Business Cycles

Cycles Affect the Markets

There are two main cycles that professional traders watch as they shift their money from one opportunity to another. First is the macro economic cycle. The second is the business cycle.

The economic cycles moves through phases from growth to contraction and back again. The business cycle cycles between bullish and bearish. The economic and business cycle are related but measured separately. The business cycle almost always lags the economic cycle.

While it may be tempting to draw these cycles as definitively in one condition or another, the reality is a lot more messy. There are no definitive markers indicating changes in cycle direction and it can be challenging to pinpoint the cycle’s current, exact position.

As in stock pricing, if enough humans have a similar perception about the economy and make the same sorts of decisions, economic conditions change. Yet humans aren’t exactly precise in when or how they make decisions and it may take time for enough humans to make the same decision. This is why pinpointing the exact place in any cycle can be difficult.

Knowing the relationship between the economic and business cycles and how they interact in different parts of their cycles can be extremely valuable to a trader. Traditionally, obtaining this information was costly, time consuming, and required professionals. It is much simpler today and part-time traders can mimic the moves of the bigger players from the comfort of their own home and with little expense of effort to time.

Within the movement of the larger economic cycle, the business cycle continuously moves through periods of bullish growth and bearish contraction. Most know that any drop of 20% or more in the value of the S&P 500 constitutes an official bear market. Yet even this can be difficult to pinpoint exactly. This is because stock prices rise or fall every day for reasons totally unrelated to the economic expansion or contraction or shift in a business cycle.

To continually keep their trading edge, all investors or traders must sort through the noise of daily price movement, compelling news narratives, their own emotional responses to price change, and contradictory analysis to find the best opportunities with the lowest risk.

The Stock Market Is Not Homogeneous

The stock market can be used as the barometer of the business cycle which is itself a barometer of the economic cycle. There are approximately 12,000 publicly traded companies from all sectors and industry groups and of all sizes. For convenience, these companies are grouped into industry groups of similar companies which are then grouped into 11 broad market sectors. On one level, the combined performance of these companies can be used to gauge the economic activity of the entire United States and the world.

Over time, tools have been created to measure the economic health of the country. Today these are known as the Dow Jones Industrial Average, the Nasdaq 100, the Russell 2000, the S&P 500, and more. These broad market indexes were developed to give investors a simple way to gauge opportunity and risk.

One challenge these indexes pose to part-time traders is the emotional swings they might feel as they watch the day to day or even minute by minute change in price. Unfortunately, these broader market indexes are only partly helpful for the purpose they were created. First, day to day price movement may not be indicative of changes in cycle patterns or even in directional movement. Second, the performance of a few larger companies may mask a different performance from a larger group of smaller companies in that same index as money is shifted into other sectors.

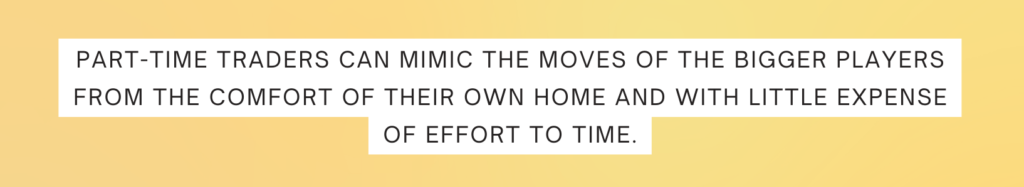

Capital flowing from one sector to another in response to changes in the broader economic environment, changing world conditions, or as a response to governmental regulation is what creates the business cycle. This money seeks opportunity while also reducing risk. There are many way to categorize the business cycle. We’ll discuss it in terms of three distinct phases:

- Growth

- Inflation

- Contraction

The flow of capital into these sectors in pursuit of opportunity and response to changing economic conditions means that some sectors perform better than others at different phases of the economic cycle. As a result, each of the 11 sectors also rotate through a cycle of expansion and contraction in response to the flow of investment dollars into or out of it.

Understand that this flow of capital is caused by the individual decisions of humans. Each of these humans make decisions about whether to take the risk of new investment or not. If enough humans with enough means under their control make the decision to protect their capital and reduce their investment, the economy will begin to contract.

