Create a Trade Plan

Create Your Trade Plan

Your trading or investing will achieve the best returns over time when you consistently follow a repeatable (and successful) process that you trust enough to follow exactly, even during trading slumps. This seems logical when stated, but the reality for most people is that this idea is counterintuitive. Many individual investors struggle to follow a system and frequently change their approach….even mid-way through a trade! Not having plan, or not following it exactly, shifts you from investor to gambler. The system then becomes, buy; then hope, wish, and pray for profits. Praying for profits is not a repeatable plan and it won’t provide consistent profits. This gambler approach is not a rules-based strategy and it depends on uncontrollable and unpredictable luck, not a controlled process.

Understanding and following a successful trading process allows you to put market probabilities in your favor and gives you an expectancy for both winning percentage and win rate. It provides a pre-determined set of actions to take as the market moves around and it gives you a structured approach to making adjustments as volatility increases and market directions shifts. Gambling is a (non) strategy that leads to charged and highly emotional, mistake-prone investing.

Trade plans are a set of rules defined by your selected market approach (strategies and tactics) and additional rules to help remain committed to this process despite whatever initial resistance you may feel.

Trade plans also give you a set of rules and expectations by which you can measure your results. Following a trade plan helps you focus on the process of trading more than the outcome of individual trades. Focusing too much on outcomes will whipsaw you into and out of trades at exactly the wrong time. This sort of trading might also cause you to give up and go back to what wasn’t working in the past.

Developing a proper mindset and learning the right emotional responses under stress is key to success in the markets. A trade plan’s specific rules gives you a place to focus other than the outcome of individual trades. Comparing your real world performance to your rules before, during, and after every trade will help you consistently improve your results because you will be able to learn from your successes and mistakes. This rules-based focus (not outcome based focus) helps you keep your mental and emotional responses to the market where they should be: On how well you followed your rules.

Unsuccessful traders frequently allow the results of their trades to dominate their emotions (usually by beating themselves up as failures), which then causes them to make ill-considered trades which costs them precious time and money. It may take a while to fully adopt this mental approach to your trading, yet the importance of learning to stay focused on the process and not the outcome cannot be overstated.

It may initially seem daunting to develop a trade plan of your own. That’s okay and it’s a very natural response to doing something new. This lesson will help you build your trade plan step by step. Your trade plan is a living document and should be reviewed and changed as you gain experience and confidence in your system.

Having a system helps you focus on the things you can control. It will also help you avoid common mistakes made by people who don’t have a system or don’t know how to follow the system they’ve chosen. Real success in any aspect of life is only achieved by people who commit to a process which eventually leads to their goal. It is therefore critically important to develop and follow a defined, repeatable plan that has proven to be successful over time in all market conditions.

The markets are random but probabilities tell us that we’ll consistently experience winning and losing streaks as we make trades over time. It is so easy to lose confidence by second guessing yourself, your chosen system, and your ability to control your own financial destiny when you suffer a trading loss or even a few losses in a row. It’s just as easy to let a few trading wins in a row spike your confidence and pull you away from following your system’s exit, trade management and portfolio management rules.

Elements of a Trade Plan

Studies have shown that individual investors are 40% more likely to beat the S&P 500 if they carefully and consistently follow (and get better at following) a proven system. They are 60% more likely to beat the S&P 500 if they keep this up for two or more years.

Your natural trading style comes with an expectation for base winning percentage and risk/reward ratios (risk 1 to make 2, etc). Additional elements to improve your trading edge and the selection of appropriate trade strategies that fit your style can be carefully added to fully define your market approach and the rules you’ll follow to reach your goals.

The idea with a trade plan is that it gives you a system of rules which tells you everything you need to do to be successful in the markets. Sometimes amidst the pressures of trading it might be tempting to drift out of your rules. A trade plan (if followed) is a way to avoid mistakes that come from the “fog of war.” It reminds you why you entered a position and helps you get out of it according to your rules–not your gut, or from fear, or from fear of losing profits. A trade plan only works if you follow it. Determining your own rules of engagement for your trading is a way for you to more fully embed these rules into your heart and mind making them easier for you to follow as you face the stresses and pressures caused by putting money in the markets.

