Build Your Skills

Become a Skilled Trader

America’s current retirement solution has failed an entire generation of people who entrusted their money to professional managers. These managers required expensive fees and generated sub-par returns which has left 66% of Americans believing that they’ll outlive their retirement savings. Worse, a recent study found that 33% of those closest to retirement have saved only $25,000!

Most people have spent their time and energy building their careers and controlling the variables required to optimize their paychecks. They hired investing professionals because they did not feel qualified or educated enough about the markets to be confident about their own efforts. These professionals have largely failed their clients.

The pressure of an underfunded retirement and the inability many have to save more creates a great deal of stress and anxiety for those approaching retirement age. Those who turn to the stock market as the possible cure for their retirement woes, may find this stress and anxiety problematic to achieving the results they hope for and so desperately need.

Most part-time traders who urgently need to catch up their retirement tend to believe that the best way to make profits in the market is to have a high percentage of winning trades. This causes them to be particularly susceptible to marketing messages about high win rates and highly accurate entry signals. These messages generally convey the sense that investing success is simply a matter of picking the right stocks at the right times.

Unfortunately, despite sincere effort, many people struggle to replicate the success of the alert service or guru they initially chose, so they move on to the next…and the next…and the next. Always looking for someone who can give them perfect entries and help them make money quickly.

Years of research has shown us that finding good trade ideas and getting in to positions at favorable times is only one of seven things a person must control to get consistent, predictable results.

Getting consistent, predictable results builds confidence both in the approach to the market and also in the individual’s own ability to get the results they want. This confidence allows them to make well-considered and incremental improvements to their trading process allowing them to continually refine and improve their results. This creates a virtuous cycle in their financial life which can have positive affect in other areas as well.

Learn the Skill of Trading

While elusive for many, the stock market has been the greatest generator of wealth in the last century. Our curriculum are designed to provide a clear understanding of how the market works, clarity about how to get predictability from the market’s random walk, and a specific and technique oriented market approach to the individual’s fear of loss level. Additionally, our live classes are designed to help the individual work through the behavioral changes that are always needed when a person chooses to make improvements to their life.

Many traders are intimidated by the markets because things outside of their knowledge or control can significantly alter their profitability. Worse, most people feel very uncomfortable when they don’t feel a sense of control over their environment. For these reasons, those who don’t have a specific, technique oriented approach to their trading will have trouble achieving financial freedom.

It’s been said that losing money may be one of the most painful experiences in life. This is especially true for those starting with smaller sized accounts. Perhaps this fear is why so many have chosen a “set it and forget it” investing approach, paying others to trade their money for them. Yet this has not solved the underlying problem: most people do not make enough in their lifetimes to be able to save their way to a comfortable retirement.

Our founder, Lincoln Holbrook, has spent the past 25 years teaching thousands of people how to trade profitably. All of that experience has been distilled down into this curriculum to give you a uniquely powerful, yet simple approach that can be learned by just about anybody.

Our hope is that as you progress through your curriculum, you’ll gain the tools you need to forge a trusted trading process comprised of a series of clear expectations, trading rules designed to achieve the desired results, and a feedback loop derived from journaling the correct data.

Once you have developed your own uniquely tailored and complete trading process, the real effort of carefully and exactly following it begins. For many, the gap between knowing what do do and actually doing it can be hard to cross. This is why we provide such a wide array of in-depth live classes…the concepts we teach are simple to understand because truth resonates. But changing behaviors to consistently follow the rules is not easy.

Each stage of this curriculum, like each stage of your complete trading process is equally necessary to achieve the desired outcome. Be intentional as you progress through the coursework and be sure to attend as many classes as possible. Avoid the temptation to skip steps, breeze through courses, or miss classes. You didn’t come here to fail. That said, you will face inevitable resistance. Mentally prepare for it and reach out if you need assistance to keep going. We want you to be successful.

Become a Skilled Trader

The market provides innumerable opportunities for astute investors and traders to find profits. But a few highly profitable and lucky trades won’t really change a person’s financial future. This future is changed as they become a skilled trader. Everyone can become a more skilled trader. It is a learned skill and one that you’ll develop as you progress through your curriculum.

