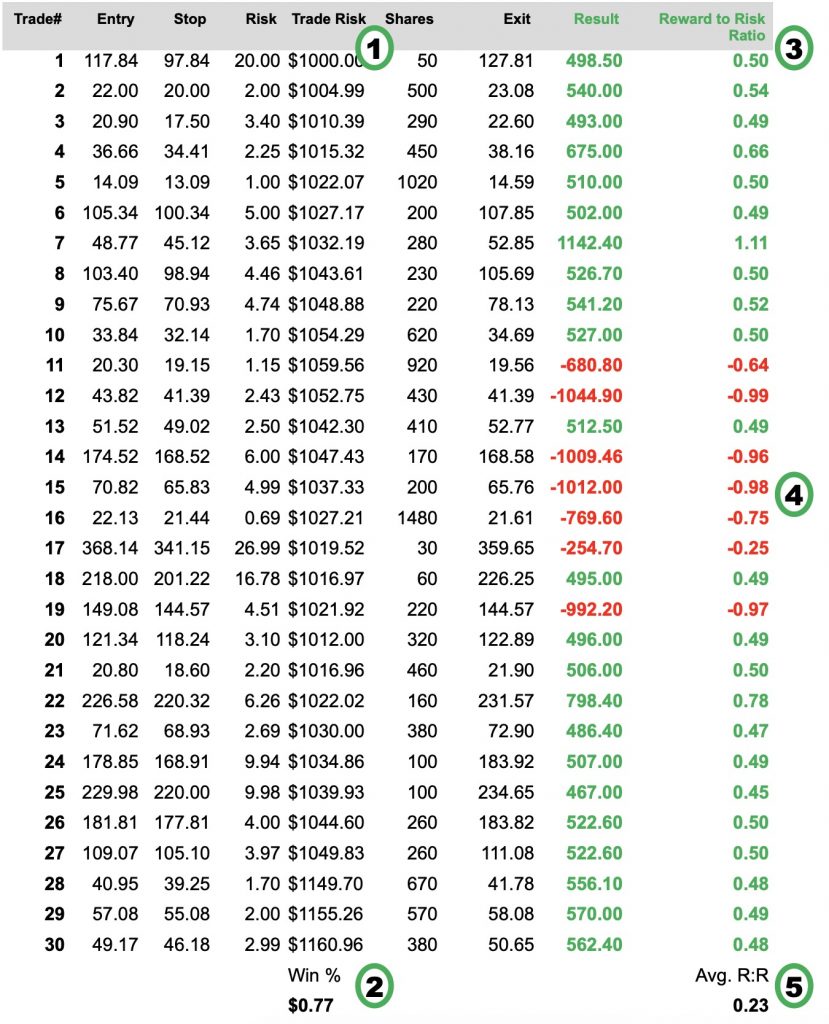

In the trade record above, we tracked 30 data points which give us at least 5 things to consider as we work through the results and seek to improve our future trades. These are:

1: A Consistent Risk approach

Explanation: Are you risking roughly the same percentage of your trading account on each trade? (Remember risk is different from allocation). If so, the numbers in the Trade risk column should be very similar. In this example the trader began with a $100,000 account and risked 1% of their running account balance. This means the risk on each individual trade should be about $1,000. After 30 trades the account balance has increased by more than 10% so the risk grew to over $1,100 per position (rebalancing of risk).

What errors look like: Traders who vary their risk amount are introducing statistical uncertainty in to their system. If the numbers in the Trade risk column were substantially different (say 2% on some trades and less than 1% on others) that would mean that some trades are, perhaps inadvertently, more critical than others. This kind of an error will sabotage your trading over time.

How to fix the error: This kind of an error is most likely a cognitive error that results from a miscalculation of the number of shares (or option contracts) to buy. To fix the error simply find a way to be certain that you are calculating the proper number of shares for each trade and that you are, in fact, using that number.

If you have an accurate way of calculating these measures, but are simply not using that number, and you do this repeatedly, then this is considered a psychological error. You should evaluate your beliefs about why you are adding more units of risk to one trade and less to another, and see if you need to create new rules to add to your trading system to protect you.

