Do What the Wealthy Do

Do What the Wealthy Do

The wealthy have always understood a key principle to wealth creation….money invested grows more money. Wealthy families who invested poorly or who stopped investing their money in favor of spending it lost their wealth. Even today it’s generally understood that by the third generation, any wealth accumulated by a “self-made” millionaire will be gone. Getting wealthy is one thing, staying wealthy is another thing.

For untold generations, it was the wealthy who funded trading vessels and other exploration in hopes of opening new trading markets for commerce. It was the wealthy who funded the war efforts to expand a nation’s borders to increase that nation’s resources and available markets. It was the wealthy who invested in business ventures and farms and it was the wealthy who got to reap the rewards. But it was also the wealthy who would bear the full brunt of the financial risks of any of these endeavors. If ships returned, the wealthy would become wealthier. If ships did not return, if wars were not won, if businesses or crops failed, the wealthy would bear the full financial loss alone.

In the year 1600 it was decided by a few of the wealthy investors that it would be more profitable to spread the reward and the risk among among other investors. So instead of owning say a merchant ship outright, these investors would each own a piece of several ships. This way, if one ship was lost, the investors would each bear a portion of the loss but be able to participate in the gains from the rest of the ships. This was the very beginning of what we call the stock market today.

In 1602, the East India Company became the first publicly traded company when it released its shares on the Amsterdam Stock Exchange. In return for buying a percentage (or share) in the company, the investor was guaranteed a specified percentage of the profits of the company’s trading activities. This was the first time people who could not previously participate a chance to invest and earn a return…to do what the wealthy had always done.

The stock market has since evolved and with the advent of computers and high-speed networks, it has become much more available to the average person. The average person will never be able to earn enough to retire wealthy. The real pressure and stress caused by our financial situation in life is often misconstrued as coming from our lack of savings or from our perceived notions that we’re not making enough to be able to retire.

The thing is, how much one makes or is able to aave almost doesn’t matter. We can still be wealthy if we simply increase the annual rate of return our money generates. The average mutual fund has returned (after fees) only about 3.5% over the past 20 years. Banks pay less than 1% in interest (if they pay anything at all). Even the stock market itself has only averaged about 10% annually over the past 50 years. Hiding our money in a mattress returns less than 0% because of inflation.

Depending on any of these sources is a sure fire recipe for never being able to retire. But learning how to match Warren Buffett’s guaranteed rate of 50% annual ROI is a surefire way to become wealthy. $25,000 compounded at 50% annual rate of return for 10 years turns into $3.5 million.

Quick History of Wall Street

Today’s Wall Street actually took its name from a wall originally built around the settlement which eventually became New York to protect against Indians or other enemies. Even after the wall was dismantled, the name of the street remained. On May 17, 1792, the first New York Stock Exchange was created and shares were actively traded under a Buttonwood tree located where the New York Stock Exchange is located today.

During the intervening centuries, especially over the past hundred years, the stock market has adapted to changing laws and technologies…but the underlying reason for its existence is the same. It is a place where risk of loss and chances for profit are spread among the many investors interested in investing their money. Until recently, stocks were bought and sold through an open outcry system where a human market maker would take orders from other humans. Today that is not the case. All orders are now run automatically through computers. This shift to computers has done several things to improve the investing opportunities of the smaller investor.

Because of computers, trading has become much less expensive and therefore more accessible to a wider number of investors and traders. This increased volume of trading has helped reduce the spreads between wholesale and retail pricing. Computers have simplified the process of finding good investments and disseminating the available information to all investors at the same time. And the costs of placing trades has dropped considerably and been made available to anyone from the comfort of their own home, in front of their computer. The internet has simply removed so many barriers that used to put the individual at a disadvantage to the big boy investors. There has never been a better time to be an individual trying to do what the wealthy have always done…invest in great businesses to make returns.

At the same time technology vastly improved the investing process and availability to individuals, the markets themselves were investing in new products to further diversify risk. These new products are mutual funds, ETFs, and options.

Investing in stocks still carries risk. Remember, stocks were created not to eliminate risk but to spread that risk among a greater number of investors. There are always things that could go wrong and each investor takes their full share of these risks when they invest or buy shares in a company.

