more sellers and reduce the number of buyers in their effort to maintain buy/sell order equilibrium. All orders to sell are executed at the bid price. If more shares are trying to be sold at this price, market makers lower their bid prices to entice more buyers into the market.

Market makers generate fees to make a market and so they work to reduce friction by increasing the speed and quality of the price matching they do. In regulated markets, like the stock market, there are always at least two market makers offering bid and ask prices for individual stocks to increase liquidity and price fairness.

The fluctuation in market prices is caused by market makers seeking to create equilibrium between buyers and sellers and competing market makers. This is the dynamic that moves prices every day with every stock. If a stock’s price rises over time it can only be because the number of buy orders outpaces the number of sell orders which causes the market maker to continually raise prices in their constant search for equalibrium. Over the long haul, prices follow directional trends because of the collective behavior of all market participants interested in that stock.

Individual traders and their smaller orders will not move the market, especially on stocks with a larger number of daily transactions. On the other hand, if these individuals all decided to buy or sell a particular stock at the same time, the overall result would change the market. This is especially so today as seen by meme stocks which have experienced violent price action caused by the collective behavior of many small traders.

On the other hand, those who control large amounts of capital seek to avoid placing their larger orders all at once and creating unnecessary volatility and price action that might negatively influence their desired price. These larger players will typically send smaller sized orders to the market maker until their entire position is either liquidated or acquired.

There are many reasons why an unusual number of orders are placed with a market maker causing prices to rise or fall. These things include company specific things, industry specific things, macro economic things, portfolio rebalancing of larger funds, or the narratives believed by many smaller investors.

The Market Maker Role

Market makers provide a key role in making a market. Today’s market makers are almost all computers running automated trading programs known as algorithms. Many large Walls Street companies maintain these computers and match the flow of orders, earning money for their effort. The money they earn is the difference between the bid/ask price which is known as the spread.

Exchanges are where companies go public and list their shares. Most exchanges require more than one market maker to compete for the privilege of making a market to insure more favorable pricing to investors while also providing more liquidity. Exchanges make money on higher trading volumes which incentivizes them to keep markets orderly and lawful and to remove any friction that might cause investors or traders to leave for alternative platforms or asset classes.

Market makers are able to see all the prices and number of shares buyers and sellers have listed and that other market makers are matching. Sophisticated and well-heeled traders pay additional money to gain access to this information to help them in their decision making. They can then use this information to place their order with specific market makers offering the most favorable pricing. During a trading day, market makers may collect several bid and ask orders to bundle a price match. This may create a momentary move in one direction with an immediate reversal as these bundles are processed throughout the day.

This daily fluctuation may cause traders with little price tolerance to sell their shares. Some active day traders may also consider market makers their opponents for this very reason. Yet in their effort to remain competitive, most market makers use sophisticated and automated trading algorithms to speed up the process of matching buyers and sellers. This means prices move mostly on autopilot. These automated process also help to keep prices relatively stable during normal conditions.

These automated process may drive price action on a minute by minute bases but can’t really affect the price long-term. All pricing is constrained by the flow of buy and sell orders. It is only during periods of significant volatility caused by an imbalance between buyers and sellers where humans might step in to evaluate the situation and take additional steps to protect the integrity of the markets.

Long term price fluctuations and directional movement can be caused by something known as herding behavior. Investor perception drives market pricing. There are times when people simply pay more for a stock because of a perception of its future value. This herding behavior is accelerated in part by the actions of other traders and the general perception of a company, the market, or the economy.

Large funds including ETFs and mutual funds tend to concentrate their investments into a relatively low number of larger stocks, which can absorb the size of their orders without much change in pricing. This concentration may significantly affect an equity’s price without any significant change in the company’s management, earnings, or competitive position if any of these larger players decide to liquidate their shares.

What Causes Long-term Price Increases?

Price fluctuations are caused by real-time changes in demand for the stock. Yet, these price fluctuations are often part of a much larger and general directional trend. Trends can be bullish, neutral, or bearish and can last for weeks, months, and even years.

