Penny stocks: a unique asset class

Penny stocks: a unique asset class

The idea of speculating in penny stocks can be exciting for many who are attracted to the idea of the low costs and high potential offered by this stock trading category. The sad reality is that most who trade penny stocks actually don’t do very well. In fact, in 2014, the SEC looked at the outcome of over 200,000 trades made by individual investors. What they found is a cautionary tale for any would-be penny stock investor, however, it also unlocks the secret to successfully trading in this class of stocks.

To be successful in penny stocks, traders must be able to both endure a high number of losing trades and have a game plan for lowering the risk of these highly volatile trades.

This course is designed to help you be a better penny stock trader by leading you through 4 steps. These steps are:

- Recognize how penny stocks are different from other securities.

- Identify how to enter, execute, and exit your planned trades.

- Create a watchlist of potential stocks that fit your criteria.

- Evaluate the risks of a penny stock trade, and develop a repeatable and consistent approach for trading in this class of stocks.

Together, these steps give you the tools and knowledge to speculate in penny stocks more systematically.

Penny stocks are different

Penny stocks are not the same as higher priced stocks, so they must be traded differently. This is why we like to refer to them as their own stock category. To be successful, penny stock traders must approach them in a unique way. Many people are attracted to penny stocks because of the persistent idea that it is an easy way to create wealth. They think they need to buy a large number of shares in the next Amazon, Apple, or Microsoft before they become the high-priced stocks we know today.

It might appear that Microsoft started out as a penny stock, but that’s only due to stock splits along the way. Microsoft actually listed at $21 when it went public. It was never a penny stock, no matter what chart prices read like today.

The hard truth about penny stocks is that most of the companies who are listed in these markets are not great companies and have little hope of ever becoming a winner.

Penny stocks are characterized mainly by their price. Stocks with prices below $5 are considered penny stocks. Though there are hundreds of penny stocks traded on the NYSE or the NASDAQ, there are thousands of penny stocks traded elsewhere. These stocks trade through a distribution known as the over-the-counter market or OTC.

The SEC does not require the same comprehensive reporting for stocks trading off the main exchanges. Some companies voluntarily report their GAAP level financial statements though most do not. This means information about the companies listed on the OTC market range from highly detailed and trusted to little or even no information reported by the company.

In our next video, we’ll discuss the extreme risks associated with penny stocks and show how most penny stocks are priced for failure.

The risks of playing in the penny stock market

Three factors generate extra risk for investors trading in penny stocks: low information, inconsistent trade volumes, and price volatility.

The first factor is that the company behind the stock may provide less information, or less reliable information, than higher priced stocks on major exchanges.

While some companies with stock traded in the OTC markets are successful businesses, most are either unproven businesses or failing businesses that have seen better days. They can no longer meet the requirements of a listing on the main exchanges.

The lack of quality information on most penny stocks, no matter where they are traded, means there is a greater variance of opinion among investors. Not everyone agrees on their outlook of how well the company is doing or what its future prospects might be.

The fact that the stock is below five dollars tells us one idea is more prevalent among investors than all others: this company is about to fail. That thinking means most investors are nervous from the start. The greater variance in opinion combined with a negative expectation can drive larger swings in price and various investors eagerly buy or impulsively sell.

A second factor that adds risk is the inconsistent volume of shares traded. Every day that brings lower trading volumes on these stocks presents a risk to the trader. Lower trading volumes may make it difficult to get out of a position in a timely manner or at a desired price point.

The third factor is price volatility. Penny stock prices can swing wildly in short periods of time. Upward price spikes in a penny stock generally come in waves that last about a month, but downward trends can last much longer.

The low expectations and the potential for big fluctuations in volume create greater volatility in this class of stocks. Let’s look at just how much more volatile penny stocks are compared to other classes of stock.

