Market Analysis Rules

Market Analysis Rules

The Market Analysis rules category of your trade plan helps you identify profitable market opportunities. The whole purpose of Market Analysis rules is to provide you a potential statistical edge where your tactics become more productive. This category helps you formulate rules that will govern your decisions for what markets you should trade (stocks, index, options, futures, forex, or something more exotic) and when you should enter and exit your positions. The choices for how to analyze the markets and individual equities within those markets literally number in the thousands. There are hundreds of technical indicators and nearly as many ways to analyze a company’s earnings, competitive position, management and industry group. Other ways to analyze the market include news sources, dark pool trading flow, insider trading, and macro economic indicators.

Risk Management and Trade Execution are two additional trade plan categories we’ll cover later in which you’ll develop rules to guide allocations (risk and portfolio management) and the tactics for timing your trades.

The rules you use to help you identify what is going on in a given market should be carefully selected to help maximize your success using the strategies and tactics that work best with your natural trading style. It is beyond the scope of this curriculum to discuss all the markets and all the timing indicators available. The simple rules we share in the lesson are great foundational indicators which can be adapted to work with most strategies and investing time horizons. As you gain experience or learn about other systems, you may want to add additional rules into this section of your trade plan to capture more consistent profits. The three basic rules we’ll discuss in this lesson are:

- The uptrend rule.

- The volatility rule.

- The downtrend rule.

Each of these rules can be adapted to any probability profile and should work well with your natural trading style. Identifying rules to help you get in or out at the right times helps you avoid big losses which automatically improves your annual results. These rules are also simple to quantify on the broad markets or individual companies using our trade tool which automates much of the work to help you find opportunities to fit your plan.

The idea with these rules is to help you develop a sense of what direction the market is heading and how volatile it is. Is it bullish? Bearish? Neutral? Is it highly volatile or not? We’ll describe each of these rules in further detail below.

Market Analysis Rule 1: The Uptrend Rule

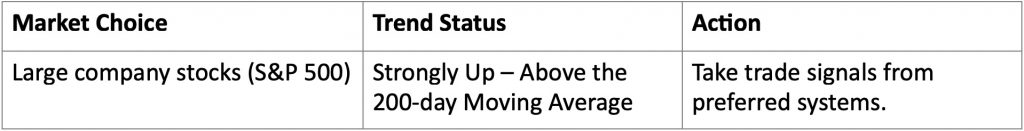

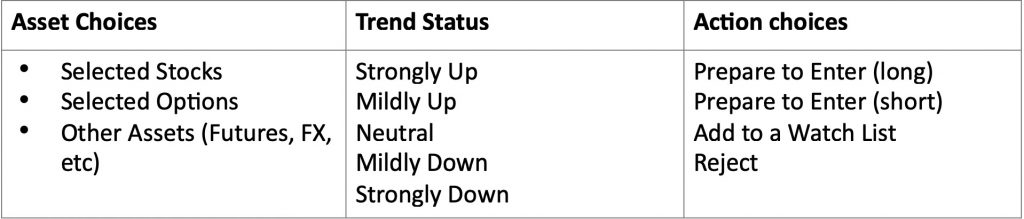

A person must first decide which market (stocks, options, etc) they want to trade. It’s possible for one person to trade in several markets with different portions of their portfolio. Any asset with a strong trend, or an indication of the beginning of such a trend, is best to trade. Whatever market you choose to trade, the uptrend rule serves as a filter for identifying when you will apply bullish tactics. You’ll want to have a market analysis rule for upward trends that looks something like this:

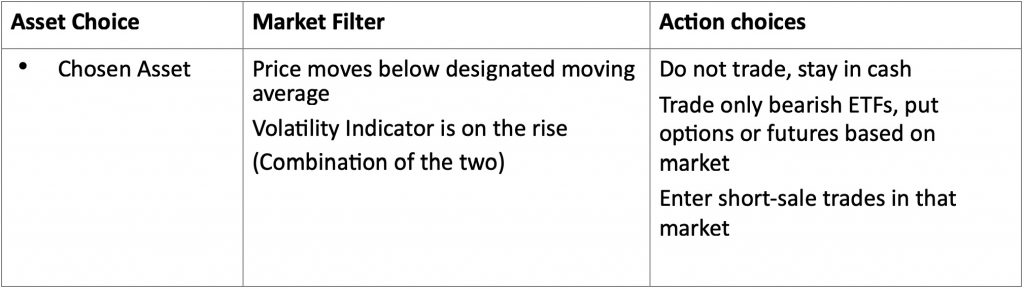

Here are some options to help your start the process of building out market analysis rules:

