Risk and Rewards for the Option Seller

Risk and Rewards for the Option Seller

The single biggest risk a call option seller has is the exact same risk of those who buy stocks, ETFs and other underlying equities: They can drop in value. The second biggest risk is lost opportunity. When sold to open a position, call options obligate the seller to sell their underlying equity at the strike price of the option. This obligation to provide the underlying at the strike price limits (or caps) the profit of the underlying at the strike price. Option sellers limit the potential upside of their positions in exchange for capturing a desired and defined premium (paycheck). They hope to make many small paychecks on a high percentage of their trades without having the underlying drop enough to wipe out all their cash flow gains.

Remember, time decay works against an option buyer….but it works FOR an option seller. Also remember that “time” is what we’ve been calling the portion of an option’s price which is not intrinsic value and that “time” is where the market maker manipulates the option’s price to give them a 70% chance of winning.

Remember one of the truths about option pricing: Options are priced so that they decrease in value more often than they rise.

Option sellers understand this truth and have positioned themselves to profit from it. The advantages of approaching options as a seller are real. Option sellers can be profitable if the underlying moves in their favor, stays the same, or even moves against them a little bit.

Those who sell options may choose from any and all the available options for that underlying. There are advantages to selling more or less time and advantages to selling more or less in the money. Future curriculum will explore a number of option strategies and help you match strategies to your natural trading style.

Winning as an Option Seller: Criteria for Success

Option sellers obligate themselves to buy (in the case of puts) or sell (in the case of calls) the underlying at the strike price of the option sold. They receive a premium (paycheck) in exchange for this promise to either buy (puts) or sell (calls) the underlying at the strike price. The safest way to employ this strategy with calls is to own the underlying or another call option. This is known as a “covered call.” Selling calls against stock or options you own has been deemed safe enough to do inside an IRA or other self-directed retirement plan. Selling a call option carries the same risks of equity ownership: The underlying could lose significant value. Beginners should only employ this strategy on stocks or ETFs which are bullish or neutral, not bearish.

Put option sellers obligate themselves to buy the equity at the strike price by expiration. The safest way to employ this strategy is to only do it on equities you like and wouldn’t mind owning and to only obligate yourself to buy the shares that you have cash on hand to pay for (no leverage).

The times that tend to create excellent opportunities for sellers are when there is excitement and high expectations in the market. Market makers tend to price options higher during these times even though the underlying is also likely to go up or at least stay the same. These trades generate small but consistent paychecks with a lower chance of the underlying losing value. If you carefully invest in equities you like anyway, and manage the risk of equity ownership, you can be very successful as an option seller focused on generating cash flow from the markets.

If you have a source of option trading ideas, such as our research tool, a subscription service you trust, or a well-chosen set of screening criteria from other sources, then you can use the following checklist to help you identify your option candidates from among the trading ideas you accumulate:

For each potential candidate, review the chart and answer the questions below:

- The equity has been heavily discussed over the past two or three weeks in emails or news coverage.

- Good earnings were published within the previous few days

- The stock has bounced up off support

- You already own the equity and simply want to generate cash without selling your position

- The related major-market index or ETF is showing a bullish to neutral pattern

- A known news event has recently passed within the last two weeks

- Smart players seem to be accumulating

As an exercise, work through a random company to see how many characteristics your candidate has from this list. A simple rule of thumb is that three or more of these mean it is likely a strong candidate for a successful implementation of the covered call strategy. Once you feel more comfortable with these characteristics, you may add one or more of these (and others that you learn about) to your Trade Plan (which we’ll teach in the next lesson).

Trading Options Systematically (as a Seller)

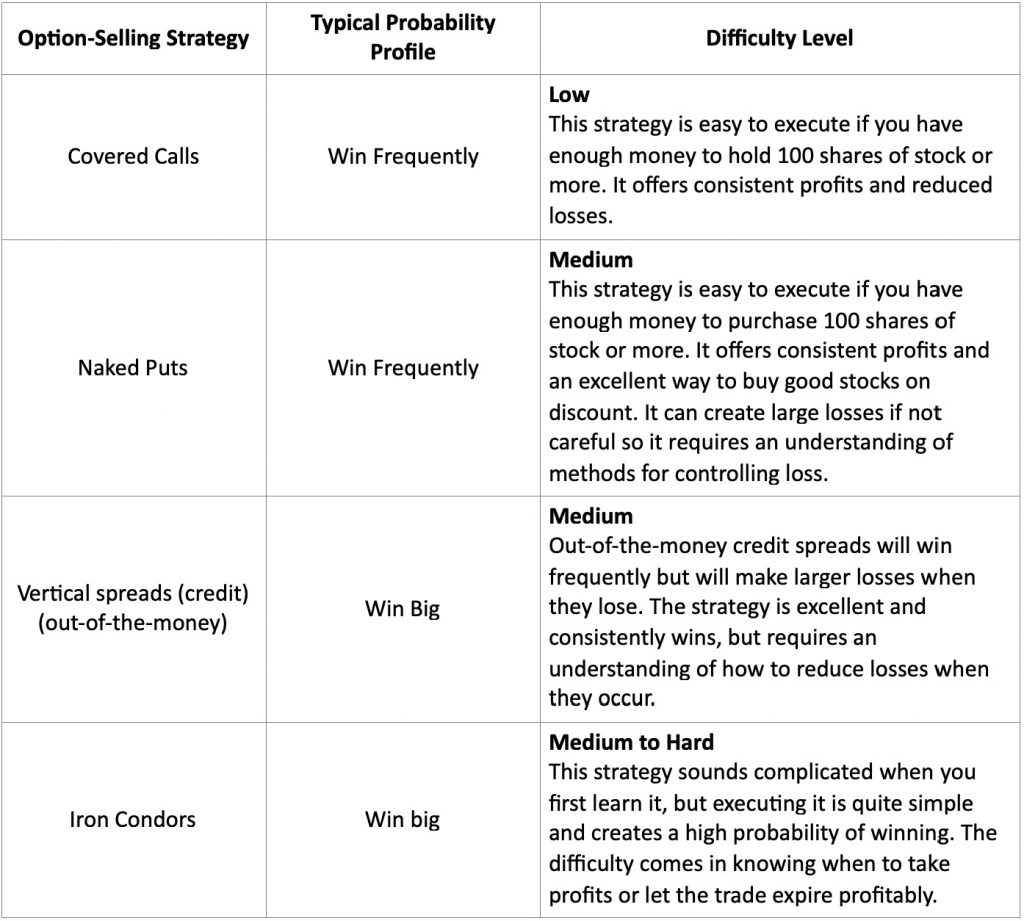

The following is a list of option strategies that traders might employ when acting as the option seller. The probability profile associated with each strategy in this list is a default, though each of these strategies can be adapted for different probability profiles. Though there are many options strategies that can be profitably traded, these are the most reliable for traders who are new to options.

Some of these strategies may be new to you and some of them may require additional permission from your broker to trade. As you look over these strategies and the rest of the information presented in this lesson, think about which approaches seem most appealing to you. Once you have singled out a strategy, add it to your Trade Plan and begin paper trading it for experience and to build your confidence and anticipation to trade it with real money.