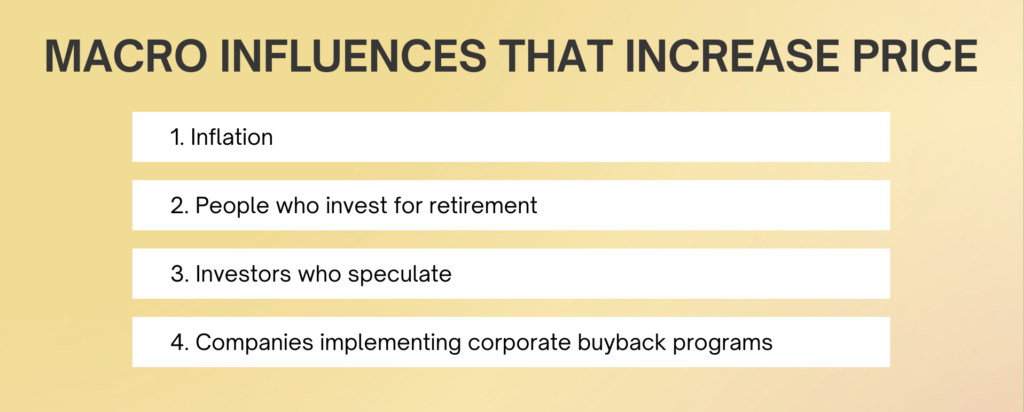

Over the past 100 years, stock prices have generally trended bullish. Some of this buying pressure comes from inflation. But there are at least three other macro influences that tend to keep prices moving higher or which can account for the occasional changes in trend direction. These three factors are:

- People who invest for retirement

- Investors who speculate

- Companies implementing corporate buyback programs

People Who Invest For Retirement

Prior to 1987, an individual’s retirement was provided by big companies in the form of defined benefit plans like pensions or Social Security and other government-funded retirement programs.

Starting in 1987, the U.S. government and large businesses made a concerted effort to shift individual responsibility for retirement directly to the individual through newly introduced retirement vehicles known as defined contribution plans like IRAs, 401(k)s, and 403(b)s.

The vast majority of these retirement plans provide a limited number of allocation options. These options may include mutual funds, ETFs, or other managed funds that invest in stocks, bonds, or alternative investments; though stocks are by far the most common asset class.

Over the years, an ever growing number of people prepare for their own retirement by saving a growing portion of their money and putting it into these investment vehicles little by little, month after month, year after year.

The net result has been a generally bullish trend as more and more money has flowed through these plans into the stock market. As long as the workforce in the U.S. economy continues to grow and increase its wages, more and more money will flow into the stock market and prices will generally rise.

Negative changes in population, the number of workers, or of those saving for retirement, will reduce demand for stocks and threaten this prevailing bullish trend.

Market Speculators

Market speculators may use some or all of their investment capital to pursue unusually large gains caused by shorter-term volatility.

To the extent that investors seek speculative gains more aggressively and demand for shares. Therefore, prices rise rapidly.

But speculators are also quick to get out of a stock once the expected move has happened or when they perceive a danger in the markets.

For example, during the 2008 financial crisis, speculators became extremely concerned about the long-term prospects of investing in stocks so they pulled back from their positions. This was a contributing factor to the severe downward trend that occurred that year.

Corporate Buybacks

Large companies with significant cash accounts are always on the lookout for profitable ways to deploy that capital and increase profits. Some companies decide that the best possible investment is to buy their own shares back from the market.

These corporate buybacks may be significant in size. For example, in the first quarter of 2021, Google announced they would buy back $50 billion worth of their own stock. In the same quarter, Apple announced a program to buy back $90 billion of their stock.

Such large buyback programs reduce the total number of shares available, while simultaneously increasing demand for shares. This can influence or at least contribute to the long-term bullish trend through increased buying pressure and a confirmation of a bullish bias for other investors.

Today’s massive scale of retirement savings, growing investor speculation, and record breaking corporate buybacks help drive demand for stocks and contribute to long-term bullish trends.

Our next lesson will discuss some of the factors that drive supply.

What Causes Long-term Price Declines?

It’s said that stock prices rise on an escalator and fall in an elevator. As mentioned in the Battle Plan, it’s human nature to be more afraid of loss than to be excited about the potential for gain. Longer-term downward trends happen when the supply of shares increases as more sell orders are received by the market maker than buy orders. This imbalance can occur over a period of days, weeks, months, or even years.

