Trade Execution Rules

Trade Execution Rules

This element of your trading plan is a category of specific trading rules to help you identify WHEN to open and close your positions. These rules usually get a lot of attention from less experienced traders who focus their energy and effort on having precisely the right entry or exit for a trade. In reality entry and exit points are only one small element of a successful trading strategy and market approach.

The Trade Execution Rules to start with are entry points, profit targets and stop losses.

Initially your entries, stop losses, and profit targets are derived from your Probability Profile (risk 2 to make 1, risk 1 to make 2, etc). It’s okay to adapt your trade execution rules as you learn about techniques to improve your trading edge, as you gain more practical experience in the markets, and as you add other trade strategies or asset classes to your trading. In the meantime, start building your execution skills with these four rules which you should fully articulate in your trading plan:

- I will use the following sources to find my entries entries: (specify).

- I will set my profit targets and stop loss orders based on the _________________ Natural Trading Style

- I will let my trades run in the following situations: (specify).

- I will exit my position early in the following situations: (specify).

Entry and Exit rules define the day-to-day decisions a person makes as they monitor their positions and adjust their portfolio. Most traders misunderstand the importance of these rules in consistently successful trading. The next sections will help you better understand why entry and exit rules are so important.

Trade Execution Rule 1: My Entry Methods

We encourage you to begin paper trading with just a single rule….you’ll buy the stock at its price and set your stop loss and profit taking targets according to your probability profile. That’s it. Don’t worry about over-complicating the entry with too many indicators or signals initially. Practice with this single rule and then add additional rules you think might help you as you continue through the curriculum and find ways to improve your trading edge.

Counterintuitively the most important concept to understand about entry methods is that they aren’t to get you in at the best price…their primary purpose is to provide you with the trade frequency you need to hit your profit target goals in the formula we showed previously. If you use an entry method that gives you high quality signals, but that signal occurs less frequently than you need to hit your profit target goals, then you’ll need to either adjust your entry signals or your targeted annual gain.

If your plan is to make 100 trades in year and achieve a 20% annual gains target, you’d need to be getting 8 or more high quality signals each month. If you need to make 100 trades in a month to hit you profit target goal, you’ll need some way to get 5 entry signals per day. The entry method you choose should give you enough signals for you to reach your annual profit targets.

Trade Execution Rule 2: My Exit Methods

Exit trades play a very important role that almost all traders are completely unaware of but that we’ve already discussed: exits determine your winning percentage. The idea that exits determine winning percentage is a big surprise to many investors and traders alike, but it is quite true and you can prove it to yourself which is part of the assignment for this course.

Your probability profile gives you a simple black-and-white exit rule that fits your natural trading style. When starting out we encourage you to paper trade using only your probability profile’s entry, stop loss, and profit target rules. So if your probability profile is Just Win, your stop loss and profit taking targets are exactly the same dollar value away from the entry (this is a risk 1 to make 1 strategy). So in this case, if the stock entry was $50, the stop loss would be $45 and the profit target is $55. If the stop loss was only $48, the profit taking target would be $52.

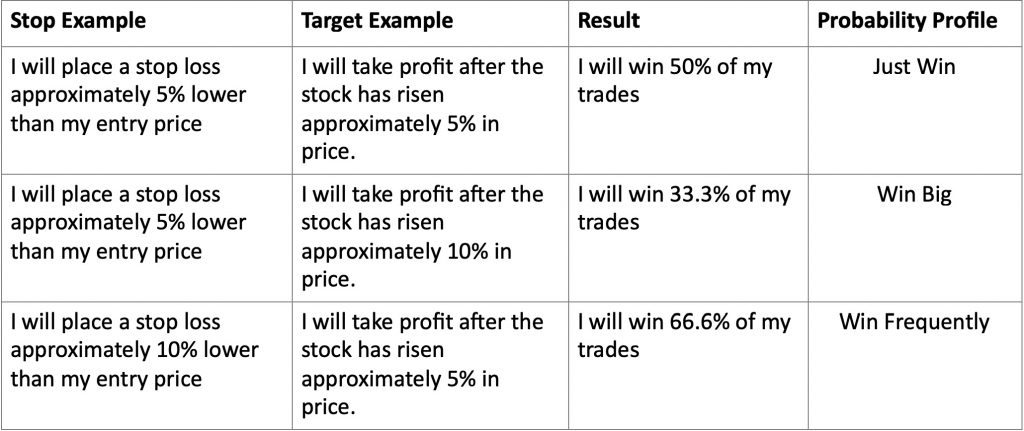

Where you set these exits determines your winning percentage. See below:

Notice the pattern. Profit targets closer to the entry point than the stop loss order are likely to be reached first giving you more frequent, though smaller wins (Win Frequently). The opposite is also true. If your stop loss order is closer to the entry than your profit target, the market is likely to hit the stop loss more frequently than your profit target give you less frequent though larger wins (Win Big).

Take some time right now to review your Probability Profile and understand how your natural trading style directs where you place your stop loss and profit taking targets. Understanding your natural probability profile’s trading style helps you build on the strengths you bring to the market from a rich lifetime of experience. Using your natural strengths and current mental and emotional patterns in a way that supports your efforts will help you avoid self-sabotaging brain glitches and allow you to take advantage of opportunities more quickly.

Conclusion

Approaching the market with a defined system of rules that you carefully (and fully) follow will improve your results over time. Having a trading plan gives you a consistent approach to the markets which can be adjusted in logical ways over time as you gain experience and confidence.

In the next two lessons we’ll talk about making the transition to real money. Real money trading applies additional emotional and psychological stresses not present when paper trading. Developing a trade plan and getting used to following it will help you make the right decisions even when your emotions may be screaming at you to do the wrong thing.