The Natural Trading Styles

The Natural Trading Styles

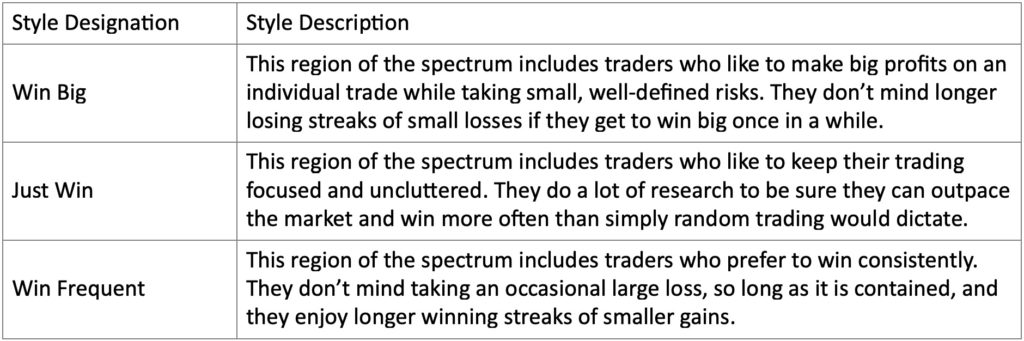

The 5 Natural Trading Styles can be broadly grouped into three main approaches to the market. These broad groupings have a primary trading style which helps you understand the kind of trading or investing that operates best in each region of the probability spectrum. The five styles are grouped into three and can be designated as follows: (1) Win Big, (2) Just Win, and (3) Win Frequent.

Within these three regions we can identify five different profiles. These can be labeled as follows:

- Win Big Extreme

- Win Big

- Just Win

- Win Frequent

- Win Frequent Extreme

We’ll talk about the extreme ends of the spectrum in this lesson though in future lessons we’ll simply refer to Win Big, Just Win, and Win Frequent trading styles. By now you should have the results of your natural style assessment. If you don’t already have your results, click HERE to get yours.

Having a clear understanding of your natural trading style helps you select trading strategies and time horizons that best match your strengths. Once you’ve studied your assessment results, we encourage you to come back and carefully read through the profile that fits your style. As you do so, take some time to think about your past market experiences in light of this new information.

As always throughout this curriculum, we encourage you to journal your reactions to your assessment results and what insights you might have gained into your prior trading experience. This is a great way for you to continue mapping your mental wiring as you learn those things that will support you and which things you’ll have to guard against as you start putting your money to work at higher rates of return like those guaranteed by Warren Buffett.

Profile 1 – Win Big Extreme

This profile describes people who patiently endure many small losses as they mine the market for big wins to pay them for their efforts. It is reminiscent of the gold-rush prospectors who would patiently sift through dirt and mud to find highly valuable gold nuggets. The system of trading they prefer is to take a series of small positions which each have the possibility of turning into big gains, but which are only likely to win one out of four times or so.

They know they can’t allow fear to stop them or cause them to shift gears midstream. They must carefully and methodically carry out their strategy even though they know that most of the positions they take will lose. They know they may experience lengthy losing streaks at times, but they are patient and confident enough to keep trading anyway because they focus on and expect to have big winners which cover all the small losses and still leave large profits.