The term Market Sentiment is used to describe the outlook of people and what their investment decisions are likely to be. If sentiment is favorable, these decisions will be confident, growth oriented, and will to assume risk in pursuit of opportunity. On the other hand, if sentiment is unfavorable, their decisions will like be to protect their assets, reduce their spending, and focus on smaller opportunity usually geared around cost-cutting.

If enough people have a negative enough sentiment about the future, companies will invest less, consumers will buy less, and investors will flee to safer sectors. Bear markets are simply a result of enough people adopting a negative perception and making individualized decisions to protect themselves. In this way it may be considered a self-fulfilling prophecy.

Like all things related to cycles, market sentiment is also hard to measure precisely. It is related to the change in the economic and business cycle but does not necessarily move in lockstep with them.

How to Mimic Professional Investors As They Track Cycles

Part-time traders may easily be overwhelmed by stuff external to them in the form of rumors, conflicting outlooks from various news sources, overwhelming availability of market data, and click-bait headlines. They may also be overwhelmed by their own emotional response to such external inputs.

One quick way to sort through all this noise is to simply perform top down analysis by tracking the performance of the 11 stock market sectors and the corresponding industry groups. This is the best way for someone with little time or resources to mimic the performance of large, professionally managed funds.

Tracking the performance of the 11 sectors is best done by tracking the performance of ETFs that follow them. Large funds and professional investors use this information to decide when to shift their investments and where to put it as they seek to outpace average market returns.

Historically, these 11 sectors can be sorted into the phases of a business cycle in which they tend to do best. This list looks like:

- Growth: XLY, XLF, XLK, XLI

- Inflation: XLB, XLE, XLRE, XLC

- Contraction: XLP, XLV, XLU

Investors or traders may choose to put money directly into these ETFs which is a simple way to diversify across a number of companies. Each ETF is designed to mimic the performance of all the companies it follows, so buying one share of the S&P 500 ETF is like buying a little piece of 500 different companies.

While it is less risky to invest directly into an ETF, it is also less likely to produce unexpected and sizable returns. Directly investing into the companies within these sectors may carry additional risk, it also can provide higher returns.

The Opportunity With Sector Investing

Today’s part time traders are simply overwhelmed by a flood of market data, charting capabilities, conflicting news stories, and clickbait headlines. Amid this firehose of data and with little education about what really makes the market work or how they can begin to gain control over their outcomes, it can be hard to make good trading decisions and to remain both unemotional and focused on following a complete trading process.

That said, once they have the proper education and strategy framework, these traders can get access to information once reserved for the elite of Wall Street. Using top down analysis to watch sector rotation and shifting their investment focus with the bigger players can significantly increase the potential for better returns.

With so much capital to invest, the average hold time of these bigger players is around a year. Individual investors may choose to mimic this hold time…or they may choose to take advantage of their smaller size to quickly move in and out based on more frequent timing indicators.

What we’ve shared in this lesson is just one way a trader may capitalize on the data available to them in today’s computerized and networked world.

The purpose for which you engaged in this education is to get more consistent market results. Consistency is what drives long-term trading success and the compounding required to achieve a desired financial condition.

Learning new things is important at the start of this journey as you explore various ways of trading and come to understand the techniques, tactics, and market approaches used by other trades in the past. Doing this research will help you hone in on the specific strategies you should employ as you create your trading process and begin following specific trading rules.

Once you have developed your trading rules, the next step is to gain confidence. First, you gain confidence in yourself as a trader. Then, you gain confidence in your trading process. Then as you find success following your rules, you gain more confidence in yourself and in your rules. This becomes a virtual cycle that is important to your success.

During this phase of your education, you should stop learning about the cool things that are out there and just focus on your process. It is during this time that FOMO (fear of missing out) can be so damaging, because it will tempt you away from a more consistent, steady approach to the market and it will hamper your efforts to be a confident trader.

At some point, you may decide to explore new asset classes or methods of investing. This is fine. In fact, it’s good to remain aware about the markets. But do so from a standpoint of confidence. When is the best time to look for a job? When you already have one! Look for new opportunities in the markets only after you have confidence and a history of success behind you.