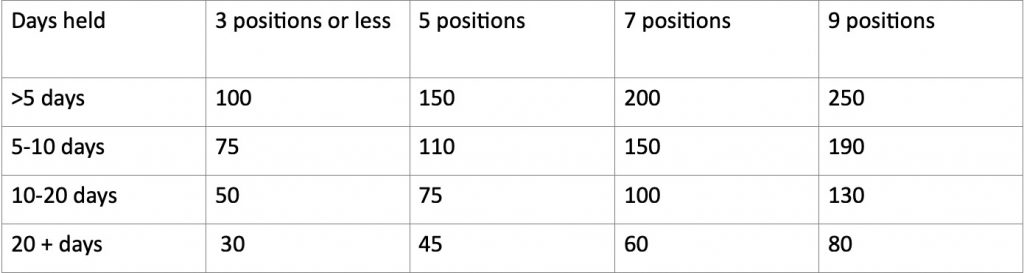

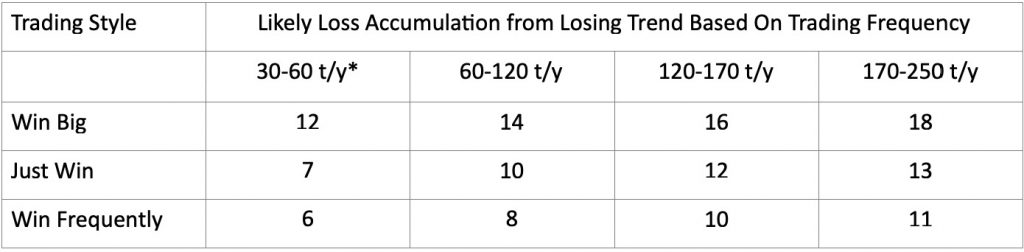

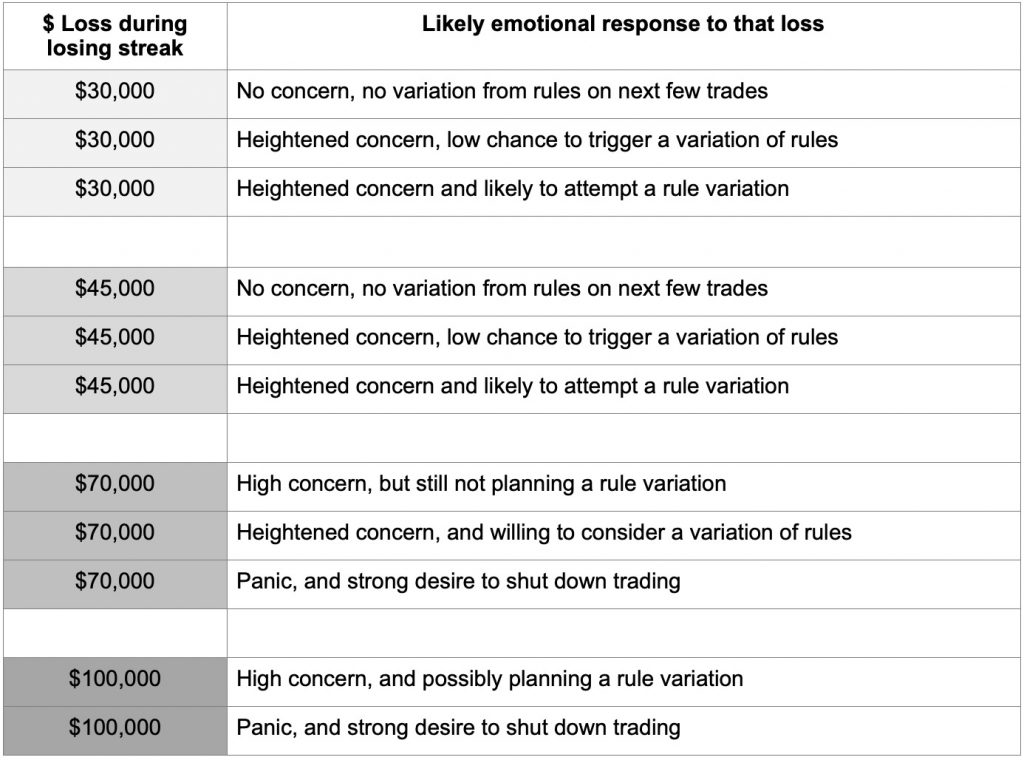

Your emotional response may signal your probability trading style. Win big traders emotionally respond to losses differently than those who are more naturally geared to a win frequently trading style. After you have selected the dollar loss and your likely emotional response to that loss, use that information as a reference point for the following table.

Level of Tolerance

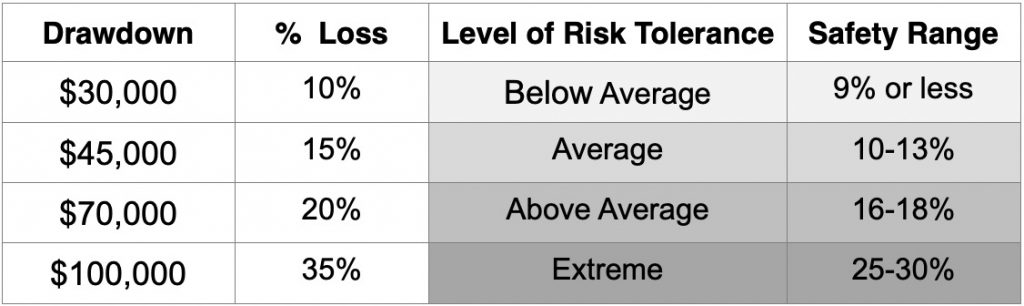

Let’s say you chose “$30,000 and heightened concern and likely to attempt a rule variation” in the previous table. This would indicate a Win frequent trading style. Now look at the table below for $30,000 in the “Drawdown Size” column. As you look at the “% Loss” column you’ll see this loss represents a 10% (or