Risks and Rewards for the Option Buyer

Risks and Rewards for the Option Buyer

Option buyers are speculators and they like volatile markets. The underlying has to move enough in the right direction for their positions to make money. All option buyers face the risk that the time value of their purchased option will decay faster than the intrinsic value will rise before the option expires. For option buyers to make money, they need the underlying to move far enough in the desired direction that intrinsic value increases faster and further than the loss of time value. It’s possible to buy an option, have the underlying move in the right direction and still lose money because time lost value faster than intrinsic value appreciated.

Market makers always create a series of options with strike prices above and below the current price of the underlying for each expiration date. This gives the option buyer several choices to select from as they seek to implement their strategy. There are trade offs to buying options above or below the the current price of the stock which individual strategies will teach.

Remember there are two basic components of an option’s price: Time value and intrinsic value. Options with more intrinsic value cost more but time value makes up a smaller portion of the overall price and are therefore more likely to expire with some value. Options with no intrinsic value are comprised only of time value and these options have a greater chance of expiring worthless though they can be much more profitable on a percentage basis if the stock does as expected.

The Win Big (risk 1 to make 2) and the Win Big Extreme (risk 1 to make 3+) trading styles look for conditions where the underlying is likely to move farther and faster than the odds would predict. They expect to only win 30-40 percent of their trades and are therefore prepared to make trades that can deliver realistic gains of double or triple the amount they risk.

Our curriculum gives you a way of looking at the market and finding your edge in forecasting both the direction and the magnitude of a trade. Whatever you use to determine the trade setup, understand that active option buyers must be prepared to endure losing streaks of 8 or 9 losses in a row over the course of 6 months to a year. Option buying can still be a highly profitable trading strategy with proper trade management (taking small losses) and portfolio balancing. Once properly understood, losing streaks can simply be a psychological hurdle rather than a financial one.

One exception to this rule is that put buyers may be both speculators and insurance buyers. If you own an equity you can’t (or don’t want to) sell and believe it may about to lose value, buy a put option as insurance. The equity will drop in value as the put option rises in value, protecting your assets. Some people purchase insurance on their entire portfolio using index put options.

Winning as an Option Buyer: Establishing Success Criteria for Entry

Option buyers must find excellent opportunities that provide a defined loss when they are wrong, but are capable of generating proportionally larger winners if they are right. The buyer further refines their strategy by timing the purchase to correspond with some additional components like technical analysis, unusual trading volume, unexpected news, earnings, etc, that could rapidly change the price of the underlying and thereby the price of the option. Option buyers love volatility. Anything that adds to movement in the underlying gives them a bigger chance for higher percentage gains in their options.

Most option buyers don’t use fundamental analysis or other long-term trading tools, focusing instead on short-term technical analysis. Listen carefully in class to identify possible screening criteria and then create a checklist to identify potential trades.

Below is a sample list of potential criteria:

- The underlying’s price is near a support or resistance line.

- Technical indicators on the underlying show a potential breakout.

- The underlying’s price, previously downtrending, crossed up through a shorter term moving average on more than average volume.

- The related major-market index or ETF shows a definite trending pattern

- There is a known news event coming two weeks or more away (earnings, Fed announcement, etc).

- Unusual trading activity by larger players.

We asked you to identify 10 random stocks to paper trade using just the risk/reward characteristics of your natural trading style (risk 1 to make 2, etc). As an exercise, go back to those 10 random stocks (or select new ones) and do the same thing (set stops and profit targets according to your probability profile) only this time only enter a trade using one of the potential criteria listed above. Continue following these stocks over time even as you paper trade the setups you see in class.

Trading Options Systematically (as a Buyer)

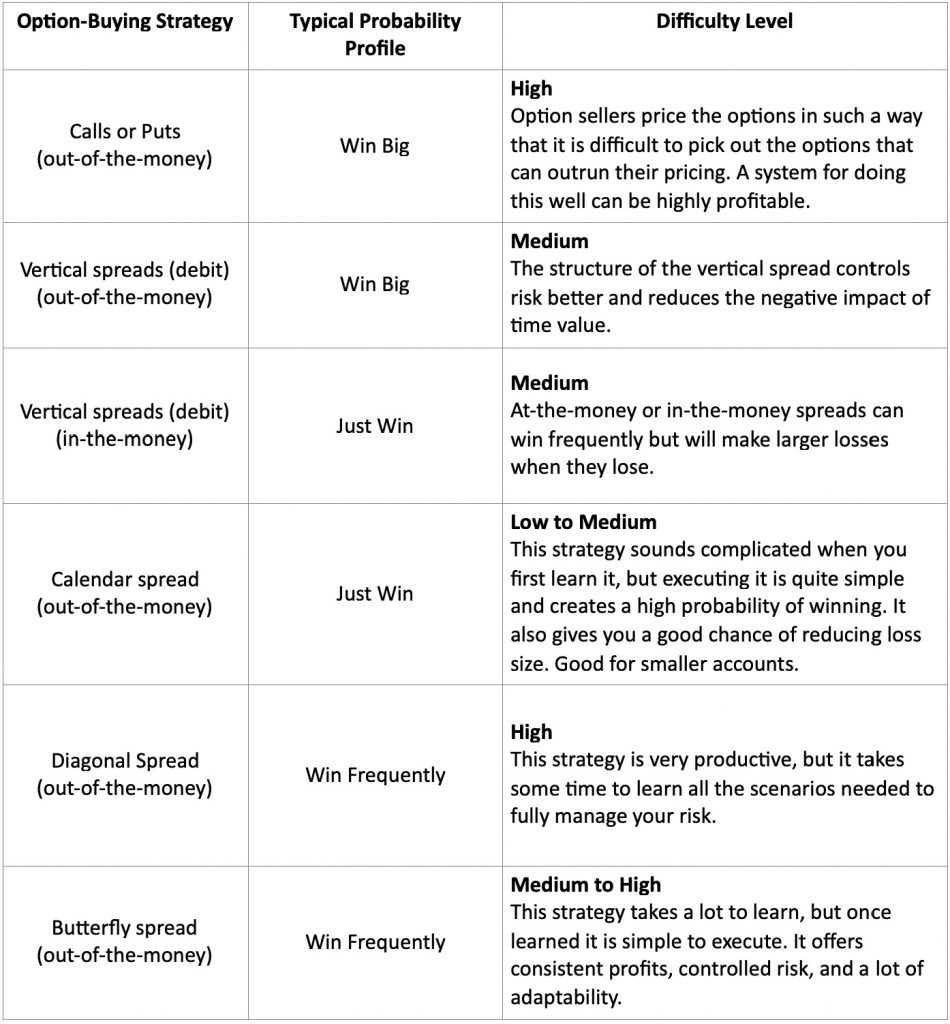

The following is a list of option strategies that buyers might employ and the probability profile associated with each. Though there are many options strategies that can be profitably traded, these are the most reliable for traders new to option strategies. You should discuss this list with your instructor so that you can select those strategies you would like to learn more about.