The ranking of volatility in stock asset classes from least volatile to most volatile is:

- Dividend paying stocks

- ETFs

- Large Cap Growth Stocks

- Small Cap Growth Stocks

- Penny stocks

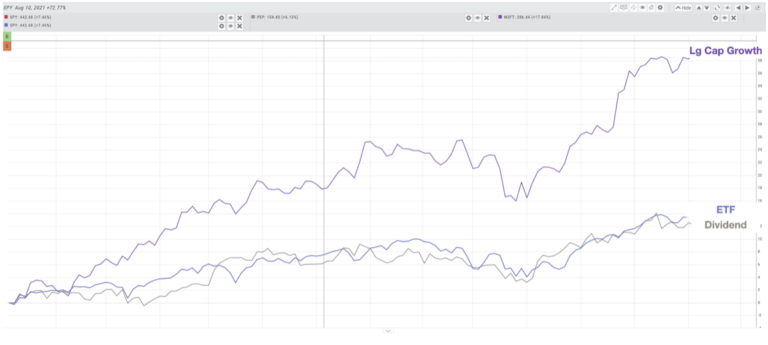

Showing just how volatile penny stocks are compared to other stock classes is best done using comparison charts. We’ll show three charts. Our first chart compares the volatility of Large Cap Growth Stocks to the less volatile ETF and Dividend paying stocks:

Volatility comparison: Large-Cap, ETF, Dividend Paying

It appears from this chart that the stock prices of Large Cap Growth stocks move around more than ETFs or Dividend paying stocks.

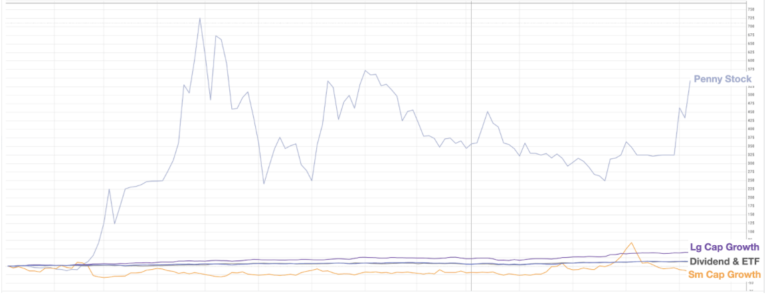

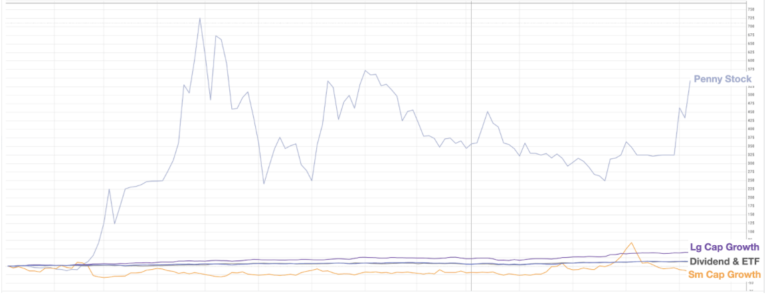

Next we add in a comparison with Small Cap Growth stocks:

Adding in Small-Cap stocks

Notice that the stock prices of Small Cap Growth companies moves around much more than even large Cap Growth stocks.

People who choose to invest or trade in the Small Cap Growth stock category can expect wild price swings in the value of their accounts.

Finally, let’s add in a comparison with penny stocks:

Adding in Penny Stocks

As can be seen, the price swings seen in penny stocks dwarf all other stock asset categories.

All traders love volatility when it means their holdings experience sudden and significant gains. This is the lure of more aggressive categories such as penny stocks.

But volatility cuts both ways and wise traders have a plan to protect their accounts from seeing sudden and significant losses by implementing a holistic trading process such as that found in this course.

Understanding the three main reasons why penny stocks tend to have such volatile price movement is the subject of our next lesson.