It might look like some people are consistently lucky or we might feel like they have a well-trained gut capable of giving them perfect trade timing. However, the less public struggle all investors or traders face is to develop, follow, and incrementally improve a successful trading process despite all the noise, conflicting signals, or emotional responses to loss all traders experience.

We have all learned how to control variables in our pursuit of success. As students, how much we studied directly affected the grade we got. In sports, how much we practiced directly affected our performance during competition. How much time we spent developing our skillset or getting things done affected our career trajectory and eventually our salary.

Why is it so hard to adapt these life skills to the markets? One reason is because our life skill focused on a desired outcome which was directly affected by the expenditure of time and effort. This mindset makes it easy to focus on the desired outcome of a trade: that it be profitable and then work to insure it is. The problem is that no person, computerized algorithm, or “golden gut” and reliably predict the minute by minute or even day by day movement of the market.

It’s a natural human bias to seek to identify the levers of control that result in a desired outcome. Making the shift away from focusing on controlling outcomes to one where we control a process trusting in the eventual outcome can be challenging. Especially when the steps in this process don’t directly connect to the desired outcome.

Another human bias is to react poorly to unmet expectations. Many traders have only vaguely defined expectations about what their results should look like. Yet even vaguely defined expectations that aren’t met can create outsized emotional response. These outsized emotional responses become overreactions for traders and is one of the biggest reasons market prices tend to be so volatile.

Remember, investor perception is really what causes the prices of any asset class to rise or fall. The challenge about investor perception is that it is influenced by the perceptions of other investors. If many investors begin to panic, other investors may begin to panic as well, causing a bigger panic and a larger and more volatile price drop.