For smaller investors who may only be able to buy shares in a couple of companies, the risk was still very high because they lacked the funds to properly diversify across industry groups, asset classes or companies.

Mutual Funds were created in 1928 when Mutual Funds in an effort to further diversify risk for smaller investors. The idea with mutual funds was to further mitigate risk by pooling several stocks into a fund which could then be divided into shares purchased by individuals. Any one share of a mutual fund would contain a number of shares of other companies reducing the negative impact if any one company were to suffer loss. Mutual funds became a very popular vehicle for the average investor to invest in the stock market. They allowed participation in potential profits while also allowing smaller investors to properly diversify risk.

It is through mutual funds that most people trade in the markets today. Most managed retirement plans trade exclusively in mutual funds. There are something like 10,000 mutual funds investing trillions of dollars. These funds buy stocks of companies that match their guidelines. So for example, a small cap fund would own stock in companies considered small cap stocks.

Over the past twenty years of so, mutual funds have not performed very well. The average mutual fund has only returned 3.58% when factoring in the management costs and actual performance of these funds. Investing in mutual funds simply isn’t the way to build a substantial retirement anymore because the gains simply aren’t enough despite the reduced risk of investing.

In response to growing backlash against the fees charged by managers of the mutual funds, Wall Street developed a new product known as ETFs or Exchange Traded Funds. These are sort of like mutual funds in that one share of an ETF contains a little piece of all the companies owned by the ETF. For example, the S&P 500 has an ETF known as the SPY allows a person to buy one share of the ETF and diversify their risk across all 500 companies in the S&P 500.

ETFs also have advantages over regular mutual funds because they trade like a stock. It is difficult to find information about mutual funds and even more difficult to trade them. However, ETFs trade like stocks. They are liquid. Many of them also have options which gives the individual investor additional choices for leverage or protection. And ETFs don’t charge fees meaning returns are not eaten up by the costs of managing a fund.

A Part Of All You Earn Is Yours To Keep

One principle the wealthy have always known is that it takes money to make money. In today’s consumption economy based on a “buy now, pay later” philosophy, it’s easy to get suckered into spending our entire paychecks. But if you want to break this cycle and truly become wealthy, you need to find some way to save some amount of your paycheck. Even small amounts saved can grow into enormous sums given enough time and annual ROI. For example saving $100 a month for 20 years is just $24,000. But investing $100 a year for 20 years at 30% annual ROI turns it into nearly $1.5 million!

In the book, “The Millionaire Next Door” the authors describe the difference between millionaires and everyone else….and it wasn’t what you think. Most people think that wealth is a function of income. They think that if they could just make “x-amount” of dollars a year, they’d be rich. But even very high salaries don’t make someone a millionaire or keep them wealthy. The authors of this book described several instances of physicians earning many hundreds of thousands of dollars a year and still just living paycheck to paycheck.

Becoming a millionaire is less a function of income and more a function of compounding returns…just like the wealthy have understood for centuries. You have to start somewhere. If you don’t have any savings start by saving a portion of your paychecks and begin investing using the methods we teach in class.

Get Paid Interest, Don’t Pay It

Avoid installment debt. Credit card use is seductive. It’s really easy to buy something today and pay for it over time. In fact, a study found that the average college student carries over $3,000 of credit card debt in addition to their student loans! How much credit card debt do you have? Do you make minimum payments? Do you know how much interest you pay on those cards? Albert Einstein is credited with saying that the most powerful force in the universe is compound interest. Compound interest is the 8th wonder of the world.Those who understand it — EARN it, those who don’t — PAY it. Those who earn it become wealthy and retire comfortably…those who pay it live paycheck to paycheck and struggle to retire at all…regardless of income levels.

Put yourself in financial control of your life. Save a portion of all you earn. Invest that portion carefully and begin compounding your money. Put it to work conservatively now and then learn to put it to work at increasing rates of return as you gain experience. Don’t pay interest…get paid interest! Then learn to increase the amount of interest (return) you can get on your money. This is the key to real wealth.