Part of building your trade plan will come from understanding the tradeoffs of each of the probability profiles we’ve discussed. These tradeoffs will guide the kind of rules you should add to your trade plan. For example, if your natural trading style is Win Frequently, your expectation is to make small, consistent profits, to have longer winning streaks, and to have larger (though less frequent) losses compared to your gains. Your trade plan should have rules reflecting these fundamental truths of the Win Frequently style. Additional rules can be carefully added to improve edge, to plug mistakes made by inexperience or sabotaging thought processes, and whatever else you feel you need to focus on to improve your results. Your trading plan should be a living document. Review it often and refine it as your experience and confidence grow and your financial situation changes.

We know how easy it is to make New Year’s resolutions and how hard it is to follow through on them for an entire year. Creating your own trading plan gives you a daily regimen to follow as you approach the markets. Going through the effort of creating your trading plan and becoming the sort of person who can actually follow that plan over time will help you achieve your financial goals for this year and the rest of your life.

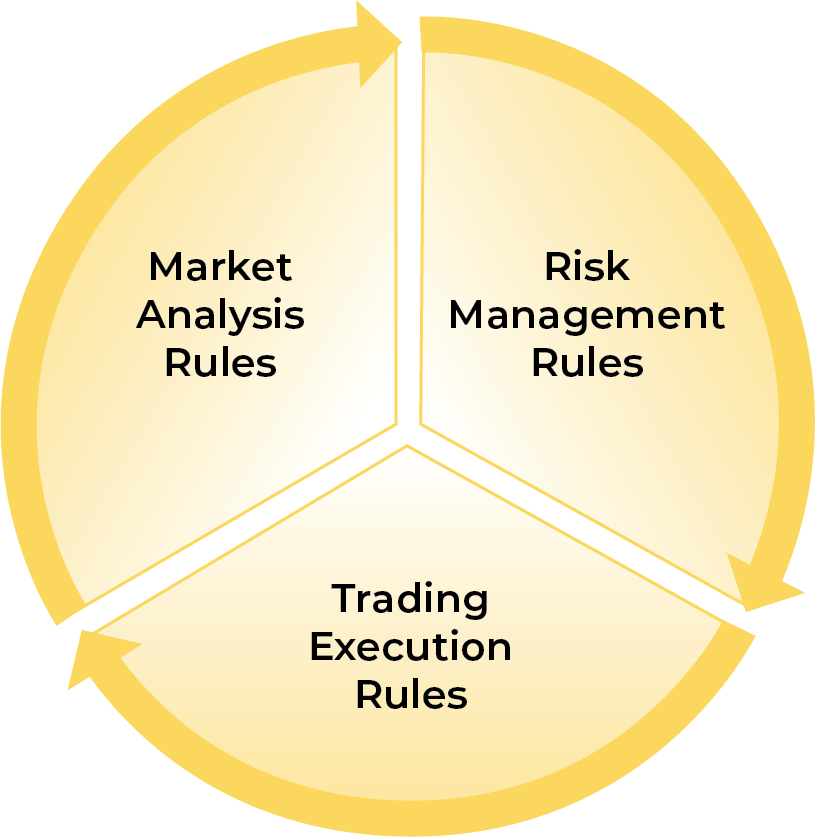

When you complete this lesson you will have developed your own initial trade plan based on the concepts, rules and strategies of your chosen probability profile and the other methods and tactics we’ll discuss later to get additional trading edge. There are the three key sections in any trading plan:

Each of these sections of your plan is vital and must be clearly understood and carefully considered and rules developed to guide actions. Each of these broad categories are comprised of a group of specialized processes and trading rules. This lesson will cover each topic in turn.