Market Analysis Rule 2: The Volatility Rule

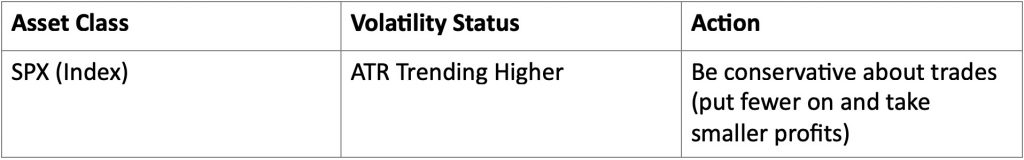

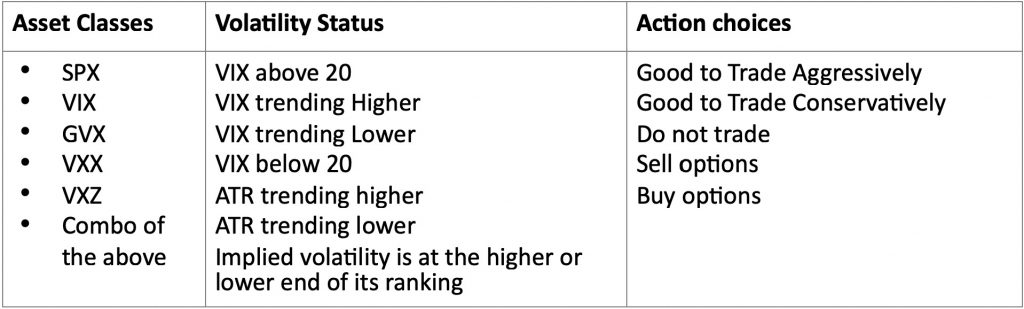

Market Volatility is simply the price fluctuation you see in the market. This rule is especially important if you trade options whose price is derived in part from the volatility of the markets. As we discussed in Lesson 3 Improving Your Results with Options, volatility increases the cost of the time portion of an option. If volatility is high, time is expensive which helps option sellers though it hurts option buyers. Because of the impact volatility has, it’s important to develop rules to help you check current market volatility. It’s all too easy to make a mistake in your trading by not watching market volatility as a whole or the volatility of the underlying you decide to trade. Another purpose of volatility rules is help you adapt your strategy or get out of your positions if the volatility changes. Here is an example of a Volatility rule:

Here are some options to help your start the process of building out your volatility rules:

Market Analysis Rule 3: The Downtrend Rule

This rule specifies how you will protect yourself or profit when your market enters a downward trend. The purpose of this rule is to give you the opportunity to alter your normal trading activity in the event of a downward trend. You may choose to sit out a downtrend and simply not trade, or you may choose to shift your tactics from bullish to bearish including buying insurance on those assets you own and don’t want to sell.

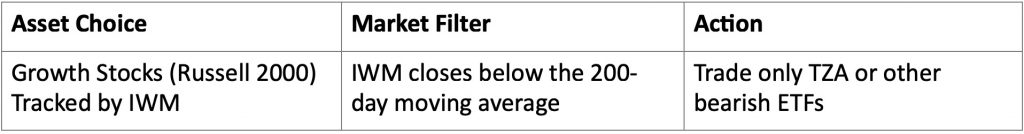

Here is an example to help you get started:

The simple market analysis rules we’ve discussed here are ways to get you started but are by no means exhaustive. Start by carefully following these rules as you continue through your curriculum and continue practicing in your paper trading account. As you gain confidence and experience, add other Market Analysis rules as necessary to help you avoid mistakes or better take advantage of market opportunities.