Compounding Makes a Huge Impact

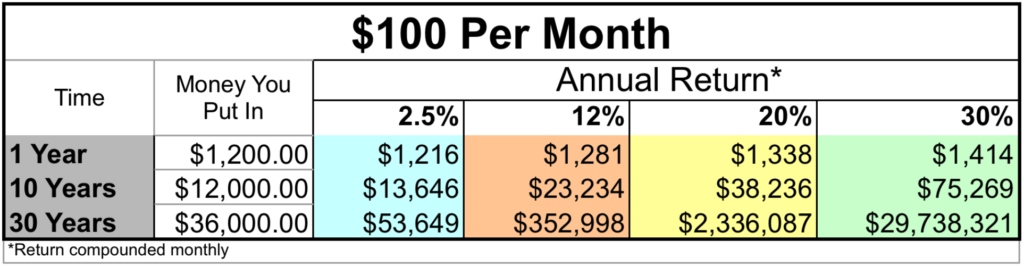

Wall Street would have you believe that low single digits is both normal and all that can be expected. But the truth is that individual investors have significant advantages once they learn how to trade and develop the mental and emotional discipline to trade successfully. Study the chart below which shows the significant financial impact just a few more points a year can have on an account, saving just $100 per month.

First, look at the “Money you Put In” column It shows how much you pull out of your pocket over the course of 30 years at just $100 per month. Now imagine putting that money to work at 2.5% rate of return, like what could be earned in a bank CD. You’d end up with more than you put in…but clearly not enough to retire on. It also doesn’t grow enough to replace your income.Now look at the 12% annual rate of return column. This is about what the stock market has averaged over the past 30 years…so if you were to just buy a market ETF like the SPY and do nothing else (assuming that future performance will at least be equal to past performance) your $36,000 turns into $352,998! Obviously there is a huge difference between the $53k and $352k. The same amount of money was invested for the same amount of time….the only difference is the annual ROI.

Now look at the 20% return column. The difference between 12% and 20% annual rates of return is almost $2 million! How different would your retirement look if you had been able to manage a 20% annual rate of return for your entire working life? You have heard from the mavens of Wall Street that it’s impossible to beat the market. That is simply not true. It’s very possible to beat the market for smaller investors who have built-in advantages to the large funds on Wall Street. Warren Buffet guaranteed it (see below).

Now, one word of caution. Look at the first year return at the 30% rate. $1,200 was saved and the account only shows an absolute dollar increase of just $214 even after a year of effort, of learning, of changing habits, of investing. Many people will fall into the trap of thinking one of two things. Either they’ll think that $214 is not worth their time and effort and they’ll decide to just go back to what they were doing…or they’ll think that $214 is not much to show for all their effort and they’ll decide to go even more aggressive and get into riskier trades. We urge you to focus more on the annual percentage gain than on the absolute dollars you’ve made. If you maintain a 30% annual rate of return, your retirement will take care of itself even with a very small starting amount.

Wall Street’s Tall Tale

In a 1999 Businessweek article, Warren Buffet is quoted as saying:

“If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.”

Wall Street would have us believe that a low single digit rate of return is all we can hope for and we should be content to earn that much. The truth is far different for those who decide to commit the mental and time resources required to learn how to invest their own money. Even today, the wealthy like Warren Buffett are not satisfied with low single digit returns promised by Wall Street. They know the importance of figuring out ways of improving the annual ROI to their continued ability to stay wealthy.

Use the calculator to see what Warren Buffett’s guaranteed 50% annual rate of return could do for your retirement. It could help you catch up your retirement account. It could help you live more comfortably in retirement without cannibalizing your account and reducing your investing principle. It could even make retirement possible for some.

No One Cares Like You Do (Or Can Do As Well)

The sad fact is that no one else cares about your money or your retirement like you do. Your financial advisor is incentivized to put more money under management. They work for their firm…not for you. They won’t take the time to help you get better returns or to teach you how to improve your results through interesting and profitable options strategies. They won’t show you how to buy insurance on your portfolio to protect your investments and lock in your return no matter what the market does. They certainly won’t help you achieve Warren Buffett guaranteed 50% annual rates of return. What they will do is try to convince you that you can only expect single digit returns and to trust them with your money. They will try to convince you that you can’t time the market. They will tell you that buy and hold is the best strategy. And they may choose to use fairly confusing market comparisons to justify their performance.