Why penny stocks experience such wild price swings

The three main reasons penny stocks experience such high price swings are:

- Low market capitalization

- Traded off the main exchanges

- Lack of visibility

Low market capitalization

Penny stocks generally have a market capitalization of under 300 million dollars. Penny stocks are often referred to as micro cap or even nano cap stocks. For reference, a mid cap company exceeds $2 billion in market cap and a large cap company exceeds $10 billion. Low market cap doesn’t refer to the number of employees or size of the company’s assets. It simply means that investors have invested less money into the company.

However, that lower degree of confidence in the company may translate into lower volume of trades. Even the potential for lower trading volume makes it difficult for institutional investors to even consider trading penny stocks.

Without the order flow of these larger players, penny stocks have the potential for a much lower volume of shares traded each day.

Therefore, low liquidity means that any increase in the flow of buy orders could result in a large increase, or decrease, of the stock’s price.

More often traded outside the major exchanges

Penny stocks are not widely known nor are they widely available for investors to speculate in. Brokerages often won’t let their clients trade in the penny stock market because of the risks associated with it. At the same time, many institutions can’t invest in stocks not listed in the main exchanges or not providing enough information to make informed decisions about the company’s prospects. As a consequence, few penny stocks are tracked by analysts or promoted by financial advisors to their clients.

Nevertheless, there are a few companies that do provide full GAAP reporting, audited financial statements, and remain compliant with all U.S. Securities law. Most established businesses which have fallen on hard times may be able to turn around. New businesses may discover a compelling competitive product that provides large upside potential. All of these reasons contribute to the wild price swings often seen in penny stocks.

Lack of visibility

Companies listed on the OTC market are not required to provide any sort of provable information about their inner workings. It’s true that some do provide data comparable to that presented by stocks on the main exchanges, but these are the exceptions. At the same time, few or no analysts provide detailed reports on these companies or conduct any research into them. Due to the relative quantity or quality of the information available, these stocks are prone to move on rumors alone.

Penny stocks experience the highest pricing volatility of all 5 stock categories because of the combination of these three things. Low trading volume means prices can spike on any rumor exciting enough to attract the attention of less sophisticated traders who often play in this market.

The SEC discovered that traders choose to lose.

To begin with, the SEC found that over 67.1% of the trades made by penny stock investors resulted in a loss. That means that, generally speaking, penny stock investors lose twice as frequently as they win.

All by itself, this is surprising. For the study, the SEC only looked at completed trades, not trades that were still open at the end of the year. So all of these trades were driven by an investor making a decision to buy, and then sell, at some point. Their best decisions ended in losses two out of three times. Why is that?

Some might conclude that penny stock traders are just notoriously bad at what they do. However, experts in the field of Behavioral Finance offer a different explanation.

Several studies have documented the instinctive human tendency to react more strongly to pain than pleasure. Some studies suggest that there is a measurable difference to that reaction. Behavioral finance researchers suggest that people consider the pleasure of making a gain in stocks to be about half of the intensity of the pain they feel at making a loss in stocks.

In other words, if a person loses one thousand dollars in a stock trade, they feel so bad about it that they need a win of two thousand dollars to generate enough pleasure to wipe out the pain. It is not surprising then, that investors in penny stocks unconsciously generate these results.

Consider the dynamic that automatically gets set up by this emotional mindset. If an investor buys a stock at a particular price–let’s say $5 per share–and then makes a plan to sell it later–let’s say for $10 per share. They hope to experience the pleasure of gaining a 100% return on their investment. However, since pain is twice as intense as pleasure, it stands to reason that the offsetting expectation for doubling your money is losing half of it!

The Foundations of Trading course pointed out that random price movement in the market will generate about a 33% win rate if an investor consistently sets a stop that is half the size of the target. Since the SEC study found that number to be true over many trades from many different investors, it is likely also true that most penny stock investors try to hunt big gains as opposed to harvesting small profits.

That alone would account for the persistent losses in penny stock trading, even if penny stocks weren’t a risky investment. Even so, there is more to be found in the data from the SEC study. The next video will take a deeper look at it.