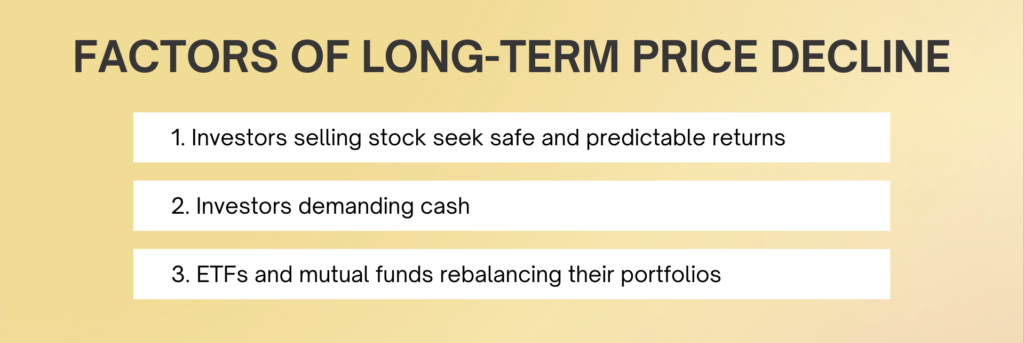

Three main factors tend to increase supplies of shares to be sold. First, investors selling stock seek safe and predictable returns. Second, investors demanding cash. Third, ETFs and mutual funds rebalancing their portfolios.

Investors Selling Stocks

Investors who begin to feel nervous about macro economic conditions may sell stock positions as a way to keep their money safe. This is especially true for growth stocks or highly speculative stocks. For example, a company like Tesla is interesting to investors because it is both high profile and innovative with the potential to change and entire industry and capture outsized profits from the disruption. Investors buy Tesla shares today with the expectation that its innovations will drive future profits for years to come.

However, if indicators led investors to have a more negative outlook about the economy, they might decide to sell their speculative Tesla shares in favor of safer investments and more predictable returns like those offered by dividend paying stocks, utilities, or corporate or government bonds.

Supply increases when many investors feel this way and sell stock at the same time which can lead to a significant drop in prices. Over the years, Tesla has fluctuated in price by 50% or more within a given year.

Investors Demanding Cash

The second factor driving up supply is a demand for cash. Life circumstances may dictate that an individual needs to sell their shares to cover expenses. Individually, these circumstances may not really affect stock prices. However, when tough times affect a number of people all at once— such as during a recession— the effect is multiplied and stocks can fall quickly.

There are other reasons people may sell stock to raise cash. First, when people hit a certain age, they can begin taking disbursements from their retirement accounts without a penalty. Second, the government mandates that people 72 years and older begin taking a 3% distribution from their tax deferred savings plans such as their IRA or 401(k).

Initially, 3% from a seemingly small portion of the population may not seem like it is enough to drive market prices lower. However, those in this age group are the wealthiest and the second largest segment of the population after millennials.

These government policies aggregated over such a large subsection of the population may create more supply for stocks than there are orders to purchase them. Given their age, these retirees might be prone to sell more speculative positions like stocks and hold more predictable investments like bonds.

ETFs and Mutual Funds Rebalancing Their Portfolios

The third factor driving the supply of shares is the activities of professional investors and portfolio managers. Many of these professionally managed funds are run by algorithmic trading decisions and include a periodic rebalancing overseen by humans. Rebalancing requires selling shares of one stock and buying shares of another. These periodic rebalancing efforts happen monthly, quarterly or annually.

The recent explosion in popularity of ETFs has concentrated ownership of popular stocks across a comparatively small number of massive funds. If even a portion of these ETFs decided to rebalance at the same time, supply would dramatically increase and prices would fall.

Over the past 20 years, the number of occasions where, for a multi-month period, there was a greater supply of shares offered for sale than new buyers could absorb, has been rare. Though in every instance, stock prices dropped dramatically.

Understanding the dynamics that cause prices to change removes some of the mystery and potentially some of the irrational fear individual investors may have about the markets. The markets don’t know you and price action is not a personal attack trying to hurt you. Price action is simply the combined affect of millions of traders making buying or selling decisions for personal reasons based on their own perception of value or needs.

Hopefully, this lesson about what moves the price of a stock will help you see opportunity in a more logical, less emotional way. The most successful traders have identified a trading process that works for them and they follow this process carefully through all market conditions and economic cycles. Hopefully, what you gain with us is the ability and the confidence to do the same.