Finding penny stocks to trade

Finding penny stocks to trade

Trading ideas for penny stocks can come from all sorts of places. This includes newsletters, screeners, friends or loved ones, unsolicited emails, or other forms of communication.

Of these, screeners are better at providing an unbiased list of potential trading candidates based on criteria you feel is most important to success.

While research can be done on many platforms, the two best suited to penny stocks are found at www.finviz.com and www.otcmarkets.com.

Both of these websites provide information about penny stocks with powerful ways of sorting that data into workable intelligence and a list of qualified potentials.

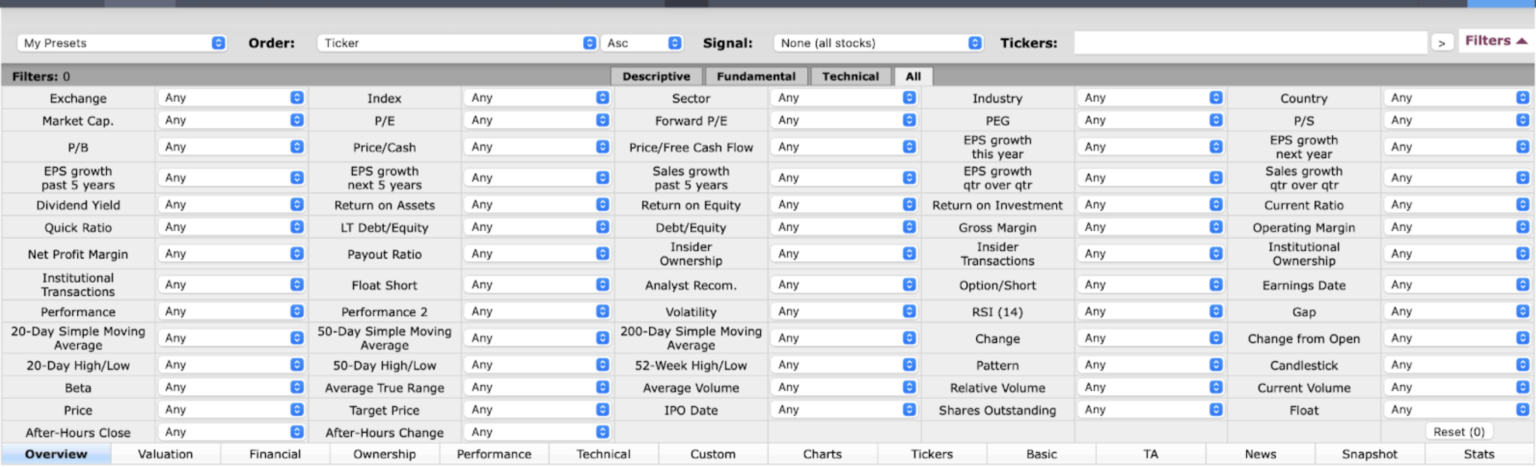

Here is a sample screener page with all the criteria available to search on from www.finviz.com.

The screening capabilities of www.otcmarkets.com are comprehensive with a bewildering number of searchable options. For the purposes of this course, we suggest limiting your search criteria to these 7 items:

- Country: USA

- Performance: Week up

- EPS Growth qtr over qtr: positive

- Sales Growth qtr over qtr: Positive

- Price: Under $5

- Average Volume: Over 1m

- Relative Volume: Over 1.5

These 7 criteria will help you find solid candidates for trading. If too few stocks are found, it’s okay to reduce or remove the 7th one, Relative Volume.

Remember, most penny stocks tend to drift lower with intermittent and sudden spikes in price that tend to revert back to their normal downward trend over the next month. A screen with the criteria listed here will keep you in the most solid companies with the greatest likelihood of providing more predictable and larger returns.

Penny stock trading ideas can come from many sources. Whatever the source for the idea, it’s important to look for a catalyst that feels comfortable and is exciting enough to move the stock price. This is the subject of our next section.

Identifying there right catalyst

With the lack of trusted information available on penny stocks, a main catalyst triggering a move in the stock price is rumor. Rumors are easy to start and spread in today’s world. So much information and propaganda is available for everyone and especially for penny stock enthusiasts. It is impossible to distinguish between naturally generated rumors, and outright falsehood being deliberately spread.

Even if there are unscrupulous actors in the penny stock market trying to trick people, the price action looks the same. Penny stocks generally experience downward trending prices over longer time frames, with comparatively quick moves higher in short time frames. Rumors that have a very compelling and believable story, and which are hard to refute with company-provided facts, will affect the price the same way regardless of whether they are false or true.

To navigate the realities of the penny stock market, it can be helpful to select from among the highest quality companies. These companies are more likely to provide a clearer look into their workings as well as regular updates about their business opportunities.

That said, there are some additional filters that can be applied to find the best and most timely investments available. All penny stocks tend to drift downward in price with infrequent and surprising price spikes of short duration. This is why penny stock traders tend to be more active and market focused.

When working to sort through the list of screened stocks, three additional data points can be reviewed to provide additional insight into the possible validity of a trade setup. These are:

- Change in price trend

- Volume / price spike (or both)

- Size of the float

Not all stocks that qualify for additional review have been through the screener for recent price appreciation. Since upward price moves tend to last only for about a month, traders may find it useful to favor shorter term time periods for trading. Some traders find it helpful to study charts that show prices within a single day to detect changes in price trends.