What the SEC study also revealed

It is true that most investors in the SEC study chose to make a loss about twice as often as making a gain, but let’s break down the data a little more.

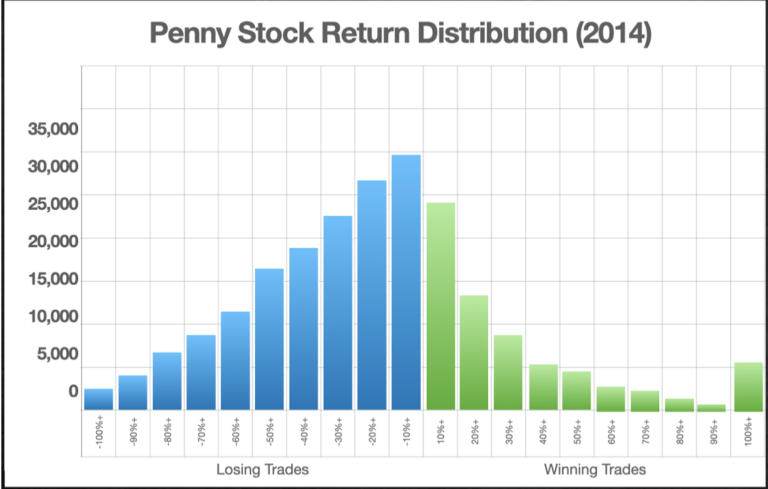

Here is a chart showing the return distribution of the penny stock trades the SEC studied. The trades are divided by how much the investor won or lost. The blue bars represent losses. The small bar on the far left represents the number of people who lost between 90 and 100 percent of what they spent on the trade.

The tallest blue bar represents the number of trades made by investors who lost between 0 and 10 percent on a trade. This is surprising because it shows that the largest grouping of trades was made by people who didn’t want to lose any more than 10% in a volatile kind of stock.

This behavior might seem counterintuitive to some investors. Of course, every investor has their own individual objective, but it is interesting to note that penny stock traders seem to know that they shouldn’t play the game according to intuition.

The data shows that penny stock traders seem to know they shouldn’t hold the trades for long, and that making twice as many small losses as gains is not a bad thing. How can we tell?

The key detail from this study comes from the far right side of this chart. The outstanding bar on the right end represents trades that have made over 100% or more in gains. These are known as asymmetric wins. These asymmetric wins can change the entire outlook for a penny stock investor.

Consider that if a penny stock trader makes four losing trades, but makes only one winner that returns ten times the original risk, then they would likely still consider their efforts to be worthwhile. They could still be very happy about their investing, even though they were losing 80% of the time.

It is this potential for outsized returns, combined with the ability to buy shares with a small amount of money, that makes penny stock trades very appealing. In fact, it is worth pointing out that there were a significantly larger number of these asymmetric wins than there were total loss trades. Notice that the blue bar on the far left end is less than half the size of the green bar on the far right end.

If we compare investors who made a trade resulting in greater than 100% gains to those who made a total loss we find this shocking detail: The winners outnumbered the losers by more than double! This is an astounding result. It implies that traders who knew how to capture asymmetric gains could perform far better than the average penny stock investor. It is this ray of hope that helps us recognize what better penny stock investing practices look like.

This course will present you with ideas on how you can seek these asymmetric gains.

Conclusion

Traders who choose to speculate on movement in the penny stocks should approach these trades as they do all other types of investing. They should use a clearly expressed and trusted trading process which provides rules to reduce risks and increase opportunities.

In all stock trading, investors look for catalysts.This is something that can spark an increase in price and is more important for stocks traded in the OTC Markets. Undervalued potential that is suddenly recognized and small successes or rumors of potential success are the things that spark a sudden price rally.

The challenge faced by speculators of penny stocks is that these price rallies are unpredictable, unexpected, and of relatively short duration before the chart continues its previous pricing pattern. That’s why traders need to set up trading methods that hunt for asymmetric wins.