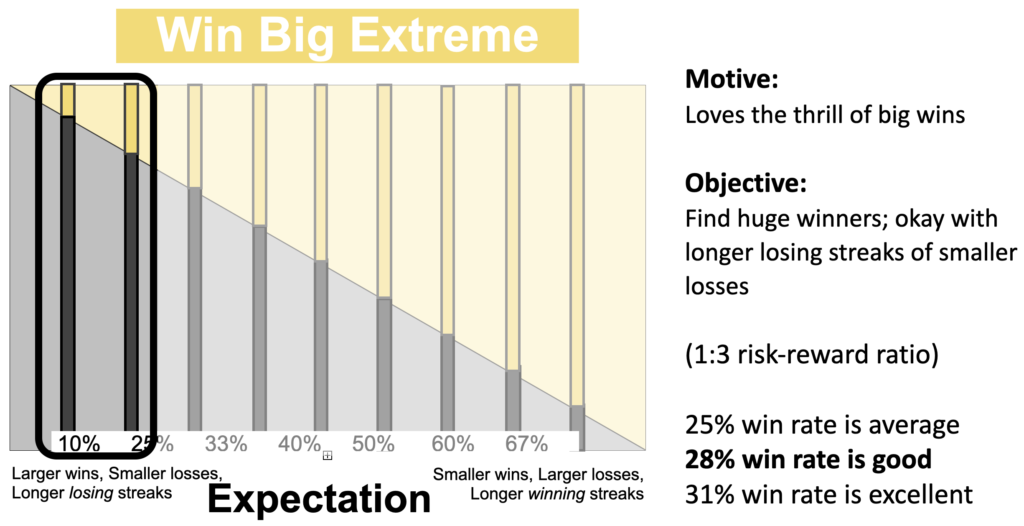

Profile 2 – Win Big

This profile describes people who are also patient enough to endure losses. They won’t strike out into the unknown (with all its risk) to find the motherlode but will work the seam with positive energy. They wait for those wins that make their efforts worthwhile, hold to a procedure in their trading, and don’t get thrown off track easily. This profile is reminiscent of a highly optimistic person who remains positive despite the negative experiences and comments of those around them. The system of trading they prefer is to take calculated risks in a repeatable procedure. They are looking for trades that will win one out of three times or better.

They know they will have to prepare for losing streaks. They don’t know which trade will be the big winner, but they know that such a winner will certainly come along. This expectation helps them carry out their strategy as a repeatable process. They are confident in their approach even though most of the time they will experience carefully controlled, small losses.

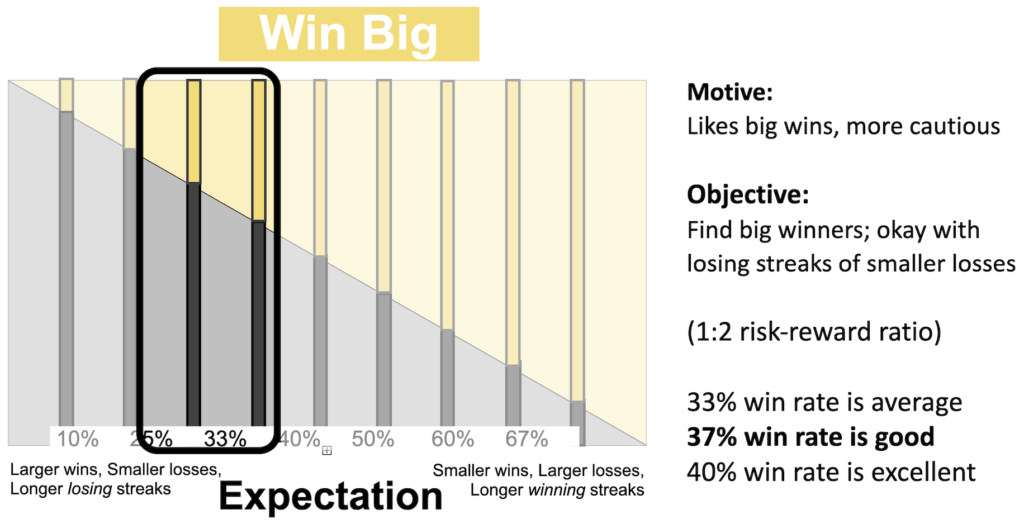

Profile 3 – Just Win

This profile describes traders who like to tightly manage their risk versus rewards. They tend to spend more time analyzing a company’s competitive position, management team, market valuation, fundamental analysis, earnings announcements, and anything else that helps them reduce their risk and contribute to their profits.

Their Natural Trading Style reflects this because they have a 50% win ratio (or near that) and they typically risk the same amount on the trade as the amount they stand to gain. This means they only have one factor to focus on: being right a little more than average. If they can achieve a 53% win rate, they will likely be profitable in their trading. If they can increase their trading edge a little more and experience a 56% win rate, they will likely outperform the markets on a consistent basis.