For example, they may use a 30-day, 10-minute chart with an 18-period simple moving average as the trend indicator.

Penny stocks should not be considered long-term investments. It’s true that some stocks do eventually turn around and become winners. Our next lesson will describe ways penny stock investors can manage their risk and capture asymmetric returns.

Managing risk for asymmetric returns

All traders and investors must manage their risk if they want to have long-term success. The old sports saying, “the best offense is a great defense,” gets applied on Wall Street oftentimes. That said, stocks on the main exchanges generally trend upward with short-term downward spikes. This requires a completely different form of risk management compared to penny stocks.

Penny stock prices generally trend downward with occasional and relatively short term price spikes that last about a month. These price spikes are generally the result of rumors about improved business prospects which are quickly found to be untrue.

There is little reported information or reliable sources of information on penny stocks. There are no analysts recommending the stock or working with management to present a true story of the company’s prospects to investors like there is on the main exchanges.

This lack of quality information and quick price surges based on rumor alone makes managing risk much more urgent for penny stock traders.

There are three main ways to manage risk when trading penny stocks:

- Find a steady stream of new trade candidates.

- Avoid scams.

- Standardized risk per trade.

Find a steady stream of new candidates

One way for traders to manage their risk is to continually screen, review, and find a steady stream of trade candidates to then place these candidates in a watchlist waiting for the peak entry time.

As new candidates are added to this watchlist, older candidates past their prime should be removed.

Avoid scams

Due to the scarcity of quality information about penny stocks, this market is ripe for fraudsters. They drive up companies whose stocks they’ve already purchased only to dump them on susceptible traders who believe them. .

One way to avoid scams is to screen for the best quality stocks with verifiable information. This removes a whole host of possibilities that scammers may use to capture your hard-earned dollars.

Standardize risk per trade

Penny stock traders could lose a high percentage of their trades despite their best efforts. This is the nature of this volatile stock category. The best way to mitigate risk is to keep all trades of equal or near equal risk and to limit the total amount risked in penny stocks to a smaller percentage of an overall portfolio.

Penny stock traders may get tempted to think more about the large number of shares they can buy at inexpensive prices and how much money they’ll be able to make when the stock rises. This distraction rarely helps a trader make good decisions. Focusing on potential opportunity without standardizing risk can tempt a trader to feel like the next opportunity they see is a “can’t miss” trade.

Since the outcome of individual trades can’t be predicted with any sort of reliable accuracy, the best way to produce consistent results includes standardizing risk sizes on every trade.

Consistent market outcomes require a consistent market approach. A trader might do everything right on 9 trades out of 10 and still blow up an account if that trade represented a much higher risk allocation than the other nine.

Tips for avoiding scams

Any investment class has instances where investors are lured by false information and lose money on bad investments. However, deserved or not, penny stocks have an especially bad reputation. The stereotype of penny stocks is that the entire class of stocks is riddled with unethical behavior and that investors could be ripped off on any given trade. While the stereotype is probably overstated, the reality is that investors should be vigilant nonetheless.

Because information about companies in the penny stock arena is generally scarce, and because these stocks react so quickly to any sort of rumor, it is difficult to distinguish between deliberate fraud and normal volatility.

Perhaps this is the reason fraudulent players are thought to frequently infest this class of stocks. Conventional wisdom suggests that there are many who would purchase a stock, then later advertise the potential for its growth solely with the intent to sell the stock after it has risen briefly. The worst of them will even short the stock after they have hyped it up.

Such activities are referred to as “pump and dump” schemes, but these activities are illegal and punishable by stiff fines and prison sentences. Any fraudulent player in the space will work hard to disguise what they are trying to do. The best an unsuspecting investor can hope for is to avoid the impact of a scam artist by limiting their exposure. There are three ways to do so:

- Stick to stocks that follow regular reporting standards: quarterly reports filed with the SEC..

- Limit trading time frames to four weeks or less.

- Look for increased sales or other fundamental data.

The first way to avoid scams is to trade among those penny stocks which are listed on the NYSE and NASDAQ, but if you trade stocks from the OTC market, you can also avoid scams by trading in stocks that follow the SEC approved reporting standards, even though they don’t have to.

Limiting your trading to these stocks assures that you can get plenty of information about the company to make more informed decisions. Traders who attempt a pump-and-dump maneuver run the risk that a legitimate company traded in OTC markets may actually take off and ruin their short-sale positions. So they are less likely to take such a risk.

The second way to avoid the effect of a pump-and-dump scam is to trade in relatively shorter time frames, and plan to exit the trade if the trend turns against you early. Most penny stocks trade lower after one year from any given date. The few that do not tend to make strong moves within the first month of trending upward.

Nobody knows the future, but the hard truth is that most penny stocks are companies that have fallen on hard times. While it’s possible for these companies to make a real turnaround, it’s far more likely that whatever caused the decline is still in place, making the turnaround impossible.

A third way that a trader may avoid the worst of these scams is by focusing on companies that have at least some strong fundamental metrics. Of all the business measures for penny stocks, one that stands out is gross revenues. If a company’s top line sales are growing in comparison to the previous quarter, then it will attract more positive attention from investors. It is one of the few metrics that seem to make a difference to the performance of a penny stock.

Once you have a list of trades to consider, double check that list with these three criteria to be sure your trading process will have which stocks to buy, the next step is to plan for and then execute your trades. Our next lesson will discuss this process.