2: A Winning Percentage with an Edge

Explanation: Your winning percentage should be slightly higher than the baseline expected winning percentage for the probability profile you are using. For example, if you are risking 1 to make 2 (a win-big trading style), then your baseline percentage is 33%. You want to see your winning percentage at 36% or higher. The example trading results in this system were generated by risking 2 to make 1 (win-frequent trading style). The 76% win rate is well above the 67% baseline and shows a strong statistical trading edge.

What errors look like: Assuming your stops and targets are properly set, a win rate less than expected for your profitability profile may mean that your system is not effective. Or it may simply be that the market moved opposite to your expectations and position direction during the time you made these trades. This problem will fix itself if you simply continue trading and the market starts trading in your expected direction. Experiencing a less than expected win rate in this scenario is likely to be the case if you have executed these trades within a single month.

However if you experience loss because you have not applied market filters or rules that direct you to react to changes in direction, then you have introduced a cognitive error.

How to fix the error: Errors in this area can be fixed by adding new market filter rules or by simply continuing to trade. If this kind of error persists you need to check to see if your stop and target orders are properly set, and then you need consider a change to which trade setups you use.

3: Well-Contained Losses

Explanation: You need to be certain that your trading activity does not risk more than you plan. If you are risking too much per trade, this will likely nullify the statistically beneficial edge you might otherwise have had. You need to evaluate your results and recognize whether your trading is generating unexpectedly large losses on some (or all of your) positions.

What errors look like: The size of your loss compared to what you anticipated risking is identified by the reward to risk ratio measurement (the last column in the table). If this number is less than negative one, then something went wrong for that trade. If you have several trades where this is the case, you have serious problems with your system and should stop trading until you can identify and fix them.

Larger than expected losses can and will occur, but they should be rare, preferably no more than one in one hundred trades. Such an error can occur because the stock you were in gapped open to a price beyond your stop loss. This may happen because of unexpected company specific or macro economic issues.

How to fix the error: This kind of an error may be an anomaly, but if it happens more frequently than 1 in 100 trades, it is most likely a cognitive error that results in a miscalculation of your trade risk and timing. To fix the error you must find a way to be certain that you are entering and holding a trade only at times when earnings announcements (or other known events that frequently cause volatility) are not scheduled to occur soon after the initiation of the trade.

If you have an accurate way of identifying these events, but are simply not paying attention to them, then this is also considered a psychological error. The best course is for you to evaluate your beliefs about why you are making such trades and decide if you want to keep making them. If so, you will need to modify your stop loss and reduce your trading size in order to accommodate such fluctuation.

4: The Right Size for Winning and Losing streaks

Explanation: The length and frequency of winning streaks is greatly influenced by the probability profile you are using. For example, if you are risking 1 to make 2 (a win-big trading style), then your losing streaks will be frequent and relatively longer. When using a win-frequent trading style, your winning streaks will be more frequent and longer.

What errors look like: Losing streaks longer than you expect are likely an indication that you may have had one or more trading errors along the way.

How to fix the error: This symptom may actually be an artifact of the problem that causes the trade errors discussed above. However there may be additional causes. Each trade in the largest losing streaks should be closely reviewed for causes. This exercise will likely yield explanations for execution errors that can be avoided, cognitive errors that can be addressed, market filters that need to be applied, or psychological issues that may be nagging at you.

5: A Strong System

Explanation: An effective trading system should have an average reward to risk ratio (R.R.), or expectancy, of greater than 0.2 to be profitable.

What errors look like: Scores lower than 0.2 indicate you may be trading a system that is unprofitable. You may want to reduce the risk amounts, and continue to trading to further diagnose the issue.

How to fix the error: This symptom is not actually evidence of an error unless you had several trades where you did not follow your rules. The first fix is to carefully follow your rules. The second fix is to see if you need to add market filters to improve your system. If neither of these work then you may need to consider changing your probability profile or finding a different system to trade altogether.