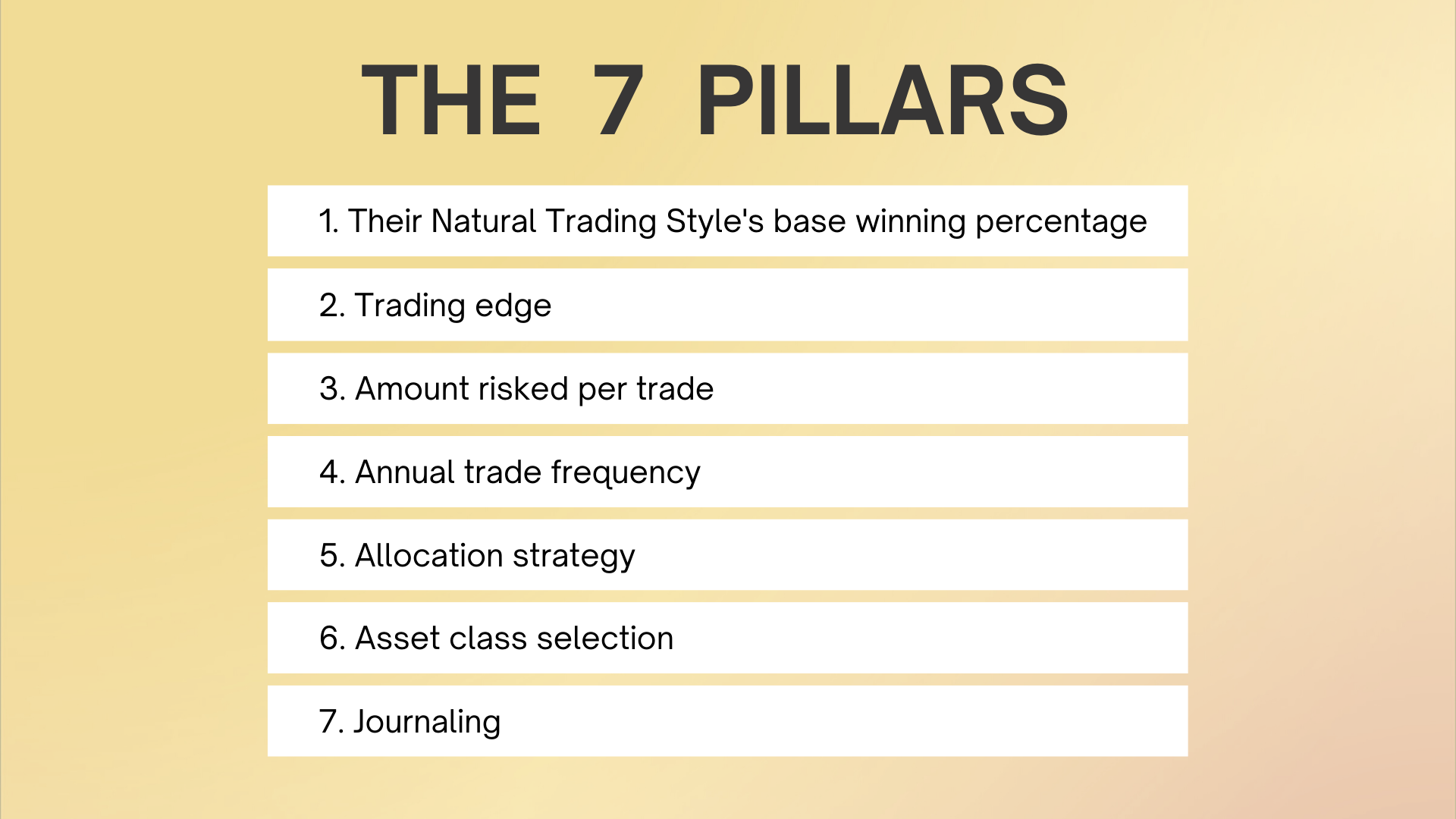

Skilled traders and investors first learn how to approach the markets in a specific, technique oriented way that is custom tailored to the lens through which they see their world. They then develop the skills they need to begin to control their desired outcome. We call these skills the 7 Pillars which are:

- Their Natural Trading Style’s base winning percentage

- Trading edge

- Amount risked per trade

- Annual trade frequency

- Allocation strategy

- Asset class selection

- Journaling

The 7 Pillars are simple but not that well knowing to the majority of part-time traders or investors and that is why so many struggle to become skilled and to achieve their desired results. You’ll have a great advantage if you take the time to properly learn these concepts, personalize your market approach, and make the behavioral shifts required to follow your rules.

The information we provide to every student is straightforward and the same. That doesn’t mean it’s a recipe everyone should follow exactly. Each individual has their own unique life experience, responses to pressure, fear of loss, and lens through which they see opportunity and risk. This is why we provide an assessment to help you begin to personalize and custom tailor our education to better fit your combined strengths, resources and constraints.

It is possible for nearly everyone to outperform the markets. But this can only be done if a person has developed and consistently follows a trading process that does have a trading edge. Not every trade will be profitable…in fact, all things being equal, the most profitable Natural Trading Style is Win Big Extreme.

Becoming a skill trader or investor is the opportunity before you. It’s simple…but not easy. There will be challenges and you will face resistance to the changes you need to make to be consistently profitable. Don’t give up or give in to self-doubt.

The Challenges and Pitfalls of Investing

All investors face the struggle of a random market and the challenge of shifting their focus on controlling a process, trusting the results will work out as expected despite the immediate feedback of individual trade outcomes.

All traders suffer from unhelpful beliefs and bias about what can or cannot be controlled or predicted from various kinds of data. Research has shown that the use of quantitative, fundamental, and even technical data does not create perfect predictions. Those who want to be successful need to understand and emotionally accept why.

Changes in market prices comes as a result of the collective actions of millions of people all around the world. The markets are not some gear-works or computer algorithm. It’s unpredictable because humans are involved. Humans make mistakes. They have needs. They have limited perceptions. They tend to react emotionally to unmet expectations or negative trades. They make conflicting decisions switching between hope, fear, greed, and confidence quickly and seemingly in random, unpredictable ways. They also struggle with FOMO or the fear of missing out and may jump into what seems to be a great opportunity without making careful choices.

Those who learn to be profitable traders learn to think in probabilities. They know they won’t win every trade and the make sure that no single loss is catastrophic. Learning to think in probabilities gives them confidence because they develop, follow, and get expected feedback from their trading process. The know that over many trades, outcomes will conform to their probability driven expectations.

The most common pitfalls experienced by investors and traders are:

- FOMO and Missed Opportunity

- Unacceptable Losses

- Lost Time

FOMO and Missed Opportunity

There are two kinds of missed opportunity. The obvious one is missing out on opportunity by not getting into something. The second is less obvious, but no less problematic: opportunity cost by staying in a trade too long.

The need to be right may cause a trader to stay with a losing trade too long as they wait for it to become profitable. This investment capital remains in this poorly performing equity when it could have been redeployed into a better, more profitable trade. This is the missed opportunity cost all traders face.