just under) loss on the entire account of $290,000. Next you’ll see that a 10% drawdown is a below average level of risk tolerance. This is not a judgement. It really doesn’t matter what your risk tolerance level is, so long as you know what it is and avoid letting fear whipsaw you out of positions or the market prematurely.

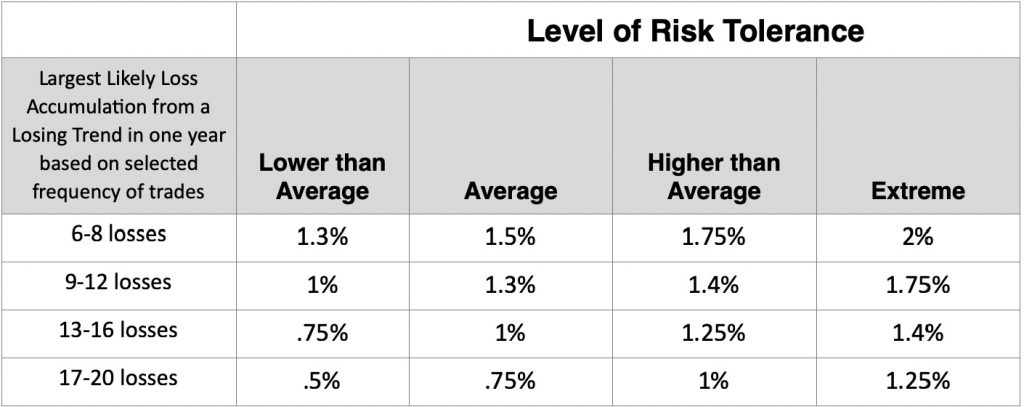

The final column in that row is the “Safety Range” column. Based on your level of risk tolerance, the safety range helps you determine what dollar amount to risk per trade over your cumulative trades so that losing streaks won’t cause you to change your approach or tweak your system. Consistency in the amount risked in each trade helps keep your emotions of fear and greed in check. This consistency also helps you avoid unnecessary loss caused by over allocation to any one position.