A 2017 Bloomberg News article by Ben Steverman titled, “Why You Still Can’t Trust Your Financial Advisor” states:

“A recent study showed ten times more people bought an investment that paid 2.25% less than an identical one. Why? Because it paid more to their advisor. The unique nature of the investing business makes it easier to exploit client ignorance.” In that same article, Benjamin Edwards, a law professor at the University of Nevada, Las Vegas is quoted as saying, “There’s an ever-present incentive to betray your client’s interest.”

The best time to have begun implementing these principles of money management and sound investing strategies like the wealthy was 20 years ago. But the educational system failed you. The second best time is today. It’s never too late to begin improving your financial situation. All it takes is a willingness to learn and a determination to keep going despite the struggles and obstacles encountered along the way.

Rule of 72

A simple way to know how long it takes to double your money is known at the Rule of 72. At 20% annual rate of return, your money will double every 3.6 years! The formula is: 72 ÷ annual return = time to double investment. So if you had $100,000 to invest and could earn 20% annual return, you’d have $200,000 in just 3.6 years! ($72 ÷ 20% annual return = 3.6 years to $200,000 invested). Take some time right now to plug your numbers into this formula. What happens to your retirement at a 20% annual return? 30%? Even 50%? Hopefully this exercise motivates you to get started!

Remember, retirement isn’t really a function of how much you earn. It’s based on how well you are able to compound your investments just like the wealthy. It doesn’t take much to get started…but it does take a willingness to get started.

Once the value of earning interest is fully understood, it’s easier to make changes in your life and household budget to increase the rate of savings and investment. Think how different your spending habits would be if every purchase (like a new TV or new car or whatever) is made with a full understanding of the true cost of that item due to lost compounding on the initial price paid.

Many people delay investing in the stock market because they don’t think they have enough money to get started. Just begin investing with what you have. Be consistent in how much you put into the market and over time you’ll end up in a great place. Consistency is the key to success in all endeavors…including investing. By learning to think in trading probabilities and staying focused on following your system, you remain consistent in how you approach the markets which helps you get more consistent results from the market.

Conclusion

The market is the best place for anyone to grow their money and to invest like the wealthy do. It’s liquid, inexpensive, and available from the comfort of your own home or office. There are many strategies for approaching the markets and many different information sources which might cause confusion if you let them. As you begin this journey, work to train your brain to think in probabilities. The best traders are those who understand the probabilities of their trading system and use them to stay focused on the process of trading. This helps them avoid the mistakes of being emotionally affected by fear or greed based on the outcome of individual trades.

It’s also important to journal your trades and to monitor your results over time to ensure your method is successful and that your actual results matches the statistical expectations given by the probabilities. As Peter Drucker once stated, “If you can’t measure it, you can’t improve it.”

Be patient with yourself. It’s easy for most people to see their failures…and really to make everything they do (even if it is successful) feel like a failure. Imagine a trade where you bought at $50 and it ran to $70 over the course of 60 days. What a great trade! You might even tell yourself that you’ve made $20. But what if the stock then drops to $65? Do you focus on the $15 gain….or the $5 “loss” from the high? Or what if you did sell at $70 only to see the stock run to $90 over the next 2 months. Are you still happy about your $20 gain? Or do you instead beat yourself up for getting out too soon and losing out on another $20?

The stock market is the best vehicle for you to do what the wealthy have always done. That said, there is a learning curve to learning how to trade successfully. This learning curve is comprised of two parts:

- To learn the strategies, tactics, jargon, and rhythm of the markets, and

- To develop the ability to think in probabilities, avoid emotional swings, and stay focused on the process of following your system.

It takes effort to think like the wealthy and to invest your own money. The comfort zone is hard to escape. But if you just keep going, you’ll eventually learn to love trading, you’ll experience financial confidence and peace because you see your money growing, and you’ll have a much richer life-style in retirement.

You have embarked on a grand journey towards financial independence. You have decided to take control of your financial destiny and throw off the shackles of Wall Street’s minuscule gains. You know there are challenges to face as you chart this course. We encourage you to face them head on. Do today what so many others won’t do so you can live tomorrow like so many others can’t.