Additionally, all traders are faced with what can feel like an overwhelming number of trade choices, investor mania, market hype, and conflicting interpretations of news and events. This flood of information can create conflict, confusion, and a feeling of missing out on good opportunities. This confusion may causes some traders to wait for confirmation before getting in…which usually turns into not getting in at all.

Unacceptable Losses

Unacceptable losses are those which are those which could have reasonably been avoided if the trader had simply followed their trading rules. Sometimes these losses are caused by putting unequal amounts at risk on every trade. They might also be caused by poor allocation rules, an over concentration into one asset class or subclass, or not following stop loss rules.

Traders may be tempted to break any or all of these rules because of the natural human bias that it’s possible to predict the immediate future based on the price performance of the immediate past. It’s easy to believe in sure things or can’t miss opportunities. Good traders learn not to trust their gut…but rather to trust their process because no single trade can be predicted with any sort of reliability or repeatability.

The temptation to break rules might be caused by market mania and it might be caused by our own response to a recent trade or even a series of recent trades.

Research has shown that 98% of the population has a strong and often sub-conscious need to be right. The underlying reason many traders break their rules is because of this foundational need. This foundational need highlights another pervasive mindset which is systemic (not systematic) in nature. Systemic thinking looks through a polarized lens. Things are either on or off, good or bad, right or wrong, successful or unsuccessful.

A trader who thinks this way may feel like they can never do anything right or that they always end up losing. This cognitive distortion might cause us to process information incorrectly leading to emotional distress and further bad trading decisions.

The need to be right combined with an oversimplified and negative trading narrative amplifies emotional responses to individual trade outcomes making it difficult to follow trading rules.

Looking at trading results through lenses like these may cause an investor to hold on to an investing position too long. Holding on too long amplifies the negative impact of breaking rules because it creates both an unacceptably large loss and generate the emotional distress of missed opportunities.

Lost Time

Many new traders may believe that the fastest way to achieve their vague investing goals is to just win a bunch of trades quickly. They mistakenly believe in the idea that a few really big winners is all it will take to remove the heavy pressure caused by the feeling of financial uncertainty.

Yet the fastest way to achieving real wealth is gained by consistent compounding at a high enough rate over the passage of time. Compounding interest has been called the most powerful force in the universe. Why that may not be true, it is the most powerful force in wealth creation.

Lost time can be described as anything that negatively impacts the rate at which you compound your investments. As such lost time may be as simple as remaining a paper trader too long. It could be bad trades caused by unacceptable losses. It could be the paralysis caused by confusion or FOMO which prevents a trade or causes a trade into a risky asset class without appropriate risk management.

As in all other challenges faced by traders, lost time can be reduced simply by implementing a complete trading process that provides a statistically realistic expectation, a set of rules to follow, and the feedback loop of proper journaling.

Questions to ask when building a trading process

There are 7 Pillars to any successful and complete trading process. These Pillars each contribute to the overall success of the whole. Mentally exploring each step of the 7 Pillars will help guide decisions in the other steps. They are all interconnected.

As you consider each of the 7 Pillars, it might be helpful to consider the following questions. Pondering these questions can result in a strong foundation for your trading, helping you use sound strategies, in a consistent way regardless of the outcome of individual trades.

- How frequently do I want to trade?

- Which asset classes will help me achieve this frequency?

- What strategic approach should I use given my Natural Trading Style and investment time horizon?

- How much am I willing to risk on individual trades?

- How do I measure my results and continually improve?

As you being this process, use our calculator to help guide your decision.

| Starting Amount | $ |

|---|---|

| Years it can compound | |

| Nest Egg | $ |

7 Pillars of Control

- Entries and Edge Techniques

- Base Win Rate

- Amount Risked per Trade

- Annual Trade Frequency

- Allocation

- Asset Class

- Journaling

The quest to become a consistently successful trader can be a challenging, painful one. However, it leads to an amazing place of financial confidence and a new sense of financial freedom. It’s never too late to change your financial condition. But it does take work. All great things in life take work.

We urge you to start mapping your own quest today. Read through the lessons, attend class, and begin practicing a trading process that yields predictable results. Gain confidence as you continue doing all these things and then keep going. You can do it!