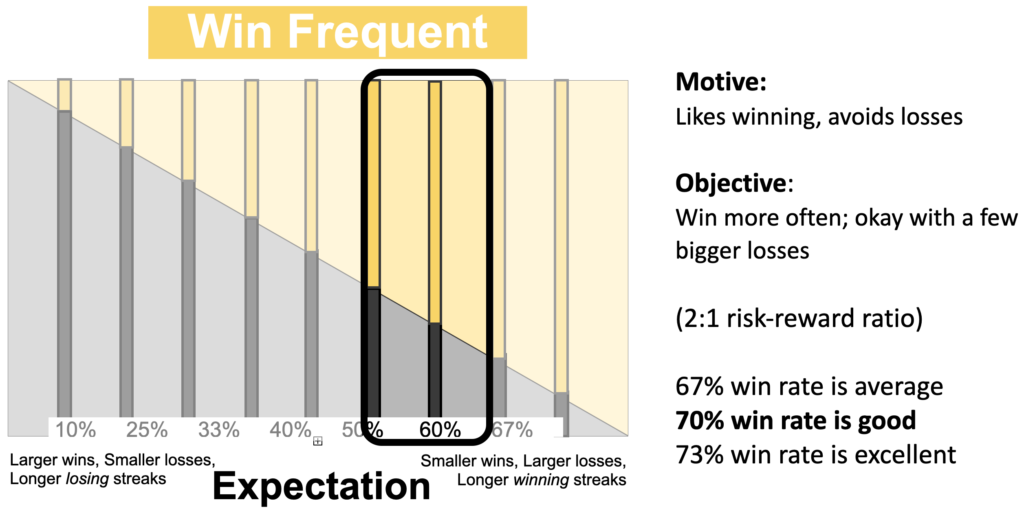

Profile 4 – Win Frequent

This profile describes people who prefer the positive reinforcement of winning consistently. It is difficult for anyone to face a near constant stream of negative results, and most people see losing money—for any reason—as a negative experience. As a result, many people want to trade with styles that offer high-probability winning percentages and longer winning streaks. Like a manager in a bustling business environment, these people must constantly attempt to solve a wide variety of problems that come along. Because of their desire to fix things, make things better and consistently keep things running well, they usually experience a string of small successes along the way. A manager like this knows big problems will come along, but is prepared to minimize and absorb the damage when such problems arise.

Those who identify their natural trading style as Win Frequent will attempt to maximize winning consistency in their trading by sticking with what works and minimizing losses when they come along. They prefer systems which win 67% or better. These people understand that many small losses may be wiped out by a larger loss which they work to manage as tightly as possible. Success in this profile requires a winning percentage of 70 to 73% while maintaining a risk to reward ratio of no more than 2 to 1.

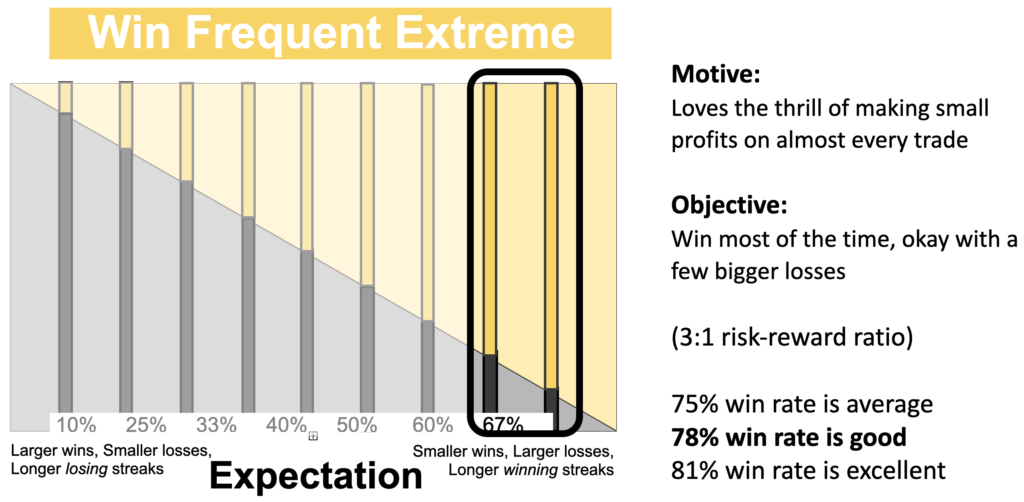

Profile 5 – Win Frequent Extreme

This profile describes people who strive to be right as much as possible. Like an “A” student, someone who works to get the right answer and get the best grades in every class, this person prefers to measure success by winning as often as possible. Their intent is to have many streaks of consistent, small wins, and to have the predictability of consistent small gains as the focus of their investing. They are less concerned about the size of their gains than they are about avoiding losing trades.

Like those in the Win Frequent trading style, people who identify with this profile accept the possibility of having an occasional losses larger than many gains. So they must seek to reduce the impact of these losses by working to keep risk no more than 3 times their average gain.

Most people start out in this profile thought it can be difficult to sustain this trading style successfully with smaller accounts because over time the comparatively larger losses can wipe out all the smaller wins if those losses come bunched in close proximity.